Readers of a certain age will remember Carnac the Magnificent, Johnny Carson’s recurring alter ego. As Carnac, the late-night host would list off three seemingly unrelated words, all of which answered a question that was sealed in an envelope that he held to his forehead.

Today we’re going to play the same game, with the answers being PayPal, Kanye (or Ye, as he’s now known) and central bank digital currencies (CBDCs). And the question: What are the consequences of financial hyper-centralization?

Some of you will make the connections immediately. For everyone else, let me explain.

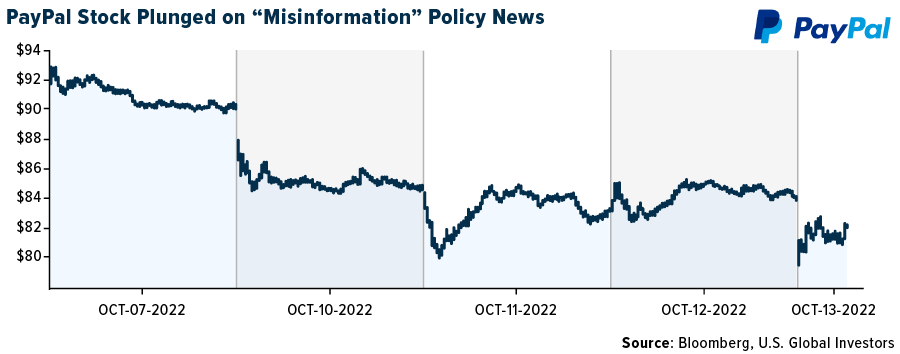

PayPal, the financial technology (fintech) firm cofounded over 20 years ago by Peter Thiel, Elon Musk and others, was roundly criticized this week after an update to its terms of service showed that the company would fine users $2,500 for, among other things, spreading “misinformation.” A PayPal spokesperson was quick to walk back the update, even claiming that the language “was never intended to be inserted in our policy,” but the damage was done. #DeletePayPal started trending on Twitter, and the company’s stock tanked nearly 12% this week.

As for Ye, he and his apparel brand Yeezy were reportedly dropped this week by JPMorgan Chase. In a letter widely shared on social media, JPMorgan says Ye has until November 21 to move his business finances elsewhere.

No reason was given for the bank to cut ties with the billionaire rapper, but it’s easy to surmise that Ye was targeted for his political beliefs and outspokenness. I don’t agree with everything he says, nor should you. He’s a controversial figure, and his comments are often erratic and designed to get a rise out of his critics. I’m not sure, though, that this alone should imperil his access to banking services.

The two cases of PayPal and Ye represent what I believe are legitimate and mounting concerns surrounding centralized finance. Admittedly, Ye is an extreme example. He’s a multiplatinum recording artist with tens of millions of social media followers. But there’s a real fear among everyday people that they too can be fined or have their accounts frozen or canceled at any time for expressing nonconformist views.

CBDCs Are Inevitable

That brings me to CBDCs. I was in Europe this week where I attended the Bitcoin Amsterdam conference, and I was honored to participate on a lively panel that was aptly titled “The Specter of CBDCs.”

As I told the audience, I believe CBDCs are inevitable, ready or not. There are too many perceived benefits. These currencies offer broad public access and instant settlements, streamline cross-border payments, preserve the dominance of a nation’s currency and reduce the operational costs of maintaining physical cash. Here in the U.S., millions upon millions of dollars’ worth of bills and coins are lost or accidentally thrown away every year.

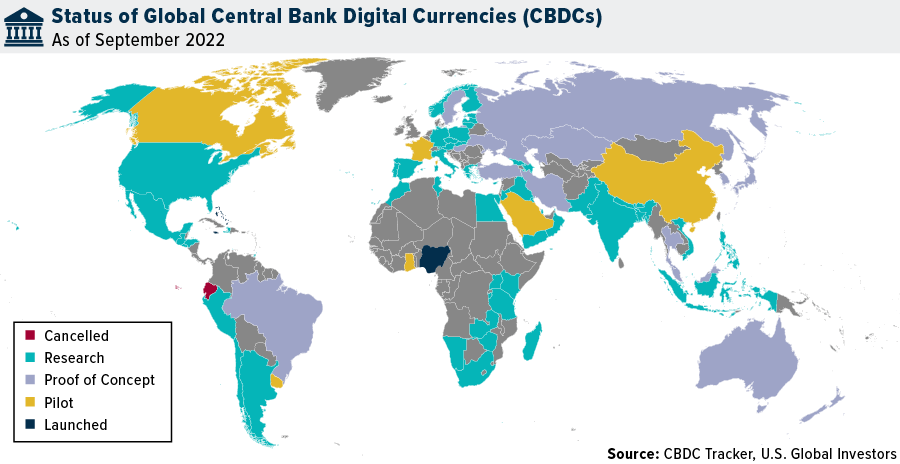

An estimated 90% of the world’s central banks currently have CBDC plans somewhere in the pipeline.

