billnoll

Introduction

Vancouver-based Equinox Gold (NYSE:EQX) reported its second quarter 2022 results on August 3, 2022.

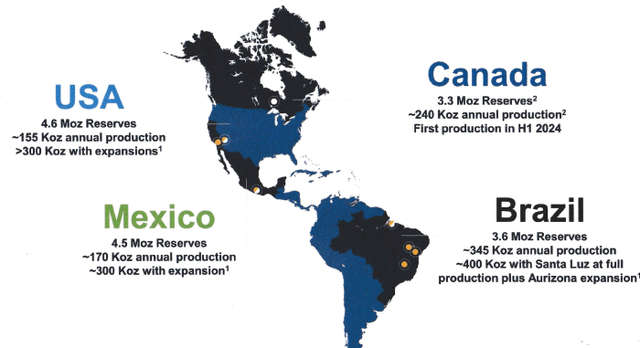

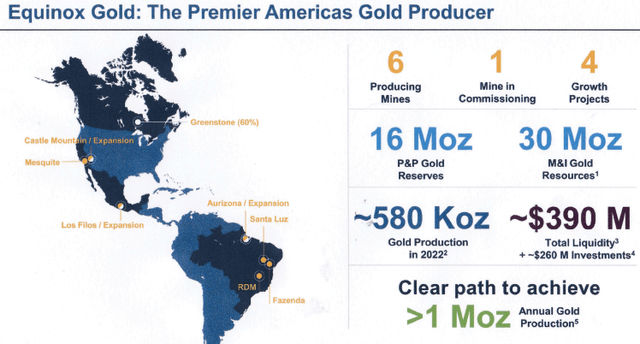

EQX Map World assets Presentation (Equinox Gold)

Important note: This article is an update of my article published on May 6, 2022. I have been following EQX on Seeking Alpha since February 2021.

1 – 2Q22 highlights

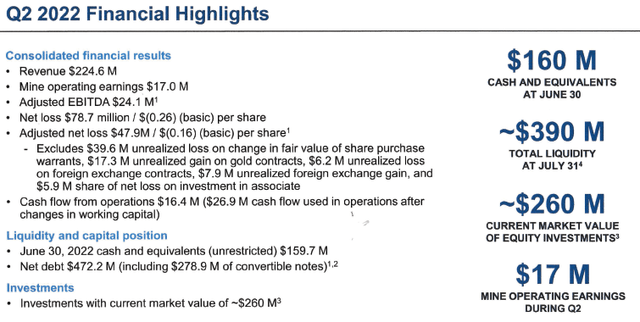

EQX 2Q22 Financial highlight Presentation (Equinox Gold)

Equinox Gold produced 120,813 Au oz during 2Q22, a 1.5% decrease over 2Q21 (122,656 Au oz) and up 2.9% sequentially.

The revenues came in at $224.6 million, down 0.7% from the last year’s quarter. The company posted a loss of $78.72 million compared to an income of $325.74 million last year.

The adjusted EBITDA for 2Q22 was $24.1 million.

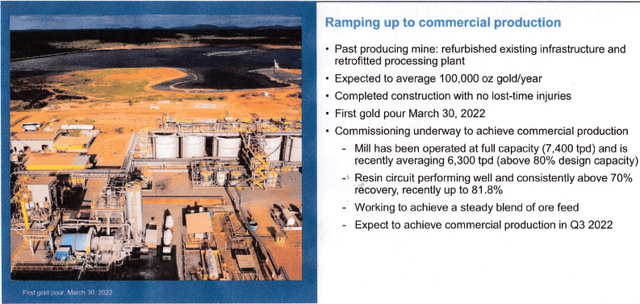

The Santa Luz project is ramping up and delivered 5,551 Au ounces this quarter (first gold pour end of March). Below is an update on the ramping up from the Presentation.

EQX Santa Luz project (Equinox Gold)

2 – Investment thesis

Equinox Gold is struggling with temporary technical issues related to its RDM mine, which forced the company to revise its 2022 guidance.

