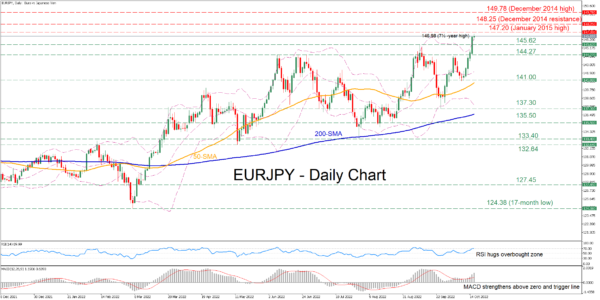

EURJPY has been in a prolonged uptrend since early March, generating consecutive multi-year highs. Moreover, even though the pair exhibited a substantial downside correction in late-September, the short-term picture has improved drastically again, with the price edging higher to a fresh 7½-year high of 146.98 in today’s session.

The short-term oscillators currently indicate that bullish forces are intensifying. Specifically, the RSI has entered its 70-overbought area, while the MACD histogram is strengthening above its red signal line in the positive territory.

Should buying pressures persist, the pair could move higher to form fresh multi-year highs, where the January 2015 peak of 147.20 might curb further advances. Conquering this barricade, the bulls may target the crucial December 2014 resistance region of 148.25. Even higher, the spotlight could turn to the December 2014 high of 149.78, which is the highest level observed since March 2008.

On the flipside, a negative correction could initially come to a halt at the recent resistance region of 145.62, which might now act as support. Should that floor collapse, the price could descend towards 144.27 or lower to test the October support of 141.00. A break below the latter could bring 137.30 under examination.

Overall, EURJPY seems to have the necessary momentum to push even higher and create fresh historical highs. Nevertheless, the bulls should not rule out the possibility of some retracement before the latter is accomplished.

Read More:EURJPY Advances to Fresh 7½-Year Highs

2022-10-18 09:16:24