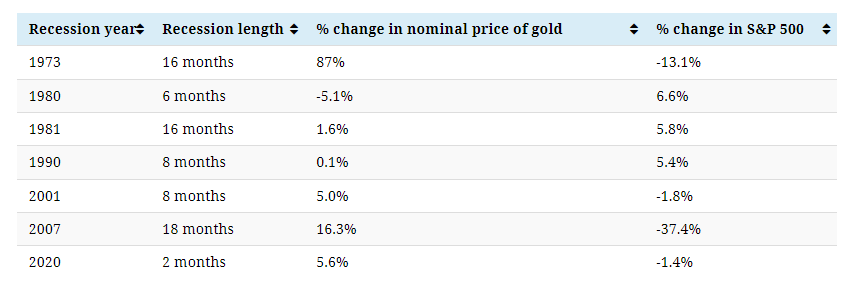

The above graphic uses data from Macrotrends to highlight gold’s price movements during recessions and compares it to changes in the S&P 500.

Gold vs. the S&P 500 in historical recessions

Gold’s value comes from its scarcity as a precious metal, in addition to its long history as a stable medium of exchange.

Gold also has a low-to-negative correlation with the stock market, suggesting that changes in the price of gold are largely independent of how stocks are faring. As a result, gold is considered an effective diversification tool for investors who want to hedge their bets.

But has gold helped investors weather recessionary storms in the past?

Since 1971, when the gold standard was abandoned, gold has largely seen positive price changes during recessions. And in the last three recessions since 2000, its performance has countered that of the S&P 500. While the increases in value haven’t been dramatic, they help cement gold’s position as a hedge against financial turmoil and as a store of value.

For example, when the stock market collapsed in 2007, investment demand for gold increased as investors looked for a safer option. Between 2007 and 2011, gold’s price more than doubled. Similarly, with fear and uncertainty at a high during the COVID-19 pandemic, gold-backed exchange-traded funds saw record inflows, and the price of gold reached an all-time high.

However, while gold’s price tends to rise during times of economic turmoil, it often stagnates or falls when the economy is healthy and investors seek riskier investments. As a result, it’s important for investors to consider the overall macroeconomic and geopolitical environment when looking at gold.

Gold’s time to shine in 2022?

The global economy has been shaking with turbulence in 2022, with consumers facing high inflation and investors seeing dismal stock market returns.

While these market conditions typically point towards rising demand for gold, that hasn’t been the case so far this year, with prices down 2% year-to-date. This is partly because of rising interest rates, which increase the opportunity cost of holding gold as investors forgo the interest income they could earn from saving accounts or bonds.

But in fact, history shows that gold often outperforms U.S. stocks and the dollar following interest rate hikes, after underperforming in the lead-up to rate hikes. Additionally, high inflation is eroding the purchasing power of each dollar, incentivizing investment in a tangible asset like gold and other hard assets.

With geopolitical uncertainty at a high and the U.S. consumer sentiment at decade-lows, will gold prove its value as a safe-haven asset in 2022?

(This article first appeared in the Visual Capitalist Elements)

Read More:Does gold’s value increase during recessions?

2022-07-11 19:28:01