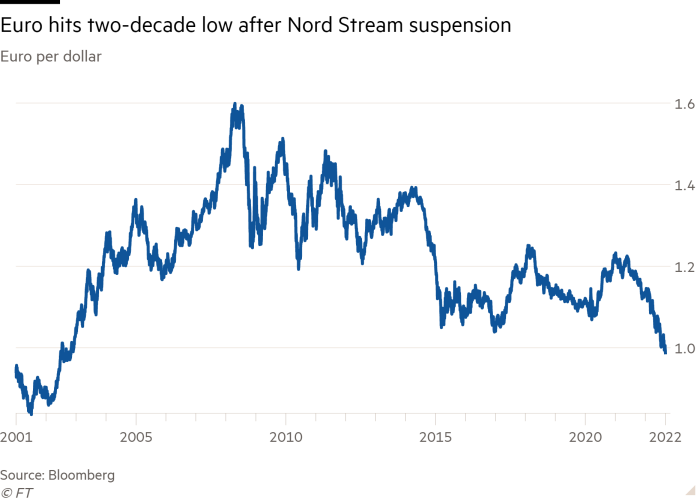

The euro dropped on Monday to a new 20-year low after Russia’s decision to shut a major gas pipeline to Europe intensified the energy crisis that has dealt a heavy blow to the region’s economy.

The common currency fell as much as 0.7 per cent to $0.988, the lowest level since 2002. European stocks also fell, with the regional Stoxx 600 index down 1.2 per cent, Germany’s Dax off 2.5 per cent and France’s Cac 40 down 1.8 per cent. London’s FTSE 100 slipped 0.7 per cent.

In energy markets, Dutch TTF gas futures, the benchmark European contract, jumped 25 per cent to €262 per megawatt hour, rising back towards all-time highs hit above €340 just under two weeks ago.

The price rise comes as European capitals struggle to contain growing concerns over Russia’s “weaponisation” of gas supplies to the continent after Moscow on Friday said it would suspend the flow of gas through the key Nord Stream 1 pipeline.

Dmitry Peskov, Russian president Vladimir Putin’s spokesman, said on Monday Russia’s gas supplies to Europe would not resume in full until the “collective west” lifts sanctions against Moscow.

“The problems pumping gas came about because of the sanctions western countries introduced against our country and several companies,” Peskov said, according to Interfax. “There are no other reasons that could have caused this pumping problem.”

Gazprom, Russia’s state-run gas monopoly, said on Friday it would halt gas supplies through Nord Stream 1 because of a technical fault, which it blamed on difficulties repairing German-made turbines in Canada.

“This was long a scenario dreaded by markets and priced with some probability, but seems to have become a reality now,” said analysts at RBC Capital Markets in London.

Sweden and Finland over the weekend moved to provide government funding for utility companies struggling with sharply heightened collateral requirements on exchanges, warning that without intervention energy markets could seize up and potentially threaten the wider financial system.

The UK energy sector has warned that electricity generators may also need government support, with Liz Truss or Rishi Sunak set to be announced as prime minister later on Monday following the conclusion of the Conservative party leadership campaign. Sterling was flat at about $1.15, only a penny over the low it hit during the 2020 coronavirus crisis.

Teresa Ribera, Spain’s energy and environment chief, said Russian president Vladimir Putin was “pushing the resilience of European citizens to the limit and undermining confidence in EU institutions”.

Ribera, minister for ecological transition, said in an interview with the newspaper Expansión that “Putin has dynamited the energy market”. “It is broken and immediate intervention is needed. It is no longer working according to the normal rules and the European Union needs to act urgently to stop the Russian leader’s blackmail.”

EU energy ministers will gather for an emergency meeting on Friday to discuss measures to tame spiralling natural gas prices.

Analysts said the latest twist in the energy crisis would raise the stakes for European Central Bank policymakers, who are also set to meet this week. Several big investment banks, including JPMorgan, Bank of America and Goldman Sachs, said last week they expected the central bank to lift rates by 0.75 percentage points, the biggest increase since 1999, as they battled record inflation. While the rise in gas prices could make the inflation situation worse, it also darkened the outlook for economic growth.

“The ECB’s task is greatly complicated by uncertainty over Russian gas supplies,” said Brian Martin, head of G3 economic research at ANZ. “Moscow’s decision not to restart gas flows via the Nord Stream pipeline raises downside growth risks while increasing the inflation outlook.”

Eurozone and UK government bonds came under pressure on Monday, with the yield on Germany’s benchmark 10-year Bund adding 0.05 percentage points to 1.57 per cent and the equivalent Italian yield rising 0.12 percentage points to 3.95 per cent. The 10-year gilt yield jumped as much as 0.08 percentage points to touch 3 per cent for the first time since 2014, reflecting a sharp drop in the British debt instrument’s price.

US markets were closed on Monday for the Labor Day holiday, something that could reduce overall trading volumes and increase liquidity.

Additional reporting by Barney Jopson and Max Seddon

Read More:Euro hits 20-year low and gas prices jump on Russian pipeline shutdown

2022-09-05 11:15:52