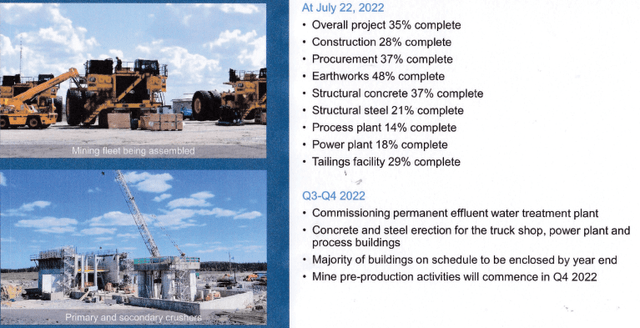

However, the company enjoys a solid balance sheet and solid future growth that deserve a long-term investment status. The Santa Luz is about to produce commercially, and the company is developing its Greenstone Project advancing on schedule with pre-production activities commencing in 4Q22.

EQX Greenstone project (Equinox Gold)

Equinox Gold is an Americas gold producer with nearly seven producing mines and four projects. Excellent mineral reserves with an estimated 580K Au ounces in 2022.

EQX World assets (Equinox Gold)

Thus, despite this weak period and extra CapEx, I still consider Equinox Gold a long-term investment.

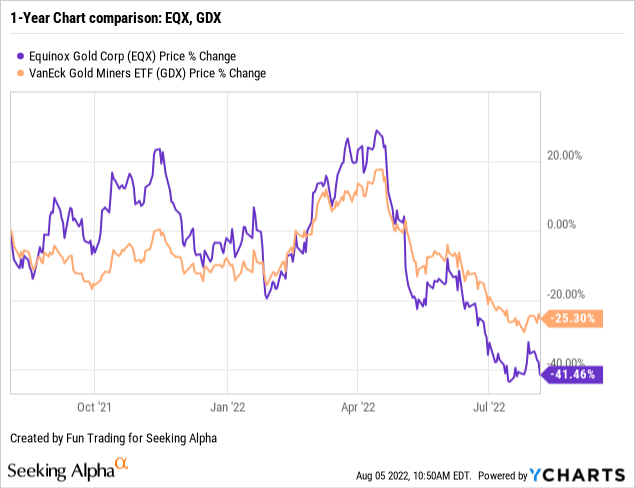

3 – Stock performance

Equinox Gold has significantly underperformed the VanEck Vectors Gold Miners ETF (GDX) and plunged over 30% after announcing weak 1Q22 results followed by weak 2Q22 results. EQX is now down 42% on a one-year basis.

CFO Peter Hardie said in the conference call:

With a tough quarter, we have reduced guidance, RDM. We suspended the guidance early in the year. So, no surprise there and also Santa Luz has been on slightly slower ramp up as we have a refurbished plant that’s starting to hit its stride a bit more these days. And so that will be about 580,000 average production for the year, slightly down on the expectations, beginning of the year and that clear path to 1 million ounces is well funded and it’s well on its way to being achieved over the next few years.

Equinox Gold – Financial Snapshot 2Q22 – The Raw Numbers

| Equinox Gold | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Total Revenues in $ Million | 226.22 | 245.13 | 381.23 | 223.16 | 224.60 |

| Net Income in $ Million | 325.74 | -5.24 | 184.08 | -19.78 | -78.72 |

| EBITDA $ Million | 364.16 | 47.55 | 244.29 | 35.91 | -4.08* |

| EPS diluted in $/share | 0.96 | -0.02 | 0.54 | -0.07 | -0.26 |

| Operating Cash flow in $ Million | 20.17 | 64.76 | 155.42 | -16.35 | -26.88 |

| Capital Expenditure in $ Million | 94.41 | 71.51 | 107.44 | 123.88 | 142.20 |

| Free Cash Flow in $ Million | -74.24 | -6.75 | 47.99 | -140.23 | -169.08* |

| Total Cash $ Million | 513.91 | 459.93 | 546.03 | 328.54 | 257.41 |

| Total Long term Debt in $ Million | 540.53 | 545.09 | 540.69 | 536.25 | 631.86 |

| Shares outstanding (diluted) in Million | 343.63 | 300.51 | 350.97 | 302.23 | 303.68 |

Data Source: Financial statement

Gold Production And Balance Sheet Details

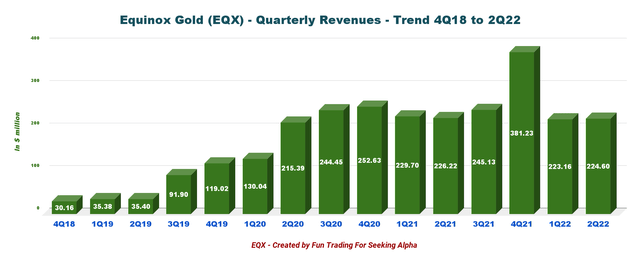

1 – Revenues were $224.6 million in 2Q22

EQX Quarterly Revenues history (Fun Trading)

Operating expense in 2Q22 was $170.7 million (2Q21 – $139.9 million).

