Companies have only just begun to report third-quarter results but investors are braced for the worst. Punk earnings could spell more downside for an already beaten-up stock market.

“We’re expecting earnings to be poor,” says Phil Orlando, chief equity market strategist at Federated Hermes. “The trends we were seeing earlier in the year have continued into the third quarter and the fourth quarter and that will lead to decelerating growth and rapidly deteriorating profit margins.”

One exception: Energy companies will likely power ahead and continue to post stronger-than-expected profits as demand for oil and natural gas is strong and prices remain elevated. It was the only sector to see meaningful upward revisions to earnings in the quarter. Another bright spot: Revenue across the board should remain in positive territory, benefiting from higher inflation.

“The swing factor is guidance,” says Orlando, referring to the practice of senior executives providing estimates for the coming quarter and year, and setting expectations surrounding their businesses. “I think it will be very cautious. Forward guidance for the fourth quarter and full year 2023 will be challenged.”

What to Watch for in Third-Quarter Earnings

- Economic Forecasts: Investors will be listening for clues from corporate executives on whether inflationary headwinds are abating or increasing, and if they are bracing for recession.

- Consumer Demand: With consumer spending critical to maintaining economic growth, investors will be paying close attention to lending activity, new orders, inventories, and sales figures.

- Employment: Companies have been struggling with a tight labor market and staffing shortages throughout the pandemic. But if demand is easing look for more layoff announcements as companies try to lower their costs.

- Profit Margins: How well are companies managing higher costs amid shifting demand.

- Supply Chains: Logjams along the supply chains moving goods and materials have been a hugely disruptive force and led to lost sales and higher costs. Any improvement on that front would be a relief to investors.

- Currency Impacts: The strong U.S. dollar has dented the earnings of big multinational and technology companies with sprawling presences overseas. Investors will be trying to gauge how long the strong dollar is expected be a factor.

Bank of America’s equity and quantitative strategist Savita Subramanian in a third-quarter preview called “Buckle Up!” says she expects earnings to slightly miss estimates but sees big downside risk starting in the fourth quarter. “Guidance is going to be terrible,” she says. She’ll be listening for mentions of recession, weak demand, and layoffs.

“Pricing is peaking, demand is slowing, yet costs are sticky,” says Subramanian. “Our Corporate Misery Indicator further declined in 3Q, indicating worsening misery and pointing to increased margin pressure. Demand is key, which was the main driver of pricing power post-COVID. Weakening demand points to weaker pricing and margin pressure. Bloated inventories also pose downside risk to margins, particularly for many retailers.”

In a recent piece titled “The End of Earnings Growth,” Jeff Kleintop, chief global investment strategist at Charles Schwab, says stock valuations will come under further pressure as third-quarter earnings will likely fall short of expectations. While Wall Street analysts have been lowering their estimates steadily to reflect a slower growth environment, expectations are still too high, he says.

Kleintop notes the historically tight correlation between the global manufacturers Purchasing Managers’ Index (PMI) and earnings growth at companies. Trends in the PMI tend to be a forward indicator of future earnings.

“Leading components of the PMI, such as new orders, suggest a further economic slowdown in the months ahead and a coming decline in earnings,” Kleintop wrote in his report. “If so, the erosion of earnings as a key support for stocks could lead to a further stock market sell-off in the weeks ahead as corporate leaders guide analysts to further lower their earnings estimates.”

Corporate earnings held up well in the first half despite the headwinds of inflation and supply chain disruptions. Now, a double-trouble combination of slowing economic growth and eroding profit margins is beginning to hurt.

Higher costs for wages, transportation and shipping, warehousing, and fuel and energy are cutting into companies’ profits and margins. Penny-pinching consumers are pulling back and trading down, squeezed by sky-high prices for rent, food, medical care, new vehicles, and mass transit, including airfares.

Indeed, the latest inflation data for September released last week showed prices climbing a higher-than-expected 8.2% from a year earlier. The so-called core Consumer Price Index, which excludes food and energy prices, rose to a new peak of 6.6%.

