- Equity markets end the week positively as the Fed pivot is back on.

- Bank of Japan (BOJ) likely intervenes in the FX market.

- Apple earnings will set the tone for the weeks ahead.

Equity and risk markets continued to recover on Friday as it looks to me like a double dose of good news set risk assets on a better path. Firstly we had the Bank of Japan likely intervening to send USDJPY lower and that was followed up only a short time later by the Fed whisperer, Nick Timaros of the Wall Street Journal putting out doveish noises from the Fed.

“I think the time is now to start talking about stepping down. The time is now to start planning for stepping down,” said San Francisco Fed President Mary Daly during a talk at the University of California, Berkeley on Friday. https://t.co/vPMSXDAKN8

— Nick Timiraos (@NickTimiraos) October 22, 2022

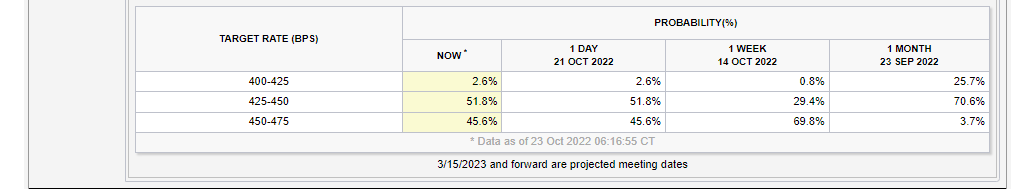

This set a massive risk on rally and the main indices closed over 2% higher. The Dow Jones led the way 2.5% higher while the Nasdaq and S&P 500 both closed over 2.3% higher. The dollar meanwhile retreated to a 146 handle versus the yen which further emboldened risk assets. The front end of the yield curve moved lower and expectations for December rate hikes lowered noticeably. Odds for a 75bps hike in December have fallen to 45.6% versus 69.8% a week ago. All this sees risk assets feel more comfortable and get their rally on!

December meeting rate hike odds

Source: CMEGroup.com

The excellent FXMacroGuy compares Fed member Daly’s dovish comments

USD Daly… the most dovish talk in a long while: More tightening is needed, important to step down hikes to 50 or 25 bps hikes at some point but not a pause, can easily find yourself overtightening, estimates neutral at 3-3.5%. Have to take global factors into account.

/10 pic.twitter.com/CMuw8D3LHs

— FX Macro Guy (@fxmacroguy) October 21, 2022

Already risk assets and especially US equities have been trying to bottom. Earnings season so far is better than expected. Apple (AAPL) can either confirm or deny that trend when it is out next week. We also have been repeating that some positioning indicators look too bearish and sentiment remains overly bearish. We have corporate buybacks about that restart in a big big way. Seasonality is also on the side of bulls now. This rally could extend all the way to yer end if the Fed does indeed pivot or keep talking doveishly.

Let’s review:

*Successful retest of June lows

*Capitulation on CPI Thursday w 5% move off intraday lows, consistent w other major lows

*Bears die in Oct

*Best 6 mos of 4-yr cycle coming up

*Earnings better than expected (no recession)

*Fed turning more dovish (WSJ article) pic.twitter.com/Qz1Fbp8jS2— Ryan Detrick, CMT (@RyanDetrick) October 22, 2022

SPY technical view

We finally closed above my key pivot at $373. Only just but still significant in my view. That should see stabilization and then a charge higher to $388. But $373 remains my key pivot point. Once Apple (AAP) is behind us there is little to stop equities from moving higher. I am making the assumption that Apple is ok, a big assumption! Market breadth is improving modestly in terms of the number of stocks above the key moving average etc. But this is the early stage.

Earnings week ahead

Apple, it really is all about that. Earnings season has been better than expected and it feels like equities want to push higher. The Fed is now in blackout and they have left dovish thoughts echoing in traders ears.

It is big tech week and this is the key week of earnings. SNAP already hit Alphabet (GOOGL) and META so they may have the bad news in the price pushing the risk-reward towards an earnings bounce in my view. Apple (AAPL) is harder to call.

Economic data due

Keep an eye on the 2 and 5-year bond auction results. The last few have been weak which could once again put a fire under yields. We get preliminary GDP data which according to the Atlanta Fed data looks like it will be around 3% and so showing continued resilience in the US economy. Also of note PCE data and Michigan inflation expectations. The Fed’s more favored data for inflation.

Read More:Doves are back, bulls are back as the USD pulls back

2022-10-23 11:59:43