It is noteworthy that the Ministry of Finance and the Central Bank of the country intervened to keep the price of the lira unchanged for nearly two months, as the Central Bank enacts decisions or pumped amounts of foreign currencies into the markets.

Today’s recommendation on the TRY/USD

risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.50 level.

- Place a stop loss point close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 18.99.

Best-selling entry points

- Entering a sell order pending order from the 18.99 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The exchange rate of the TRY/USD maintained its stability without change. The Turkish government continued to enact measures that limit foreign currency transactions in the country in order to relieve pressure on the lira, which lost about 30 percent of its value during the current year. Investors early followed the decision of the country’s banking supervision authority, which aims to limit the collection of foreign currency.

Under the new rules, the net foreign currency position of private banks in the country is prohibited from exceeding only 5 percent of the capital, as the new rules require banks to reduce the surplus in foreign exchange before the application of the new rules.

It is noteworthy that the Ministry of Finance and the Central Bank of the country intervened to keep the price of the lira unchanged for nearly two months, as the Central Bank enacts decisions or pumped amounts of foreign currencies into the markets. In terms of data, investors followed data issued by the Turkish Statistical Institute, which revealed a slight increase in the unemployment rate in the country last October, as it recorded 10.2% compared to 10.01% last September.

TRY/USD Technical Analysis

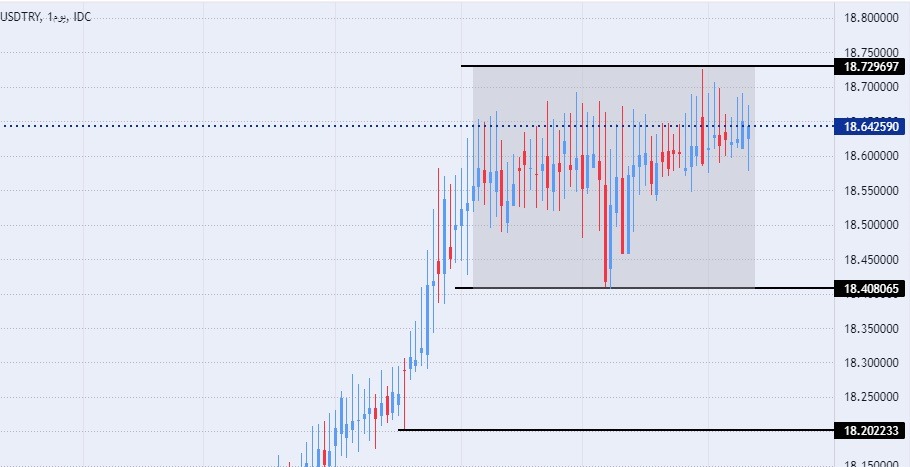

On the technical front, the Turkish lira pair traded against the dollar without changes during today’s early trading. Where the dollar pair settled against the lira within the narrow trading range that has been circulating in its vicinity for more than two months. The levels of 18.40 and 18.20, respectively, are still the closest support levels for the pair. While the pair is trading below the resistance levels at 18.72, which is the highest recorded peak for the pair, as well as the psychological resistance at 19.00.

In the meantime, the US dollar pair traded against the Turkish lira above the moving averages 50, 100, and 200 on the daily time frame, indicating the general bullish trend of the pair, while the price traded between these averages on the four-hour time frame, as well as the lower time frames, in a sign of the divergence that the pair records in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers to check out.

Read More:Government Attempts to Limit banks

2022-12-12 12:39:15