Torsten Asmus

Gold continues to languish near major lows after a rough summer, deeply out of favor with traders. Oddly this leading alternative investment seems oblivious to the first inflation super-spike since the 1970s. That should be driving big gold demand, fueling a major upleg. But that classic inflationary response has been temporarily delayed by heavy-to-extreme gold-futures selling. When that reverses to buying, gold will soar.

As everyone running a household or business knows, inflation is raging out of control. Not even lowballed government statistics can hide it. The monthly US Consumer Price Index has averaged blistering 8.3% year-over-year gains so far in 2022! That’s 4.6x 2019’s +1.8%-YoY monthly average, the last normal year before the pandemic-lockdown stock panic and its extensive aftermath. This June, the CPI soared 9.1% YoY.

That proved its hottest print since way back in November 1981, a staggering 40.6-year high! That’s despite today’s CPI being way watered-down compared to the 1970s one, extensively understating real inflation. Americans sure wish prices were only climbing 9%ish annually, but the grim reality out there is at least double to triple that. With such extreme inflation, gold should be soaring on huge investment demand.

Gold skyrocketed during the last similar inflation super-spikes in the 1970s. In the first the CPI blasted from +2.7% YoY to +12.3% over 30 months into December 1974. Gold’s monthly-average prices from trough to peak CPI months launched 196.6% higher! During the second the CPI exploded from +4.9% YoY to +14.8% in 40 months climaxing in March 1980. Gold’s monthly-average prices were a moonshot, up 322.4%!

If today’s CPI still used its far-more-honest 1970s methodology, headline inflation would be about double reported levels. Gold’s stunning disconnect from today’s raging inflation is troubling, leaving the great majority of traders forgetting about that 1970s precedent. After suffering one of its worst summers in modern bull-market years, gold has largely been left-for-dead. Instead of flocking back, investors are fleeing.

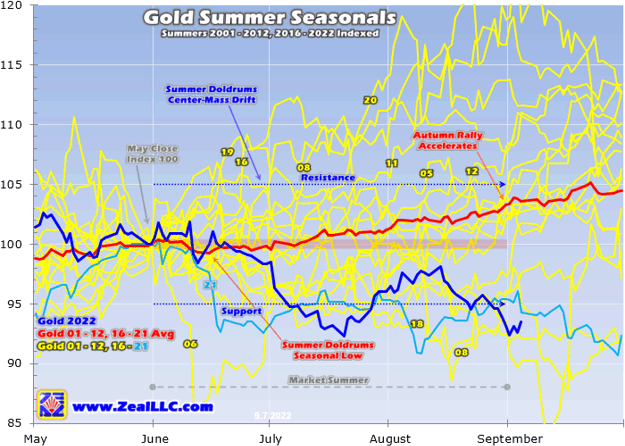

This vexing gold impotence is sure evident in this chart updated from my latest gold-summer-doldrums essay of early July. It normalizes gold prices during modern bull-market summers, indexing price action to May closes. Gold’s average summer performances between 2001 to 2012 and 2016 to 2021 are rendered in red. Superimposed in dark blue are 2022’s anomalously-weak technicals, which have been ugly.

Gold Summer Seasonals Summers 2001 – 2012, 2016 – 2022 Indexed (ZealLLC.com)

Normally gold carves a major seasonal low in mid-June, then starts marching higher as its autumn rally fueled by outsized Asian gold demand accelerates. But instead of bottoming, gold deviated wildly from that trend this year. Down 7.7% summer-to-date in late July, that was gold’s worst performance during all these modern gold-bull years! The yellow metal should’ve been surprising to the upside with inflation raging.

Since price action drives herd sentiment, that fueled overwhelming bearishness that continues to fester. Neither speculators nor investors want anything to do with gold, because its momentum has been going the wrong way. If not even the first inflation super-spike since the 1970s can ignite big, sustained gold demand, what on earth could? Looking broken given this super-bullish backdrop, gold has been abandoned.

But the kicker is recent months’ dreadful gold underperformance isn’t fundamentally-righteous. It is just a short-lived anomaly driven by heavy-to-extreme gold-futures selling. That’s what has been dogging gold, and it is inherently self-limiting and mean-reverting. Gold-futures speculators’ capital firepower to sell is relatively-small and finite. Once that is expended, they will have to buy proportionally to normalize their bets.

The biggest problem in gold markets is the extreme leverage intrinsic in futures trading. That enables a tiny group of traders to wield wildly-disproportional influence over gold prices. This week, each contract controlling 100 ounces was worth $170,000 at $1,700 gold. Yet traders are only required to maintain cash margin in their accounts of $6,500 per contract, making for crazy maximum leverage way up at 26.2x!

Running at 26x, each dollar traded in gold futures has 26x the price impact on gold as a dollar invested outright! So gold-futures speculators punch way above their weights in dominating short-term gold price action. This is a serious structural problem undermining gold fundamentals, as such extreme leverage creates irresistible opportunities for price manipulation. Recent US federal-court cases have proven this out.

Just a month ago, the former head of JPMorgan Chase’s precious-metals business and his top gold trader were convicted of manipulating gold prices from 2008 to 2016! They face decades in prison when sentenced. They did this through leveraged gold-futures trading, including spoofing. That is unleashing huge bogus gold-futures sell orders to hammer gold, which are then quickly cancelled before execution.

