Whilst there are some strong numbers coming out from China, its slowdown remains apparent. Which is still a net-positive when compared to Japan’s negative growth figures.

Asian Indices:

- Australia’s ASX 200 index rose by 22 points (0.3%) and currently trades at 7,465.00

- Japan’s Nikkei 225 index has risen by 136.55 points (0.46%) and currently trades at 29,748.56

- Hong Kong’s Hang Seng index has fallen by -20.63 points (-0.08%) and currently trades at 25,307.34

- China’s A50 Index has fallen by -39.36 points (-0.25%) and currently trades at 15,515.80

UK and Europe:

- UK’s FTSE 100 futures are currently down -9.5 points (-0.13%), the cash market is currently estimated to open at 7,338.41

- Euro STOXX 50 futures are currently down -6.5 points (-0.15%), the cash market is currently estimated to open at 4,363.83

- Germany’s DAX futures are currently down -16 points (-0.1%), the cash market is currently estimated to open at 16,078.07

US Futures:

- DJI futures are currently up 179.11 points (0.5%)

- S&P 500 futures are currently up 18 points (0.11%)

- Nasdaq 100 futures are currently down -0.25 points (-0.01%)

Japan’s GDP didn’t just underwhelm, it disappointed

Data from Japan was underwhelming to say the least. Whilst expectations were for the annualised growth rate to contract by around -0.8%, not many were mentally prepared for the -3% it delivered. And the quarterly expansion was simply not there, instead contracting by -0.8%. Yet even more worrying is that capital expenditure plunged by -3.8%, which is its weakest quarter in 10-years.

The Japanese yes is the weakest currency overnight which helped GBP/JPY touch a 3-day high as it tries to build a base around the September high. USD/JPY is holding above 113.78 support and the Nikkei is struggling to find buyers around 29.7k.

China retail sales rebounded (with a little help from the government)

On the face of it, data for China was okay overall. Yet evidence of a slowdown continues to surface whilst the upside surprise for retail sales can be attributed to a recent government’s warning to its citizens.

Consumption was a little more upbeat with retail sales beating expectations. Rising 4.9% y/y, it far exceeded the 3.5% forecast and rose above September’s rate of 4.4%, although perhaps we should factor in that the government had urged its citizens to stockpile “essentials” earlier this month, due to energy shortages, extreme weather and covid restriction. Presuming there is a limit to how much a household can stockpile, we may see retail sales peter out in the coming month/s.

House prices slowed to 3.4% y/y from 3.8% in September, marking its fifth month of slower growth. And this should not come as too much of a surprise given Beijing’s crackdown on the property sector, intent on hampering speculative bubbles and more evenly distribute wealth.

Urban investment was slightly below expectations, falling to 6.1% from 7.3% prior. Industrial production slowed for an eight straight month to 10.9% from 11.8%, although industrial output rose to 3.5% from 3.1%.

US dollar dragged lower by bond yields

Weak US consumer sentiment on Friday gave a little hope to the ‘inflation is transitory’ camp which allowed investors to move back into bonds and drag yields lower. And it has taken the dollar lower with it. US yields are off by another -8 to -10 basis points overnight, and the US dollar index is down around -0.1%. It’s by no means a volatile affair but it is enough for some dollar bulls to book profits following last week’s CPI-induced rally.

EUR/USD is trying to lift itself from last week’s low but is making hard work of it. Last week’s high met resistance at the 200-week exponential MA, and we suspect traders may try to fade (sell into) minor rallies to realign themselves with its dominant, bearish trend this week. And any move towards the 1.1500 handle may well prompt such action, unless we a fresh catalyst to prompt buying the euro over the dollar, as opposed to booking profits on the dollar.

EUR/GBP bears eye break of 0.8520

The British pound finds in a slightly better position after the EU said they’re willing to work on a practical solution over Northern Island. GBP/USD erased most of Thursday’s losses and has since made a mild attempt at breaking to a 3-day high overnight. And the relative shift weighed on EUR/GBP by around -0.35% on Friday, which raises the prospect for a retest (and potential break below) 0.8500.

EUR/GBP is consolidating between 0.8520 and 0.8536, and a break either side of this range could mark its next directional move. We saw a breakout from its rising channel last week, and a break beneath 0.8520 also invalidates trend support to bring 0.8500 into focus. Take note of the 50% retracement level in the area, so we’d expect it to hold as support initially.

With a quiet economic calendar today, we may need to wait for tomorrow’s initial GDP for Europe and CPI report for the UK for volatility on EUR/GBP to pick up.

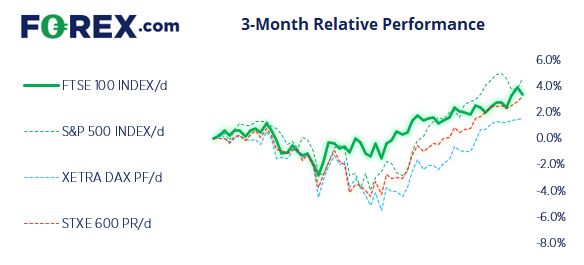

A dark cloud lingers over the FTSE 100

The FTSE 100 briefly traded above 7400 on Friday before giving back most of Thursday’s gains with a -0.5% decline. This leaves a Dark Cloud Dover reversal pattern at its post-pandemic high. And given its strong performance of late, perhaps it is time for the FTSE to retrace. The 7330 high could prove pivotal today and set the daily bias for traders, as it could tempt dip buyers back to the table if it holds, or prompt another leg lower should this support level break.

FTSE 350: 4213.89 (-0.49%) 12 November 2021

- 164 (46.72%) stocks advanced and 173 (49.29%) declined

- 33 stocks rose to a new 52-week high, 2 fell to new lows

- 61.82% of stocks closed above their 200-day average

- 63.53% of stocks closed above their 50-day average

- 25.64% of stocks closed above their 20-day average

Outperformers:

- + 12.00%-Jtc PLC(JTC.L)

- + 6.62%-Helios Towers PLC(HTWS.L)

- + 5.12%-Oxford Instruments PLC(OXIG.L)

Underperformers:

- -6.81%-AstraZeneca PLC(AZN.L)

- -6.13%-Molten Ventures PLC(GROW.L)

- -5.24%-Endeavour Mining PLC(EDV.L)

Up Next (Times in BST)

Read More:European Open: China Data Mixed, EUR/GBP Bears Eye Break Of 0.8520

2021-11-15 06:55:03