Fed Slowdown

The US Fed runs its most aggressive tightening in decades, with a series of outsized 75 basis points hikes and Chair Powell signaled a downshift, speaking at the Brookings Institute on Wednesday. He said that the moderation in the pace of rate increases “may come as soon as the December meeting”.

This is not something new, as Chair Powell has talked of slower pace before and other officials have appeared ready to ease, but yesterday’s speech cemented market expectations for a smaller 50 basis points hike in this month’s upcoming meeting.

Chances of such an outcome increased as per CME’s FedWatch Tool, while expectation for the terminal rate eased. The highest probability is now assigned to rates peaking at 5.00%, from 5.25% previously.

As a result, the USDOLLAR slumped, while bond and stock markets jumped, with NAS100 closing Wednesday with gains of nearly 2%.

Supportive Jobs Data

It seems that we are living again in this bizarro world, where bad news is good news for Wall Street and vice versa, since the stock market cheered yesterday’s poor jobs data. The labor market is very tight, making hard for the Fed to take its foot of the tightening pedal, so any bad news actually enable a moderation, helping Wall Street.

Labor demand slowed down in October, as JOLTS Jobs Opening fell to 10.344 million, from 10.717 million in the prior month. Furthermore private payrolls growth eased in November, with the addition 127,000 jobs, from 239,000 previously.

Misplaced Optimism?

Despite preparing markets for smaller hikes, Mr Powell once again stressed that further tightening is needed and downplayed the significance of the pace of increases. Instead, he stressed the importance of the terminal rate and the period for which rates will need to stay at a restrictive level.

He noted that bringing inflation down will likely require maintaining interest rates at such levels “for some time” and believes that rates will peak higher than previously expected. He also cautioned on the risks of loosening policy prematurely.

Given the above, one has to wonder whether market reaction was overly optimistic and/or premature. Markets have been quick to call peaks on rates, on the Fed’s hawkishness and on inflation and such hopes have been disappointed before, whereas the current week includes two more key economic releases from the US

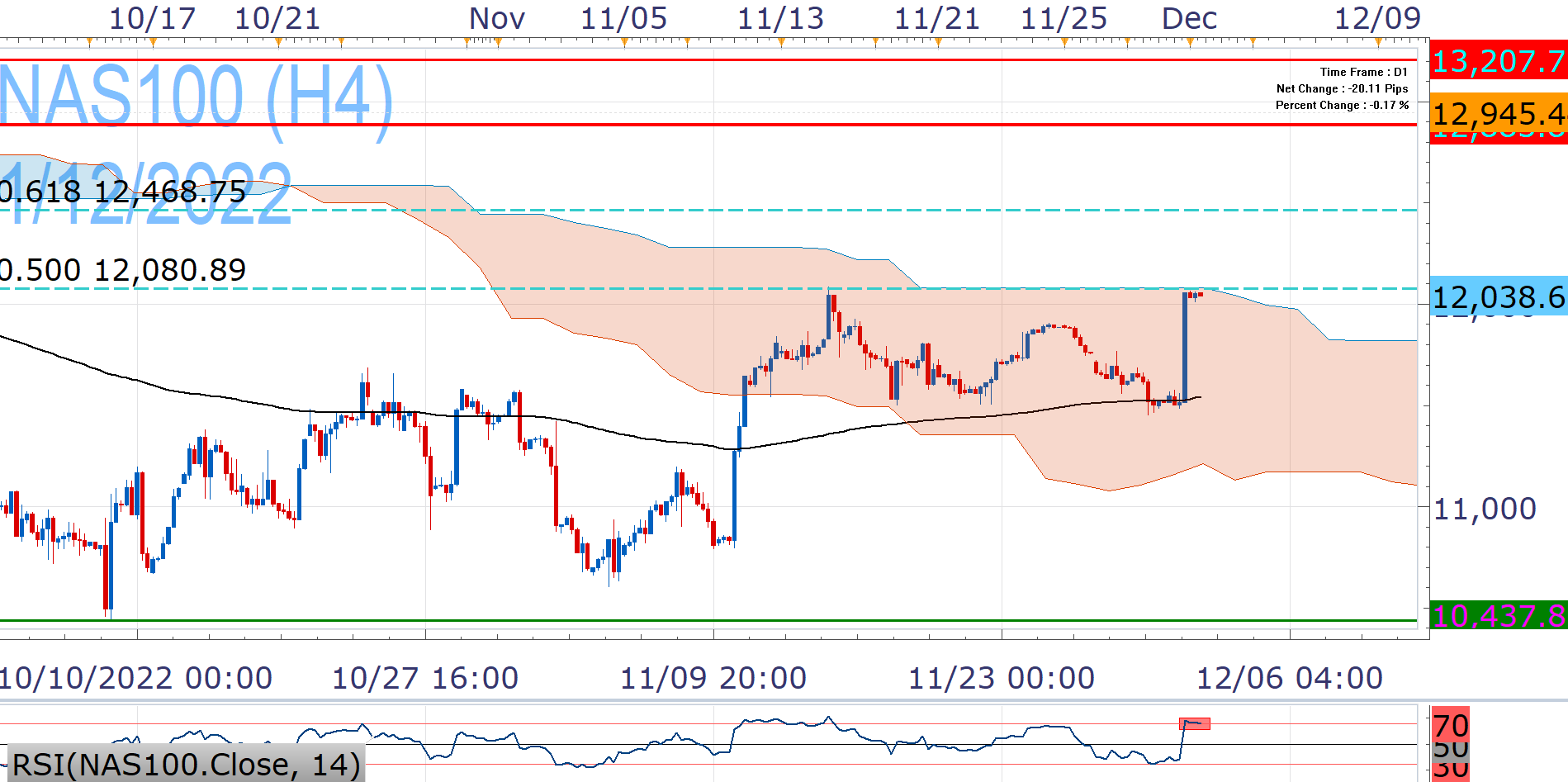

NAS100 Analysis

The tech-heavy index consolidates at familiar levels after yesterday’s rally, as investors await the PCE Inflation update later in the day and the Jobs Report on Friday, among other data, which can spur volatility and determine its path.

Yesterday’s jump has brought 12,468 in the spotlight, but pullback or a catalyst may be required for taking this level out and extending gains towards and beyond 12,833-91.

It has been a year since the record highs of NAS100, back in November 2021, which were followed by steep decline. Despite the two-month rebound it remains deeply in bear territory, closing November almost 30% below that peak.

Furthermore, NAS100 consolidates today and has not yet cleared the 50% Fibonacci and the daily Ichimoku Cloud, which had stopped its advance earlier in the month, while the Relative Strength Index (RSI) points to overbought conditions.

This can cause renewed pressure back to the EMA200 (11,550-11,449), although a strong disappointment from the upcoming data would be required for a deeper decline that would contest the 11,000 handle.

Read More:NAS100 Steadies after the Powell-Fueled Rally

2022-12-01 07:09:33