NAS100 Analysis

Wall Street took a hit in the middle of last week, after a series of poor economic releases sparked recession fears. Most notably, both Retail Sales and Industrial Production posted their biggest decline in at least one year last month.

However, this downbeat data along with softer PPI figures support a slowdown in the pace of tightening by the US Federal Reserve. Markets expect another downshift, as CME’s FedWatch Tool prices in a 25 basis points rate increase at the upcoming meeting.

Just before the quite period, Fed officials reiterated their hawkish stance, but we did not see any meaningful pushback against the tame market pricing. In fact, some policy makers embraced those expectations, such as Governor Waller who succinctly stated that “i currently favor a 25-basis point increase” at the next meeting.

This helped NAS100 to a two-day rally, but is cautious today as investors eagerly await quarterly results from tech heavyweights. Microsoft reports today after market close, shortly after announcing a 5% reduction to its workforce . Tesla Motors releases its Q4 results on Wednesday, having already reported record deliveries, but 2022 growth missed the 50% target.

Market participants also await the preliminary Q4 GDP and the PCE Inflation figures from the US, which are due on Thursday and Friday respectively.

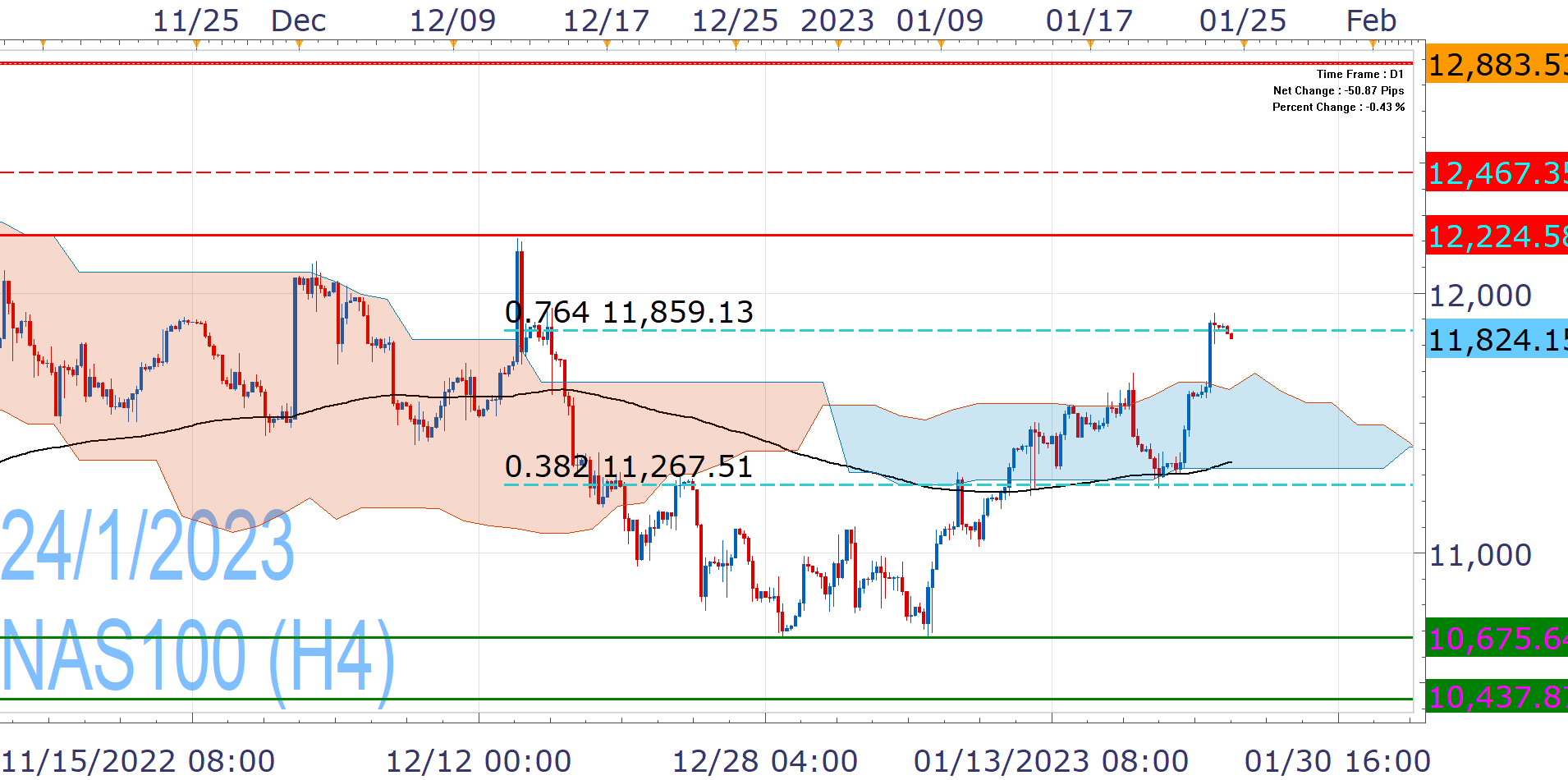

NAS100 has covered most of last month’s losses on optimism for a Fed pivot, with gains of around 8%, so far in January. This puts 12,224 in its crosshairs, but bulls will likely need fresh impetus for taking it out and push even higher.

On the other hand, the move looks stretched at this point and NAS100 is under pressure today. A slide towards the key 11,3500-11,267 region would not be surprising, but a significant deterioration in sentiment would be needed for daily closes below it that could pause the upward bias.

Read More:NAS100 Cautious Ahead of High-Profile Earnings

2023-01-24 11:17:57