Why is the economy headed for a financial crash? It appears to me that the world economy hit Limits to Growth about 2018 because of a combination of diminishing returns in resource extraction together with rising population. The Covid-19 pandemic and the accompanying financial manipulations hid these problems for a few years, but now, as the world economy tries to reopen, the problems are back with a vengeance.

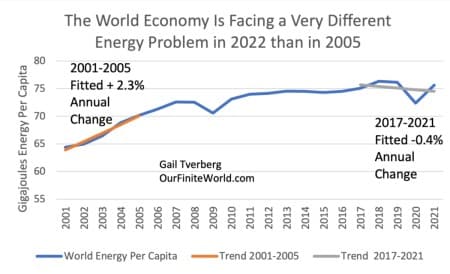

Figure 1. World primary energy consumption per capita based on BP’s 2022 Statistical Review of World Energy. Same chart shown in post, Today’s Energy Crisis Is Very Different from the Energy Crisis of 2005.

In the period between 1981 and 2022, the economy was lubricated by a combination of ever-rising debt, falling interest rates, and the growing use of Quantitative Easing. These financial manipulations helped to hide the rising cost of fossil fuel extraction after 1970. Even more money supply was added in 2020. Now central bankers are trying to squeeze the excesses out of the system using a combination of higher interest rates and Quantitative Tightening.

After central bankers brought about recessions in the past, the world economy was able to recover by adding more energy supply. However, this time we are dealing with a situation of true depletion; there is no good way to recover by adding more energy supplies to the system. Instead, the only way the world economy can recover, at least partially, is by squeezing some non-essential energy uses out of the system. Hopefully, this can be done in such a way that a substantial part of the world economy can continue to operate in a manner close to that in the past.

One approach to making the economy more efficient in its energy use is by greater regionalization. If countries can start trading almost entirely with nearby neighbors, this will reduce the world’s energy consumption. In parts of the world with plentiful resources and manufacturing capability, the economy can perhaps continue without major changes. Another way of squeezing out excesses might be through the elimination (at least in part) of the trade advantage the US obtains by using the dollar as the world’s reserve currency. In this post, I will also mention a few other ways that non-essential energy consumption might be reduced.

I believe that a financial crash is likely sometime during 2023. After the crash, the system will start squeezing down on the less necessary parts of the economy. While these changes will start in 2023, they will likely take place over a period of years. In this post, I will try to explain what I see happening.

[1] The world economy, in its currently highly leveraged state, cannot withstand both higher interest rates and Quantitative Tightening.

With higher interest rates, the value of bonds falls. With bonds “worth less,” the financial statements of pension plans, insurance companies, banks and others holding those bonds all look worse. More contributions are suddenly needed to fund pension funds. Governments may find themselves needing to bail out many of these organizations.

At the same time, individual borrowers find that debt becomes more expensive to finance. Thus, it becomes more expensive to buy a home, vehicle, or farm. Debt to speculate in the stock market becomes more expensive. With higher debt costs, there is a tendency for asset prices, such as home prices and stock prices, to fall. With this combination (lower asset prices and higher interest rates) debt defaults are likely to become more common.

Quantitative Tightening makes it harder to obtain liquidity to buy goods internationally. This change is more subtle, but it also works in the direction of causing disruptions to financial markets.

Other stresses to the financial system can be expected, as well, in the near term. For example, Biden’s program that allows students to delay payments on their student loans will be ending in the next few months, adding more stress to the system. China has had huge problems with loans to property developers, and these may continue or get worse. Many of the poor countries around the world are asking the IMF to provide debt relief because they cannot afford energy supplies and other materials at today’s prices. Europe is concerned about possible high energy prices.

Related: Europe’s Warm Winter May Not Be Such Good News For Energy

This is all happening at a time when total debt levels are even higher than they were in 2008. In addition to “regular” debt, the economic system includes trillions of dollars of derivative promises. Based on these considerations alone, a much worse crash than occurred in 2008 seems possible.

[2] The world as a whole is already headed into a major recession. This situation seems likely to get worse in 2023.

