- USD/CHF is rallying on dollar strength and higher interest rates.

- The Fed meeting next week might push the pair higher.

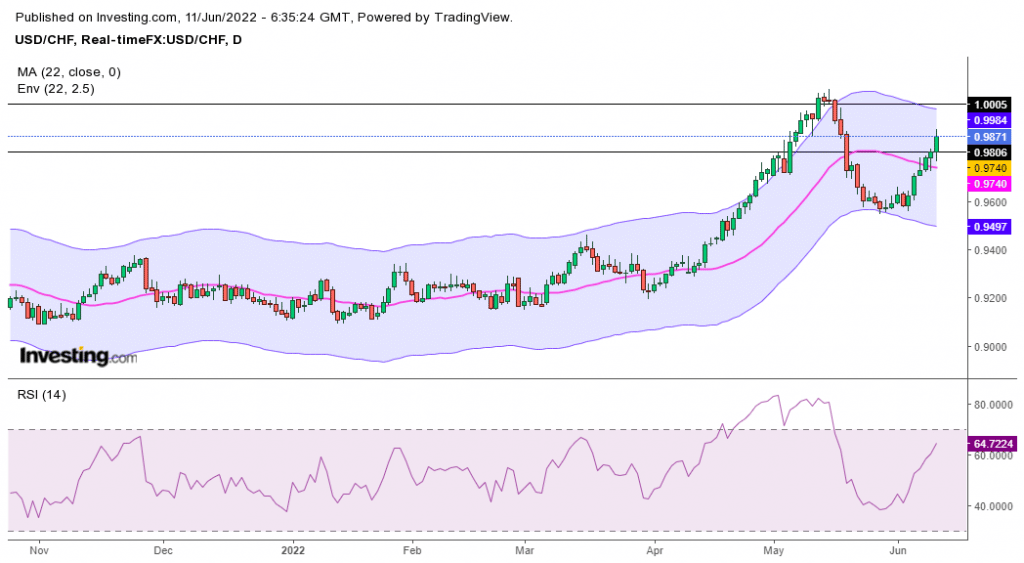

- The price has crossed back above the 22-SMA in the charts.

The weekly forecast for USD/CHF is bullish as investors expect more hawkish remarks from US policymakers after higher-than-expected inflation on Friday. The pair might continue last week’s rally and get to 1.0000.

-Are you interested in learning about forex tips? Click here for details-

Ups and downs of USD/CHF

The USD/CHF pair had a bullish week, with the price closing higher daily. This move can be attributed to the rising tensions in global markets over recession concerns that pushed investors to buy the dollar. This move was accelerated on Friday after US inflation data surprised investors.

The higher inflation is concerning as it could lead to more rate hikes, pushing the US economy to a recession. The inflation report was published ahead of the Fed’s anticipated second 50 basis points rate hike next week on Wednesday.

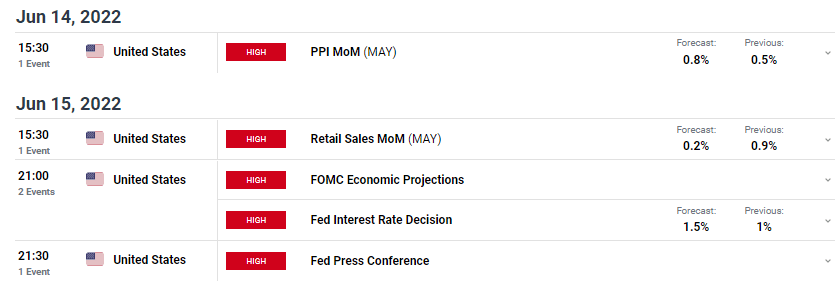

Next week’s key events for USD/CHF

Following the inflation report, two-year Treasury yields, highly sensitive to rate hikes, went up to 3.057%, the highest since June 2008. Benchmark 10-year yields went up to 3.178%, the highest since May 9.

“Today’s report should extinguish any pretense that a ‘pause’ in rate hikes will likely be appropriate by the end of summer, as the Fed is still behind the eight ball on bringing inflation under control,” said Jason Pride, chief investment officer for private wealth at Glenmede in Philadelphia on Friday.

Next week’s Fed meeting will guide investors on the way forward regarding interest rates. If the Fed is more hawkish, we might see USD/CHF pushing higher.

-Are you interested in learning about the forex basics? Click here for details-

USD/CHF weekly technical forecast: Bulls eying 1.0000

The daily chart shows a sharp rise in USD/CHF that pushed the price back above the 22-SMA. The RSI is trading above the 50 level, and showing bulls are in charge of the market. If bulls continue with the same momentum next week, we could see the price return to 1.0000. This level has acted as resistance before, and bulls will retest it to see if they can break above it and make a higher high.

The bias will remain bullish if the price keeps trading above the 22-SMA and the RSI stays above 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Read More:Fed Hawks Pushing Towards Parity Again

2022-06-11 14:02:30