Japanese Yen Talking Points

USD/JPY appreciates for five consecutive days as it extends the series of higher highs and lows from last week, and the exchange rate appears to be on track to test the yearly high (139.39) after clearing the opening range for August.

USD/JPY Rate Eyes Yearly High After Clearing August Opening Range

USD/JPY largely mirrors the rise in US Treasury yields as it trades to a fresh monthly high (137.65), and the exchange rate looks poised to track the positive slope in the 50-Day SMA (135.55) as it climbs back above the moving average.

As a result, USD/JPY may stage another attempt to test the September 1998 high (139.91) if it manages to clear the yearly high (139.39), and the diverging paths between the Bank of Japan (BoJ) and Federal Reserve may keep the exchange rate afloat over the coming months as Chairman Jerome Powell and Co. move towards a restrictive policy.

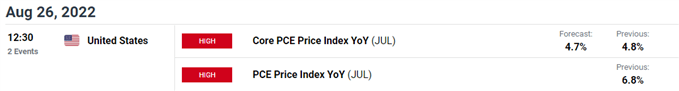

However, data prints coming out of the US may influence USD/JPY as the core Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, is expected to narrow to 4.7% in July from 4.8% per annum the month prior, and evidence of easing price pressures may curb the recent strength in the Greenback as it encourages the FOMC to adjust its approach in combating inflation.

In turn, the FOMC may implement smaller rate hikes over the coming months in an effort to achieve a soft-landing for the US economy, and it remains to be seen if the committee will adjust the forward guidance at the next interest rate decision on September 21 the central bank is slated to update the Summary of Economic Projections (SEP).

Until then, USD/JPY may track the positive slope in the 50-Day SMA (135.51) as it climbs back above the moving average, while the tilt in retail sentiment looks poised to persist as traders have been net-short the pair for most of the year.

The IG Client Sentiment report shows 30.42% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 2.29 to 1.

The number of traders net-long is 6.62% higher than yesterday and 0.57% lower from last week, while the number of traders net-short is 5.46% higher than yesterday and 24.31% higher from last week. The decline in net-long position comes as USD/JPY trades to a fresh monthly high (137.65), while the jump in net-short interest has fueled the crowding behavior as 31.52% of traders were net-long the pair last week.

With that said, recent price action raises the scope for a further advance in USD/JPY as it extends the series of higher highs and lows from last week, and the exchange rate may attempt to test the yearly high (139.39) as it clears the opening range for August.

USD/JPY Rate Daily Chart

Source: Trading View

- USD/JPY trades back above the 50-Day SMA (135.55) following a five-day rally, and the exchange rate may continue to track the positive slope in the moving average as it reverses course ahead of the monthly low (130.39).

- The series of higher highs and lows from last week has pushed USD/JPY to a fresh monthly high (137.65), with a break/close above the 137.40 (61.8% expansion) to 137.80 (361.8% expansion) region to bring the yearly high (139.39) on the radar.

- A break above the September 1998 high (139.91) opens up the 140.30 (78.6% expansion) region, with the next area of interest coming in around 141.70 (161.8% expansion).

- However, failure to close above the 137.40 (61.8% expansion) to 137.80 (361.8% expansion) region may lead to a near-term pullback in USD/JPY, with move below 135.30 (50% expansion) bringing the Fibonacci overlap around 132.20 (78.6% retracement) to 133.20 (38.2% expansion) back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Read More:USD/JPY Rate Eyes Yearly High After Clearing August Opening Range

2022-08-23 00:30:00