The UK Economic Data Overview

The British economic calendar is all set to entertain the cable traders during the early hours of Monday, at 06:00 GMT with the monthly release of July 2022 GDP figures. Also increasing the importance of that time are Trade Balance and Industrial Production details for the stated period.

Having witnessed a contraction of 0.6% in economic activities during June 2022, market players will be interested in July’s monthly GDP figures to confirm the recently hawkish hopes from the Bank of England (BOE), especially after Liz Truss’ elections as the UK PM.

Forecasts suggest that the UK GDP will reverse the previous drop with 0.5% MoM in July. GBP/USD traders also await the Index of Services (3M/3M) for the same period, likely to deteriorate to -0.8% versus -0.4% prior, for further insight.

Meanwhile, Manufacturing Production, which makes up around 80% of total industrial production, is expected to improve to 0.6% MoM in July. Also, the total Industrial Production is expected to rise to 0.4% versus -0.9% previous figures.

Considering the yearly figures, the Industrial Production for July is expected to have eased to 2.0% versus 2.4% previous while the Manufacturing Production is anticipated to have risen to 1.7% in the reported month versus 1.3% the last.

Separately, the UK Goods Trade Balance will be reported at the same time, prior £11.387B.

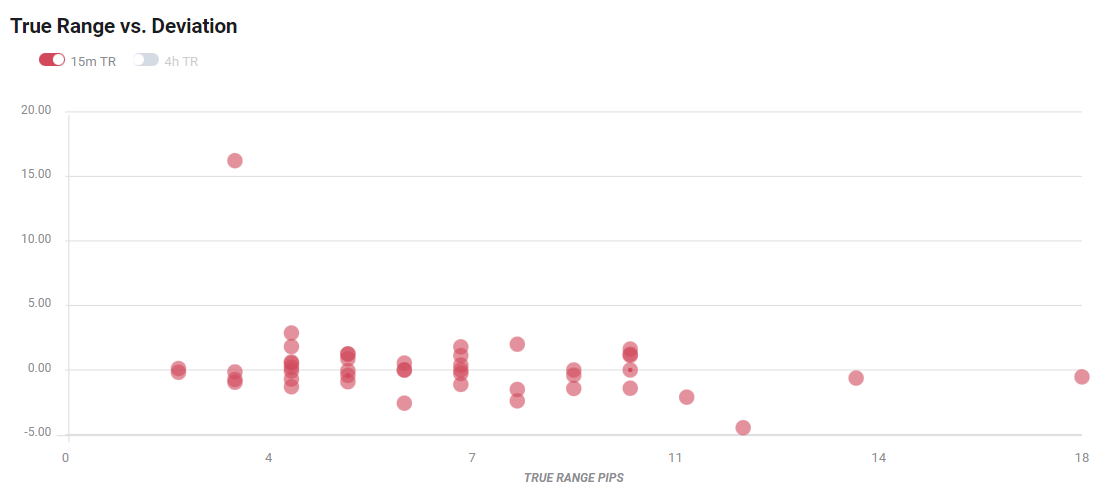

Deviation impact on GBP/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could affect GBP/USD?

GBP/USD pares intraday losses around 1.1600 ahead of the key data releases on Monday. In doing so, the Cable pair struggles to defend buyers amid fears that the ongoing economic inaction in the UK, due to Queen’s death, might add to the recession fears of the nation.

Given the increasing push to the BOE towards following the hawkish Fed, mainly due to the newly elected PM Liz Truss’ criticism of the BOE’s slow action, the GBP/USD may witness further upside in the case of upbeat data. It’s worth noting, however, that major attention will be given to the UK/US inflation numbers, up for publishing on Tuesday and Wednesday. Even if the scheduled data print a softer outcome, the GBP/USD upside appears more likely due to the US dollar’s pullback from the multi-year high, as well as due to the cautious optimism in the markets amid a sluggish session.

Ahead of the event, Westpac said, “The trade deficit is set to remain wide in July given the strength of imports) market forecasts: -£11300mn).

Technically, GBP/USD bulls cheer the upside break of the 10-DMA and monthly bearish channel amid the recently firmer RSI (14) and the strongest bullish MACD signals to aim for the 21-DMA hurdle surrounding 1.1700 ahead of the UK’s key monthly statistics for July.

In case of an alternative move, the 10-DMA resistance-turned-support, around 1.1555 by the press time, will precede the stated bearish channel’s upper line, close to 1.1500 at the latest, to restrict the short-term downside.

Key notes

GBP/USD stays mildly bid below 1.1650 as BOE postpones meeting, UK data, US inflation eyed

GBP/USD Price Analysis: Bulls keep reins above 1.1600 ahead of UK data dump

GBP/USD Weekly Forecast: Eyes 21 DMA on a technical rebound ahead of critical US, UK events

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

Read More:When are the UK data releases and how could they affect GBP/USD?

2022-09-12 05:08:10