Australian Dollar, AUD/USD, RBA, Oil Prices Talking Points

- Australian Dollar eyes RBA monetary policy statement

- Oil prices continue to drop after OPEC stays on course

- AUD/USD may target 50-day SMA if weakness persists

Friday’s Asia-Pacific Forecast

Asia-Pacific markets are set to move higher after a rosy Wall Street session overnight. The benchmark S&P 500 index closed 0.42% higher following an upbeat jobless claims report. The US Dollar softened via the DXY index despite a drop in the rate-sensitive 5-year Treasury yield. A surprise decision from the Bank of England (BOE) played into an already weakened outlook on near-term Federal Reserve tightening.

The risk-sensitive Australian Dollar saw a big drop versus the Greenback overnight, notwithstanding the broader USD strength – which was primarily due to Sterling weakness. Yesterday, Australia saw its trade surplus widen more than expected for September, although exports dropped 6% on a month-over-month basis. A drop in iron ore prices during the reference period likely weighed on outgoing cross-border transactions.

The Reserve Bank of Australia’s monetary policy statement will cross the wires today, which will provide updated quarterly economic projections. Earlier this week, the central bank signaled that its record low interest rate may not be on hold until 2024, as previously communicated. Rising price pressures and the removal of Covid restrictions likely encouraged policy makers to shift the cash rate target forward. However, that still leaves the RBA behind other major central banks.

Elsewhere, oil prices continue to slide. Crude oil broke below the psychologically imposing 80 handle, while Brent – the global benchmark – slipped as well. OPEC and its allies opted to keep pace with its current tapering of output cuts at 400k barrels per day for December. That comes despite calls from the United States to push more supply onto markets.

AUD/USD Technical Forecast

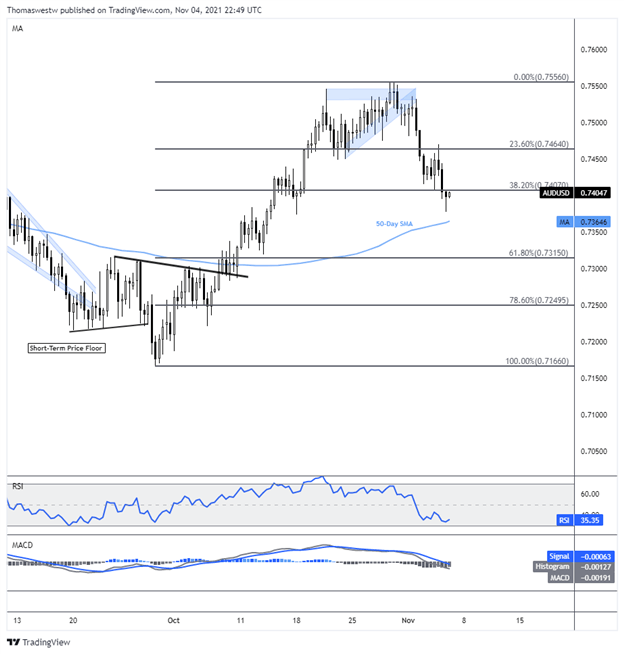

AUD/USD fell below its 38.2% Fibonacci retracement overnight, but weakness eased prior to hitting the rising 50-day Simple Moving Average (SMA). That said, the Fib level may now serve as resistance as the Aussie Dollar catches a small bid in the early APAC trading hours. However, a resumption to the downside will see the 50-day SMA shift into focus.

AUD/USD 8-Hour Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

Read More:AUD/USD Eyes RBA Monetary Policy Statement

2021-11-04 23:00:00