CNBC Pro: Forget Amazon. Here’s what top tech investor Paul Meeks is buying

Investor confidence in the tech sector has been shaken this year amid a flight to safety, but top tech investor Paul Meeks said he is now “more bullish” on the sector than in recent months, though he remains selective within the sector.

He tells CNBC the stocks he favors.

Pro subscribers can read more here.

— Zavier Ong

South Korea’s revised GDP confirms growth in the third quarter

South Korea’s revised gross domestic product for the third quarter confirmed growth of 3.1% compared to the same period a year ago – higher than a 2.9% expansion seen in the second quarter.

The economy saw slower quarterly growth of 0.3% in the third quarter, following a growth of 0.7% in the previous period.

Separately, South Korea reported a trade deficit of $7.01 billion for November, exceeding expectations of $4.42 billion — marking the third consecutive month of rising trade deficit driven by sluggish exports.

Exports shrank by 14%, lower than forecasts of a drop of 11% — while imports grew more than expected by 2.7%, according to preliminary data from the customs agency.

– Jihye Lee

CNBC Pro: UBS reveals 15 global stocks sensitive to China’s reopening plans

Chinese stocks have risen this week after the nation’s health authorities reported a recent uptick in vaccination rates, which experts regard as crucial to reopening the country.

The impact of Beijing’s change in tack toward dealing with the outbreak of Covid-19 is being felt not only in China but also around the world.

The Swiss bank UBS has identified 15 stocks in the MSCI Europe index that will outperform “in an environment where China’s growth rebounds and the country reopens its borders.”

CNBC Pro subscribers can read more here.

— Ganesh Rao

Powell continues to believe in a path to a soft-ish landing

Federal Reserve Chair Jerome Powell says he continues to believe in a path to a “soft-ish” landing — even if the path has narrowed over the past year.

“I would like to continue to believe that there’s a path to a soft or soft-ish landing” Powell said at the Brookings Institution.

“Our job is to try to achieve that, and I think it’s still achievable,” Powell said. “If you look at the history, it’s not a likely outcome, but I would just say this is a different set of circumstances.”

— Sarah Min

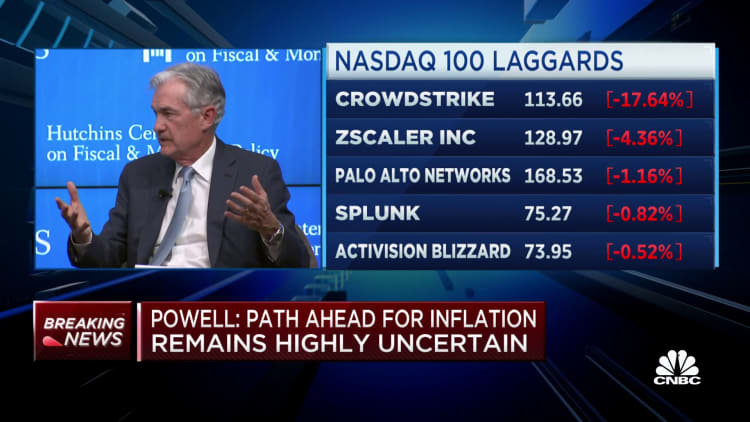

Indexes jump on Powell comments

Fed Chair Jerome Powell’s comments indicating the central bank will slow future interest rate hikes as soon as December put upward pressure on the three major indexes.

The S&P 500 jumped up 0.6% from the red on the news.

The Dow was near flat after trading down for most of the day.

The Nasdaq Composite gained steam to 1.3% up.

— Alex Harring

Powell says Fed can “moderate the pace” of future rate increases due to lagged effect of past hikes

Federal Reserve chairman Jerome Powell told an audience at the Brookings Institution Wednesday that the central bank can afford to ease back on its tighter monetary policy at its December meeting (due to wrap up Dec. 14).

The lagged effect of higher rates already taken in 2022, plus the drawing down of the size of the Fed’s balance sheet through quantitative tightening, mean “it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” Powell said.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” said the 69-year-old Fed chair.

In response to Powell’s remarks, the S&P 500 quickly gained to about 3970 vs about 3950 before the address.

— Scott Schnipper, Jeff Cox

Read More:South Korea GDP, Caixin Manufacturing PMI, Japan Consumer Confidence

2022-12-01 01:21:00