During closing arguments in that trial, the federal prosecutor stated “They had the power to move the market, the power to manipulate the worldwide price of gold.” That brings the US Justice Department’s secured convictions to ten former Wall Street traders at JPMorgan, Merrill Lynch, Deutsche Bank, Bank of Nova Scotia, and Morgan Stanley. So there’s no doubt leveraged gold-futures trading greatly affects gold prices!

Thus it desperately needs to be reformed dramatically to eliminate this extreme leverage that inevitably attracts fraudsters. 20x to 30x should be illegal, like in the stock markets where 2x has been the limit since 1974. Even for the vast majority of gold-futures traders who aren’t criminals, such radical leverage is so exceedingly-risky that it compresses their trading time horizons into a very-myopic ultra-short-term.

Running 26x, a mere 3.8% gold price move against specs’ positions will wipe out 100% of their capital risked! So all they can afford to do is chase hour-by-hour momentum, which is what they did this summer to slam gold. They can’t care about gold’s global supply-and-demand fundamentals, nor inflation, nor prevailing trends in gold and broader markets. All that matters is whether gold is rising or falling each minute.

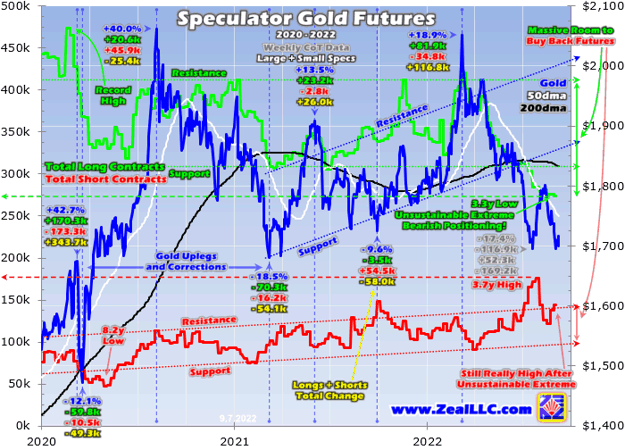

This chart superimposes recent years’ gold technicals over speculators’ total positions in gold-futures long and short contracts. Those are reported weekly in the famous Commitments-of-Traders reports, current to Tuesday closes. Gold disconnected from inflation in recent months because gold-futures specs puked out enormous amounts of selling! This short-term-momentum chasing had nothing to do with fundamentals.

Speculator Gold Futures 2020 – 2022 (ZealLLC.com)

Gold started 2022 quite strong, surging 16.0% over 3.2 months into early March. While Russia invading Ukraine was a big contributor to that fast spike to $2,051, that just extended a year-old uptrend. Investors impressed by gold’s strong upside momentum were growing more bullish and increasingly deploying new capital. Gold even consolidated high near uptrend resistance after that initial geopolitical shock passed.

But something changed in mid-April when gold was still running $1,977. Over the next 3.2 months into late July, it collapsed 14.3% to $1,695. That was despite headline CPI inflation in April, May, June, and July coming in red-hot up 8.3%, 8.6%, 9.1%, and 8.5% YoY! It made no sense to flee gold with that kind of wildly-bullish backdrop, given the yellow metal’s centuries-long history of being the ultimate inflation hedge.

Gold crumbled contrary to fundamentals because gold-futures speculators started aggressively selling and that snowballed. From early March to late July, they vomited out an enormous 116.9k gold-futures long contracts while piling on another 52.3k short ones. That 169.2k contracts of spec selling dwarfed anything seen in recent years, adding up to a massive equivalent of 526.1 metric tons of gold dumped!

That was way too much too fast for markets to absorb, so gold prices collapsed. This huge gold-futures spewing was initially catalyzed and subsequently fueled by the US dollar rocketing parabolic to hit multi-decade secular highs. Gold-futures specs watch the US Dollar Index for their primary trading cues, doing the opposite. Within that span gold plunged, the USDX skyrocketed an utterly-enormous-for-it 8.8% at best!

Heavy gold-futures selling and thus gold prices almost perfectly inversely mirrored the USDX’s fortunes during that time. That leading dollar benchmark blasting to an extreme 20.1-year high in mid-July fueled great euphoria. Like always during big-and-fast surges to lofty heights, traders’ greed flared to bullish extremes. Despite that long-dollar trade being wildly-overcrowded, they assumed its upside would last indefinitely.

That deluge of capital into the extraordinarily-overbought US dollar was in turn driven by the Fed’s most-extreme hawkish pivot ever. That included aggressive official jawboning on coming rate hikes, multiple massive 50- and 75-basis-point ones executed, and ramping up the biggest-and-fastest quantitative-tightening monetary-destruction campaign ever attempted! The dollar soared with the Fed blasting rates higher.

It was boosted by a cratering euro, as that dominates the USDX at 57.6% of its weighting. Just like the Fed, the European Central Bank had redlined its monetary printing presses since March 2020’s scary pandemic-lockdown stock panic. So inflation was raging in the Eurozone too, but the ECB was dragging its feet on hiking rates. With American yields soaring way faster than European ones, the euro was sold hard.

Exacerbating that long-dollar short-euro trade, Europe is facing a severe recession if not a depression due to its heavy reliance on Russian natural…

Read More:Futures Still Dogging Gold | Seeking Alpha

2022-09-10 02:20:00