Persistent high inflation will keep pressure on the Federal Reserve to continue boosting the federal-funds rate as it attempts to rein in the fastest pace of growth in consumer prices in 40 years.

Technology and consumer discretionary companies will be the most challenged in this environment, according to Orlando of Federated Hermes. With consumer spending such an important factor in U.S. economic growth—representing about 70% of gross domestic product—the holiday season bears close watching. He’s concerned margins could be under an extraordinary amount of pressure. One cautionary sign: Walmart (WMT) plans to hire far fewer seasonal workers during the holiday season than it did last year. It will also offer current employees extra hours before adding to staff.

Depending on the guidance companies give, and based on a forecast for negative economic growth in the first and second quarters and full-year 2023, Federated Hermes is considering cutting its 2023 earnings estimate for the S&P 500 to $200 from $230. That compares with the current Wall Street consensus of $238.

Bank of America’s Subramanian is also forecasting earnings of $200 on the S&P in 2023.

“We’re on a glide path to an outright recession next year,” says Orlando. “Directionally, that’s what we’re thinking.”

Events scheduled for the coming week include:

- Monday: Bank of America (BAC) and Bank of New York Mellon (BK) report earnings.

- Tuesday: Netflix (NFLX), Johnson & Johnson (JNJ), and Goldman Sachs (GS) report earnings.

- Wednesday: Tesla (TSLA), United Airlines (UAL), and Procter & Gamble (PG) report earnings.

- Thursday: American Airlines (AAL), AT&T (T), and Snap (SNAP) report earnings.

- Friday: Huntington Bancshares (HBAN), Verizon (VZ), and American Express (AXP) report earnings.

For the trading week ended Oct. 14:

- The Morningstar US Market Index fell 1.78%.

- The best-performing sector was consumer defensive, which rose 1.07%

- The worst-performing sectors were technology, down 4.37%, and consumer cyclical, which fell 3.65%.

- Yields on the U.S.10-year Treasury rose to 4.01% from 3.88%.

- West Texas Intermediate crude oil prices fell 7.59% to $85.61 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 282, or 33%, were up, and 561, or 67%, declined.