The decrease in revenue compared to the comparative period of 2021 was primarily due to a 5% decrease in gold ounces sold, offset partially by a 4% increase in the realized gold price.

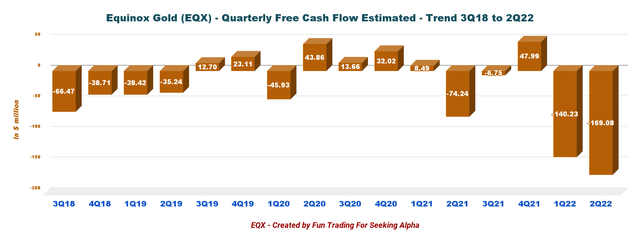

2 – Free cash flow was a loss estimated at $169.08 million in 2Q22

EQX Quarterly Free cash flow history (Fun Trading)

Trailing 12-month free cash flow was an estimated loss of $268.07 million with a loss in 2Q22 of $169.08 million. The loss in free cash flow is due mainly to the CapEx attached to Santa Luz and Greenstone. Therefore, it should not be considered a negative but an excellent investment for future growth.

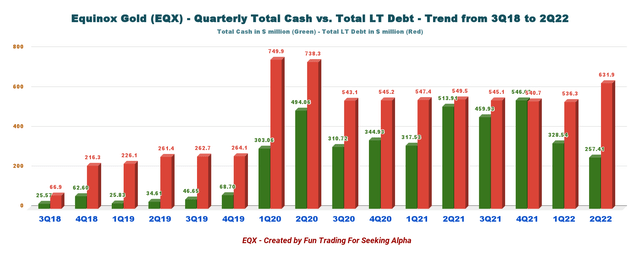

3 – Net debt is $374.45 million, and cash of $257.41 million in 2Q22

EQX Quarterly Cash versus Debt history (Fun Trading)

As of June 30, 2022, the total cash was down to $257.41 million, and the total liquidity is ~$505 million. However, the company indicates a Net debt of $385.1 million on March 31, 2022 (which includes $278.9 million of in-the-money convertible notes).

Total liquidity decreased to $390 million as of July 31, 2022.

The current market value of equity investment held by Equinox Gold in 2Q22 was approximately $260 million.

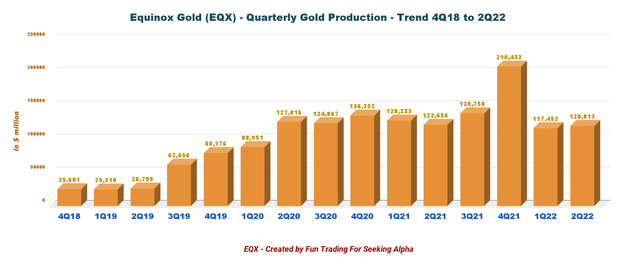

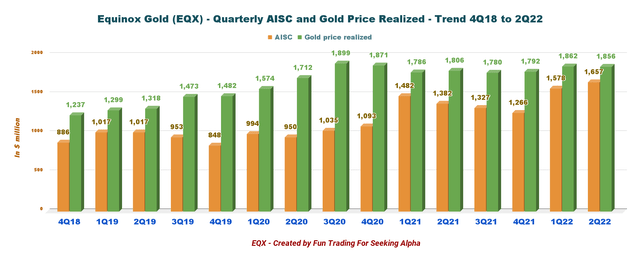

4 – Gold production consolidated details – 2Q22 gold production was 120,813 Au Oz (120,393 Au Oz sold)