As I write this, only two countries have officially launched their own digital currencies—the Bahamas with its Sand Dollar, and Nigeria with its eNaira—but expect many more to follow in the coming years. China, the world’s second largest economy, has been piloting its own CBDC for a couple of years now, and India, the seventh largest, released a report this week laying out the “planned features of the digital Rupee.” A pilot program of the currency is expected to begin “soon.” And speaking at an annual International Monetary Fund (IMF) meeting, Treasury Secretary Janet Yellen said that the U.S. should be “in a position where we could issue” a CBDC.

CBDCs Improve Bitcoin’s Use Case

Due to the centralized nature of CBDCs, there are a number of concerns that give many people pause. Unlike Bitcoin, which is decentralized and anonymous, CBDCs raise questions about privacy, government interference and manipulation.

In the White House’s own review of digital currencies, issued last month, policymakers write that a potential U.S. coin system should “promote compliance with” anti-money laundering (AML) and counter-terrorist financing (CFT) laws. Such a system should also “prevent the use of CBDC in ways that violate civil or human rights,” and it should be sustainable; that is, it should “minimize energy use, resources use, greenhouse gas emissions, other pollution and environmental impacts on local communities.”

Nothing about this sounds inherently nefarious, but then, some of us may have said the same thing about PayPal’s “misinformation” policy (whether intended or not) and JPMorgan’s decision to end its relationship with a polarizing celebrity.

I believe this only improves Bitcoin’s use case, especially if we’re headed for a digital future.

Worst 60/40 Portfolio Returns in 100 years

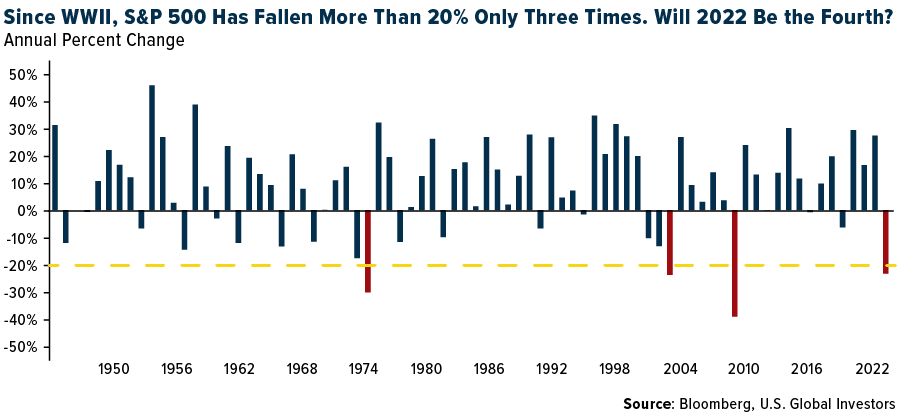

With only a little over 50 trading days left in 2022, it looks more and more likely that this will be among the very worst years in history for investing. Since World War II, there have been only three instances, in 1974, 2002 and 2008, when the S&P 500 ended the year down more than 20%. If 2022 ended today, it would mark only the fourth time.

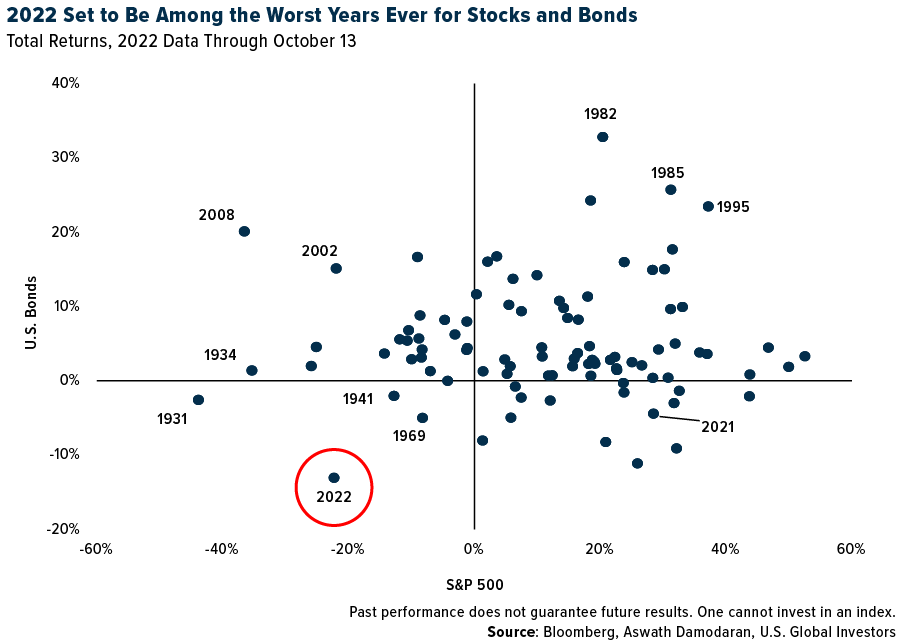

Here’s another way to visualize it. The scatter plot below shows each year’s total returns for the S&P 500 (horizontal axis) and U.S. bonds (vertical axis). As you can see, 2022 falls in the most undesirable quadrant along with the years 1931, 1941 and 1969. Not only have stocks been knocked down, but so have bond prices as the Fed hikes rates at an historically fast pace.