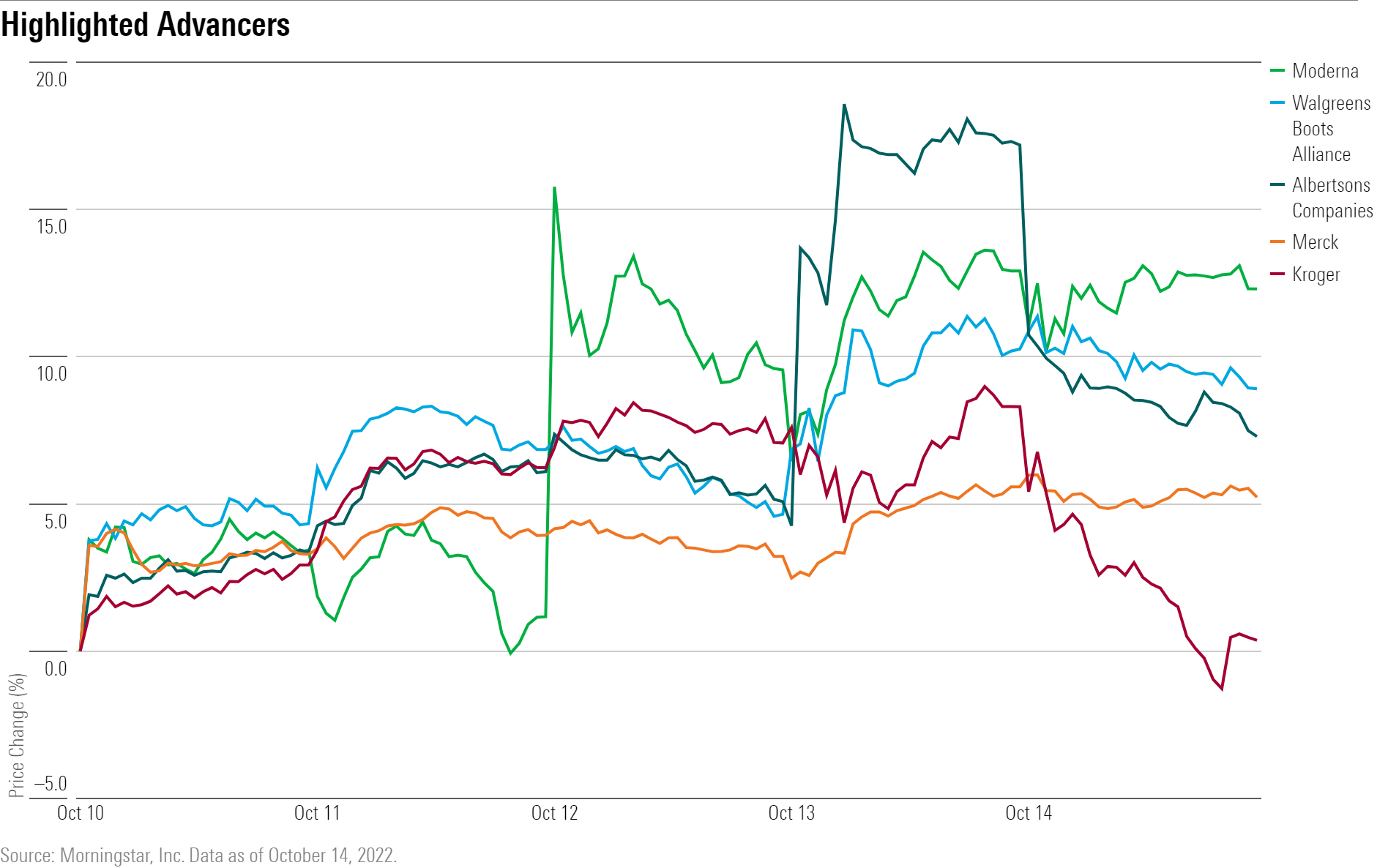

What Stocks Are Up?

Albertsons’ (ACI) stock surged after Kroger (KR) agreed to purchase the supermarket operator in a $24.6 billion deal, CNBC reported. Shares of Kroger inched up.

“While we believe a combination between the two largest pure-play grocers in the United States would create scale benefits (and associated cost and purchasing leverage) that would help fend off burgeoning omnichannel titans Walmart and Amazon, we suspect overlap between the two chains’ footprints in many markets may lead regulators to scrutinize a transaction closely,” says Zain Akbari, Morningstar equity analyst.

Walgreens Boots Alliance () stock rallied after the pharmacy retailer posted results that beat market expectations. Management now expects an earnings per share range of $4.45-$4.65 for fiscal 2023.

“This guidance is driven by rapid acceleration of its U.S. healthcare business and core business growth compensating for adverse currency movements and COVID-19 vaccine volume headwinds,” Morningstar senior equity analyst Julie Utterback says.

Shares of Moderna (MRNA) and Merck (MRK) were up on news the two drug manufacturers would team up to produce personalized cancer vaccines for patients with high-risk melanoma, CNBC reported.

