EUR/USD Rate Talking Points

EUR/USD is on the cusp on pushing above the 50-Day SMA (1.0607) as it extends the advance following the Federal Reserve interest rate decision, and a move above the moving average may lead to a further advance in the exchange rate as the testimony from Chairman Jerome Powell does little to curb the advance from the monthly low (1.0359).

EUR/USD on Cusp of Pushing Above 50-Day SMA Following Fed Testimony

EUR/USD appears to have reversed coursed after defending the yearly low (1.0349), and the advance from earlier this month may lead to a test of the former support zone around the May high (1.0787) as it now appears to be acting as resistance.

Looking ahead, it remains to be seen if EUR/USD will respond to the 50-Day SMA (1.0607) as the moving average continues to reflect a negative slope, but the limited reaction to the Fed’s semi-annual testimony raises the scope for a further appreciation in the exchange rate even as Chairman Powell insists that “the American economy is very strong and well positioned to handle tighter monetary policy.”

The comments suggest the Federal Open Market Committee (FOMC) will deliver another 75bp rate at its next interest rate decision on July 27 as officials forecast a steeper path for US interest rates, and it remains to be seen if Chairman Powell will continue to tame speculation for a 100bp rate hike as the central bank head warns that it will be “very challenging” to foster a soft-landing for the economy.

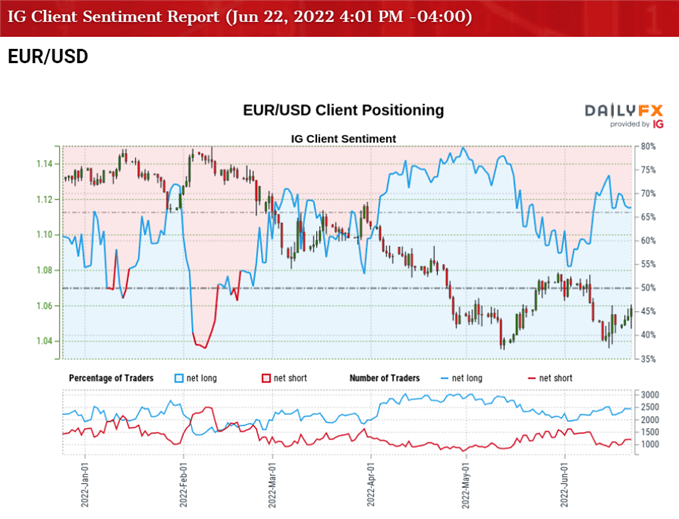

Until then, EUR/USD may stage a larger recovery following the failed attempt to test the yearly low (1.0349), but the tilt in retail sentiment looks poised to persist as traders have been net-long the pair for most of the year.

The IG Client Sentiment report show 60.83% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.55 to 1.

The number of traders net-long is 12.70% lower than yesterday and 17.50% lower from last week, while the number of traders net-short is 14.33% higher than yesterday and 41.01% higher from last week. The decline in net-long position comes as EUR/USD comes up against the 50-Day SMA (1.0607), while the jump in net-short interest has helped to alleviate the tilt in retail sentiment as 68.58% of traders were net-long the pair last week.

With that said, EUR/USD may attempt to push above the moving average as it extends the advance following the Fed rate decision, and the exchange rate may ultimately test of the former support zone around the May high (1.0787) as it appears to be acting as resistance.

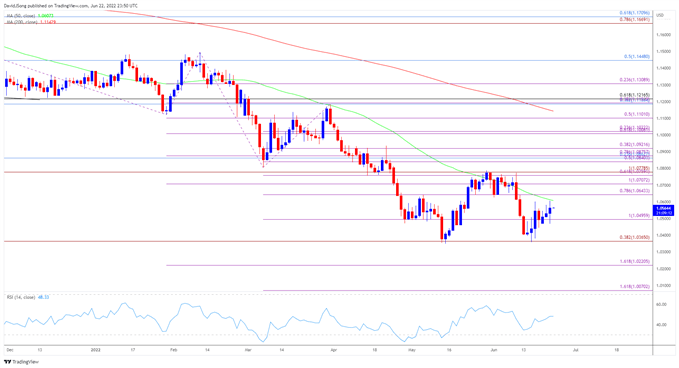

EUR/USD Rate Daily Chart

Source: Trading View

- EUR/USD approaches the 50-Day SMA (1.0607) after failing to close below the 1.0370 (38.2% expansion) region, with the Relative Strength Index (RSI) reversing ahead of oversold territory as the exchange rate defends the yearly low (1.0349).

- A move above the moving average may push EUR/USD towards the 1.0640 (78.6% expansion) area, with a break/close above the 1.0710 (100% expansion) region opening up the Fibonacci overlap around 1.0760 (61.8% expansion) to 1.0780 (100% expansion), which lines up with the monthly high (1.0774).

- It remains to be seen if EUR/USD will react to the moving average as indicator continues to reflect a negative slope, but need a close back below the 1.0500 (100% expansion) handle to bring the 1.0370 (38.2% expansion) region back on the radar.

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Read More:EUR/USD on Cusp of Pushing Above 50-Day SMA Following Fed Testimony

2022-06-23 00:30:00