What this means is that the traditional “60/40” portfolio—composed of 60% stocks and 40% bonds—now faces its worst year in 100 years, according to Bank of America.

My takeaway is that diversification matters more now than perhaps in any other time in recent memory. Real assets like gold and silver look very attractive right now. Real estate is an option. Bitcoin continues to trade at a discount. Diversification doesn’t ensure a positive return, but it could potentially spell the difference between losing a little and losing a lot.

You can watch my panel at Bitcoin Amsterdam by clicking here!

Index Summary

- The major market indices finished mixed this week. The Dow Jones Industrial Average gained 1.15%. The S&P 500 Stock Index fell 1.55%, while the Nasdaq Composite fell 3.11%. The Russell 2000 small capitalization index lost 1.16% this week.

- The Hang Seng Composite lost 5.94% this week; while Taiwan was down 4.19% and the KOSPI fell 0.91%.

- The 10-year Treasury bond yield rose 13 basis points to 4.016%.

Airlines & Shipping

Strengths

- The best performing airline stock for the week was Qantas, up 8.4%. Airline stocks are so cheap from a valuation standpoint, writes Yahoo! Finance, they ought to take off at a rapid pace – they just need the right series of catalysts, which might be taking shape. “With continued network restoration and lower assumed fuel [costs] next year, the case for traffic growth in 2023 (versus 2022) is obvious. Over time, capacity normalization should drive unit cost (and unit revenue) normalization,” Evercore ISI analyst Duane Pfennigwerth stated in a note to clients.

- American Airlines’ and United Airlines’ fourth quarter booked revenue – through the end of September – continues to exceed that of 2019 by a wide margin, continuing the trend established earlier this year. Chase daily card swipes for future travel have also strengthened and stabilized post-Labor Day.

- American Airlines updated its third quarter 2022 guidance. Management is now guiding revenue, unit revenue, and margins above the prior range. Capacity is expected to be at the lower end of the prior range with non-fuel unit costs at the higher end.

Weaknesses

- The worst performing airline stock for the week was Air China, down 16.3%. Boeing reported third quarter 2022 commercial deliveries of 112 aircraft, up from 85 in the same quarter last year, but down sequentially from 121 in the second quarter of 2022. The delivery numbers were mixed, reflecting a resumption of deliveries with the 787, however, 737 MAX deliveries were down 14% sequentially from the second quarter.

- For container shipping, spot freight rates have fallen 16 weeks in a row with the latest rates closing below $2,000, levels perceived by the industry as the “trough”. Against this backdrop, the three Asia-based container liners, COSCO Shipping, OOIL and Evergreen Marine, have seen drastic selloffs in recent months, reflecting concerns over whether this would be a bottomless downcycle, like the episode witnessed in the past decade.

- According to an 8-K released last week, damage from Hurricane Ian has potentially impacted the construction timeline of Allegiant’s Sunseeker Resort in Charlotte County, Florida. The resort was previously selling rooms for May 2023 but has since pushed back this selling date to September 2023. While the extent of the damage is largely unknown, as access to the resort has been limited since the storm, it appears the resort was protected by the seawall along the Charlotte Harbor and structures built above the mean high tide, according to management.

Opportunities

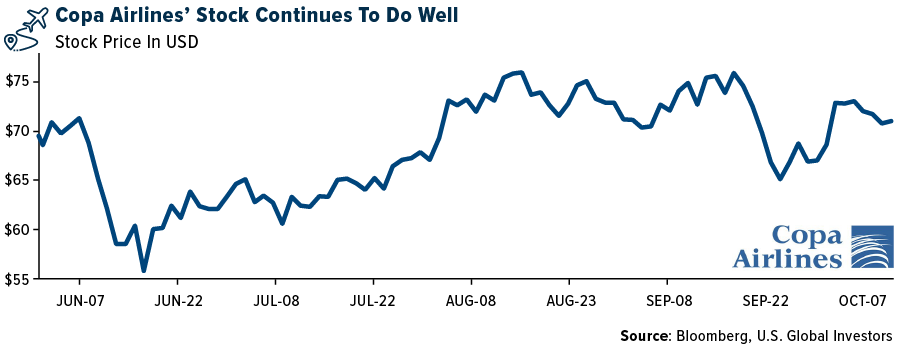

- According to Raymond James, while economic uncertainty persists, the group continues to believe Copa Airlines’ improved unit cost (versus pre-crisis) reaffirms a structural cost advantage, which along with its robust balance sheet and advantaged hub, serves as a formidable defensive moat. In addition, Copa is one of the first airlines to start returning cash to its shareholders, currently through buybacks (with $200 million in repurchases authorized this year), and the group expects a more meaningful dividend in 2023.

- Unadjusted global air freight demand in August was 2.9% below the same period in 2019, while seasonally adjusted volumes increased 1.0%…

Read More:PayPal, Kanye and CBDCs

2022-10-15 00:11:15