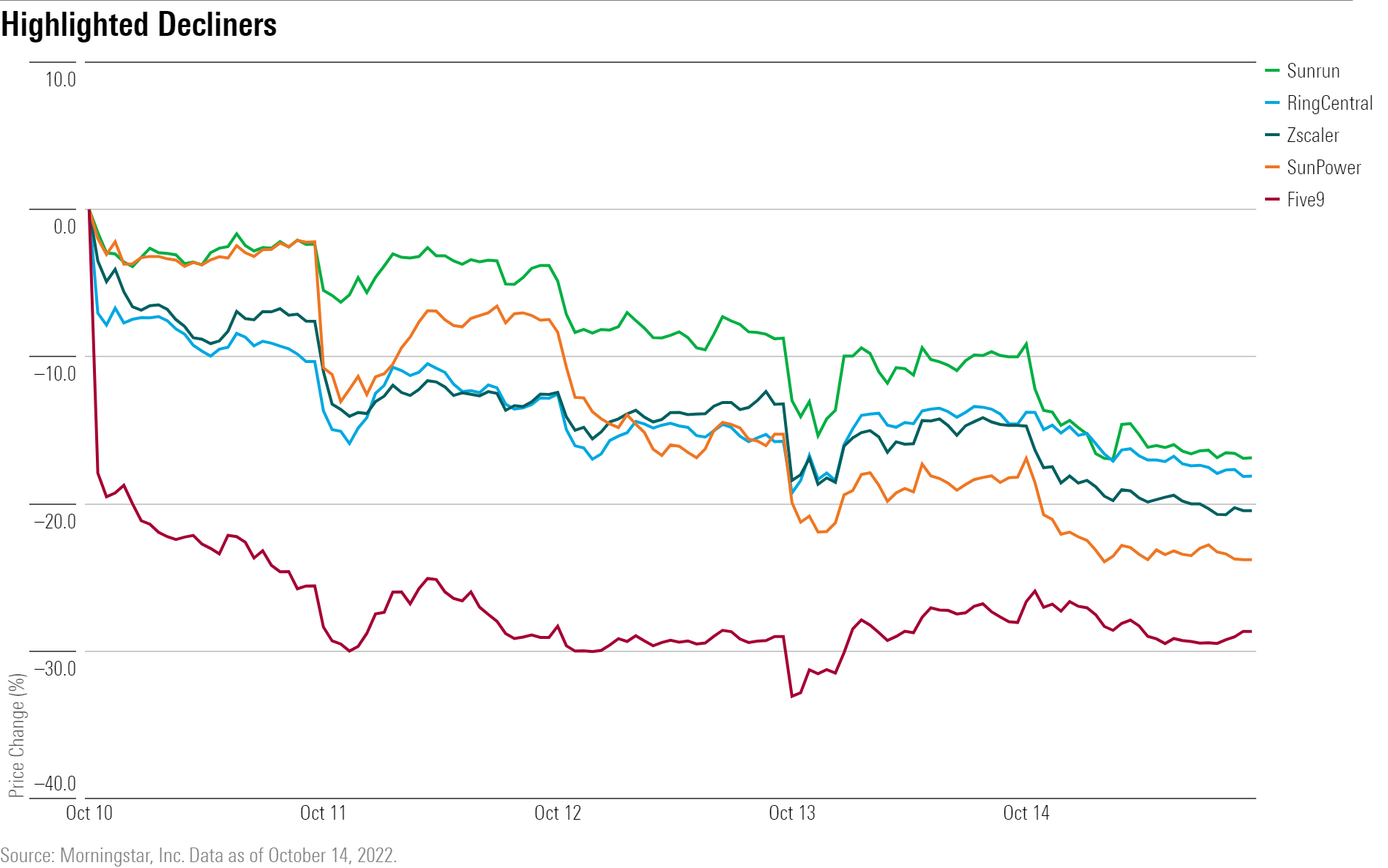

What Stocks Are Down?

Five9 (FIVN) shares plunged after chief executive Rowan Trollope said he would resign from the software company, CNBC reported.

Volatility in solar stocks continued with the likes of SunPower (SPWR) and Sunrun (RUN) closing the week lower, after a hotter-than-expected Consumer Price Index report was seen as further indication thatthe Federal Reserve would continue aggressively hiking interest rates, raising concerns for the high-growth industry.

Tech stocks also fell during the week on increased concerns of about a possible recession, with Zscaler (ZS), RingCentral (RNG), and Atlassian (TEAM) among the worst performers.

Read More:Markets Brief: What to Watch for in Q3 Earnings

2022-10-14 21:05:46