The Global Purchasing Managers Index (PMI) has been signaling problems for months. A few bullet points from their site include the following:

- Service sector output declined in October, registering the worst monthly performance since mid-2020.

- Manufacturing output meanwhile fell for a third consecutive month, also declining at the steepest rate since June 2020.

- PMI subindices showed new business contracting at the quickest rate since June 2020, with the weak demand environment continuing to be underpinned by declining worldwide trade.

- The global manufacturing PMI’s new export orders index has now signaled a reduction in worldwide goods exports for eight straight months.

- Price inflationary pressures remained solid in October, despite rates of increase in input costs and output charges easing to 19-month lows.

The economic situation in the US doesn’t look as bad as it does for the world as a whole, perhaps because the US dollar has been at a relatively high level. However, a situation with the US doing well and other countries doing poorly is unsustainable. If nothing else, the US needs to be able to buy raw materials and to sell finished goods and services to these other countries. Thus, recession can be expected to spread.

[3] The underlying issue that the world is starting to experience is overshoot and collapse, related to a combination of rising population and diminishing returns with respect to resource extraction.

In a recent post, I explained that the world seems to be reaching the limits of fossil fuel extraction. So-called renewables are not doing much to supplement fossil fuels. As a result, energy consumption per capita seems to have hit a peak in 2018 (Figure 1) and now cannot keep up with population growth without prices that rise to the point of becoming unaffordable for consumers.

The economy, like the human body, is a self-organizing system powered by energy. In physics terminology, both are dissipative structures. We humans can get along for a while with less food (our source of energy), but we will lose weight. Without enough food, we are more likely to catch illnesses. We might even die, if the lack of food is severe enough.

The world economy can perhaps get along with less energy for a while, but it will behave strangely. It needs to cut back, in a way that might be thought of as being analogous to a human losing weight, on a permanent basis. On Figure 1 (above), we can see evidence of two temporary cutbacks. One was in 2009, reflecting the impact of the Great Financial Crisis of 2008-2009. Another related to the changes associated with Covid-19 in 2020.

If energy supply is really reaching extraction limits, and this is causing the recent inflation, there needs to be a permanent way of cutting back energy consumption, relative to the output of the economy. I expect that changes in this direction will start happening about the time of the upcoming financial crash.

[4] A major financial crash in 2023 may adversely affect many people’s ability to buy goods and services.

A financial discontinuity, including major defaults that spread from country to country, is certain to adversely affect banks, insurance companies and pension plans. If problems are widespread, governments may not be able to bail out all these institutions. This, by itself, may make the purchasing of goods and services more difficult. Citizens may find that the funds they thought were in the bank are subject to daily withdrawal limits, or they may find that the value of shares of stock they owned is much lower. As a result of such changes, they will not have the funds to buy the goods they want, even if the goods are available in shops.

Alternatively, citizens may find that their local governments have issued so much money (to try to bail out all these institutions) that there is hyperinflation. In such a case, there may be plenty of money available, but very few goods to buy. As a result, it still may be very difficult to buy the goods a family needs.

[5] Many people believe that oil prices will rise in response to falling production. If the real issue is that the world is reaching extraction limits, the problem may be inadequate demand and falling prices instead.

If people have less to spend following the financial crash, based on the reasoning in Section [4], this could lead to lower demand, and thus lower prices.

It also might be noted that both the 2009 and 2020 dips in consumption (on Figure 1) corresponded to times of low oil prices, not high. Oil companies cut back on production if they find that prices are too low for them to expect to make a profit on new production.

We also know that a major problem as limits are reached is wage disparity. The wealthy use more energy products than poor people, but not in proportion to their higher wealth. The wealthy tend to buy more services, such as health care and education, which are not as energy intensive.

If the poor get too poor, they find that they must cut back on things like meat consumption, housing expenses, and transportation expenses. All these things are energy intensive. If very many poor people cut back on products that indirectly require energy consumption, the prices for oil and…

Read More:2023: Expect A Financial Crash And Major Changes In Global Energy Markets

2023-01-10 22:00:00