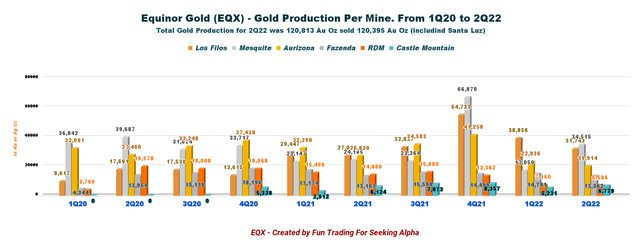

EQX Quarterly Gold production history (Fun Trading) The decrease in production was mainly due to lower gold sales at Aurizona and RDM, which were impacted by lower gold production and the Mercedes Transaction. Lower gold production at Aurizona was due in part to lower gold grades as high rainfall impeded access to higher-grade ore. Lower gold production at RDM was mainly due to the temporary suspension of mining and plant operations in mid-May due to a delay in receiving permits for the scheduled TSF raise and suspension of plant operations from mid-February to mid-March to reduce water levels in the TSF to comply with regulatory requirements. AISC in 2Q22 was $1,657 per ounce sold, and the gold price realized was $1,856 per ounce. The AISC is very high this quarter due to the low production sold. EQX Quarterly AISC and gold price history (Fun Trading)

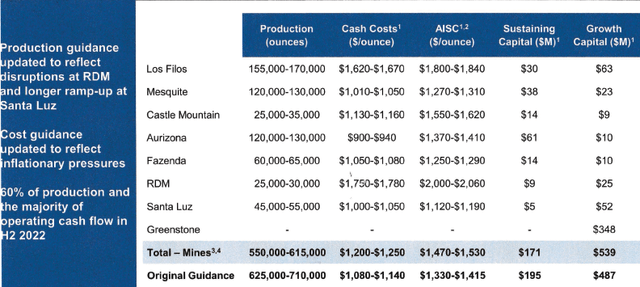

5 – Updated 2022 Guidance. 2022 Gold production is expected to be 582.5K Oz (mid-point), down 12.7%.

Production guidance has been updated. Production is expected to be 550K to 615K oz of gold and AISC of $1,330 to $1,415 per gold sold.

EQX Updated guidance 2022 Presentation (Equinox Gold)

6 – Production details per mine

EQX Quarterly gold production per mine history (Fun Trading)

Also, Equinox began full-scale construction at the Greenstone project in Canada. The project is 20% complete on schedule and budget at the end of 1Q22.

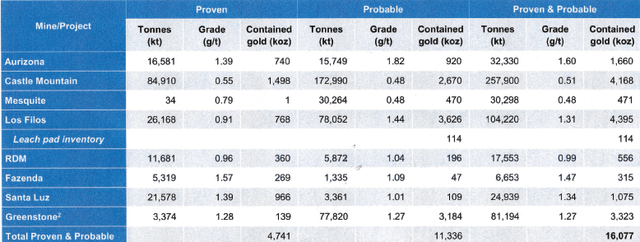

7 – Proven and Probable Mineral Reserves

Mineral reserves are now 16.077 Moz.

EQX Mineral reserves (Equinox Gold)

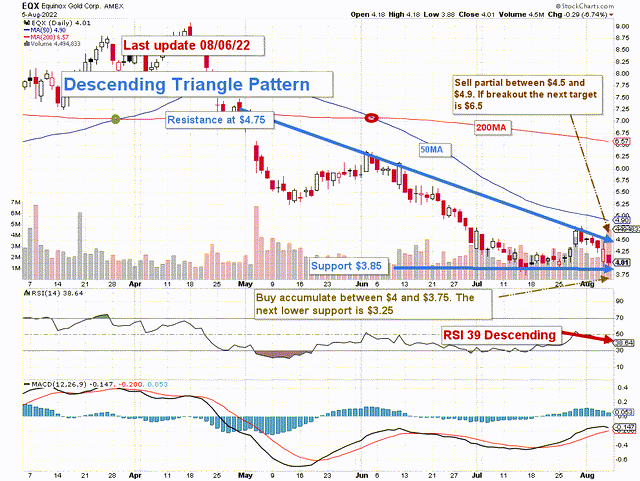

Technical Analysis (Short Term)

EQX TA Chart short-term (Fun Trading)

EQX forms a descending triangle pattern with resistance at $4.75 and support at $3.85.

The dominant trading strategy that I usually promote in my marketplace, “The gold and oil corner,” is to maintain a core long-term position and use about 40%-50% to trade LIFO while waiting for a higher final price target for your core position between $9 and $10.

I believe it is safe to accumulate for the long-term, and I recommend buying EQX between $4 and $3.85 with potential lower support at $3.25.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States to generally accepted accounting principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Read More:Equinox Gold Q2 Earnings: We Have Seen Better Days (NYSE:EQX)

2022-08-06 10:29:00