Oleksandr Andriushchenko/iStock via Getty Images

Market Commentary

A wild quarter in equity markets ended in the worst returns since Q1 2020. Rising inflation drove the Federal Reserve to begin its rate hiking cycle, while Putin’s invasion of Ukraine sent commodity prices surging (learn more about the war’s agricultural impact in our recent podcast) and an already challenged supply chain system into further disarray. After the Fed raised rates in March, some optimism crept back into markets as investors viewed the sell-off as an opportunity to gobble up stocks that sold off sharply in January and February.

The Russell 1000 Index closed the quarter down -5.13%. Returns were weaker down the market-cap spectrum as the Russell Midcap Index fell -5.68% and the Russell 2000 Index declined -7.53%. Across the cap spectrum, stocks in the value indexes held up far better than their growth index peers. The Russell 1000 Value Index outpaced its growth counterpart by 830 basis points (bps), while the Russell Midcap Value and Russell 2000 Value Indexes outpaced their growth counterparts by more than 1,000 bps each.

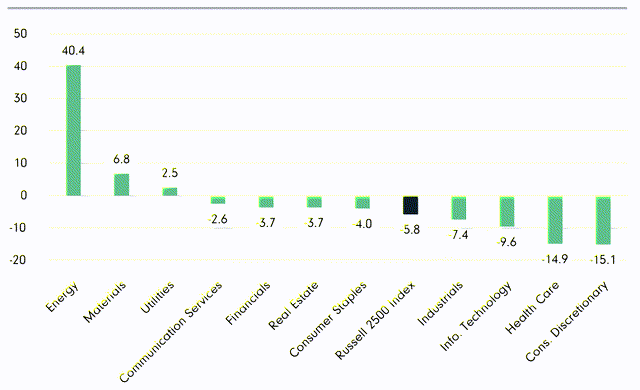

In the Russell 2500 Index, the energy sector advanced 40% as the Russia/Ukraine war and sanctions on the Russian energy sector sent oil and gas prices skyrocketing in Q1. Brent crude reached a high of $140 per barrel in early March, a level not seen since the global financial crisis in 2008. In the US, gasoline prices jumped past $4 per gallon, with expectations that prices could reach $5 over the next six months. (Learn more about the state of energy markets in our latest industry perspective.) Materials were up 7%, and utilities posted a small, 2% gain in Q1.

Consumer discretionary and health care led the rest of the field down, each posting -15% losses. Technology and industrials trailed the index with -10% and -7% losses. The remaining sectors outpaced the index with single digit declines.

1Q22 Russell 2500 Index Sector Returns (%)

Source: FactSet, as of 31 Mar 2022.

Performance Discussion

Amid a rocky market quarter overall, our portfolio’s negative returns still outpaced the Russell 2500 Index by a healthy margin in Q1. Our significant underweight to health care provided a relative boost, with our holdings also outpacing index peers. Strength among our consumer staples and financials holdings also aided results, as did our underweight exposure to technology, which took a beating in the first half of the quarter. Our consumer discretionary holdings were our largest source of relative weakness as economic uncertainty reemerged tied to higher inflation expectations. Our underweights to the index-beating materials and energy sectors were additional headwinds.

On an individual holdings’ basis, top contributors to return in Q1 included Cal-Maine Foods (CALM), South Jersey Industries (SJI), Alleghany Corporation (Y) and Kirby Corporation (KEX). Fresh egg producer Cal-Maine benefited from its significant advanced investment in cage-free facilities as some states have begun their transition to providing only cage-free eggs, most namely California. Additionally, a number of competitors contended with bird flu outbreaks in their facilities, driving up egg prices and shining a light on the quality of CalMaine’s production capabilities.

Natural gas utility South Jersey Industries received a boost when it accepted an offer from a privately held infrastructure fund to purchase the company at a 53% premium to its prior close. The price offered was consistent with our own long-term view of the company. Similarly, during Q1, property and casualty insurance firm Alleghany announced it would be acquired by Berkshire Hathaway (BRK.A, BRK.B) for a 25% premium to its prior market value.

Kirby Corporation, a US-based tank barge transporter of bulk liquid products, benefited as the receding omicron wave in North America contributed to increased demand for hydrocarbon distillates and generally improved industrial activity.

Also among our top Q1 contributors was energy exploration and production company Coterra Energy (CTRA). Demand for energy increased as COVID-related economic restrictions eased in tandem with concerns regarding supply interruptions related to Russia’s invasion of Ukraine.

Bottom contributors in Q1 included NVR Inc. (NVR), PROG Holdings (PRG) and Colfax Corporation. Homebuilder NVR, along with other housing companies, was pressured in Q1 primarily on concerns that rising mortgage rates will dampen new home demand. We recognize the challenges presented by a rising interest rate environment in the near term. Longer term, the secular outlook on housing construction is positive, as there remains a material shortage of housing stock in the US. We also like NVR’s approach in which it has an option on land rather than owning it outright, which exposes the company to less risk from falling land prices.

Rental and leasing services company PROG Holdings saw declining lease-to-own applications in January while PRG’s retail partners struggled with retail traffic and store staffing due to the omicron variant. Further, visibility into the lease-to-own consumer is cloudy in the near-term, as the industry starts lapping the prior year’s stimulus benefits. In our view, results should improve as the retail environment continues opening up. Because PRG offers flexible lease purchase solutions to help more credit-challenged customers toward product ownership, a recessionary environment could highlight the strength of PRG’s business model. We continue to be attracted to PRG’s relatively high-quality cash generation and its asset-light business model. There are also opportunities for the company to grow its relatively sticky retail partner base and expand into e-commerce and direct-to-consumer channels.

Diversified technology company Colfax Corporation underperformed largely due to concerns surrounding the company’s exposure to Russia in its fabrication technology business, which generated about 7% of that business line’s revenue. Just after the quarter’s end, the company completed a planned split – the fabrication technology business becoming ESAB (ESAB) and the medical technology business organized as Enovis (ENOV). ESAB has removed Russia from its guidance for 2022, and with the split finalized, we continue to hold both, believing the two new companies are in an excellent position to leverage their business systems to continuously improve operations over time and engage in value-creating acquisitions in their respective industries.

Other bottom contributors included UGI Corporation (UGI) and Sensata Technologies (ST). Taking a cue from the energy crisis in Europe, investors are questioning whether UGI Corporation, a natural gas and electric power utility, may mismanage commodity risk or face some demand destruction. We believe these risks are transient and manageable. What’s more, UGI has made significant investments in its renewable fuels business, including renewable natural gas (RNG) and bioLPG-propane produced from renewable sources such as plant and vegetable waste material. Developer of industrial sensors, Sensata Technologies is facing ongoing uncertainty in the automotive industry tied to supply chain disruptions and semiconductor chip shortages.

Portfolio Activity

New holdings in Q1 included Civitas Resources (CIVI) and Live Oak Bancshares (LOB). Energy exploration and product company Civitas presented an opportunity for exposure to what we believe are excellent, long-term assets that can benefit from higher energy prices.

Regional bank Live Oak’s fundamentals remain strong, though shares sold off in sympathy with other bank names in Q1. Near-term weakness presented an opportunity to initiate a position in a company we know well-one we believe is uniquely positioned as a small business bank that is also a technology leader.

Webster Financial Corporation (WBS) is also a new name in the portfolio, having completed its merger with our prior holding Sterling Bank. The combination means that Webster’s large health savings account (HSA) platform, which is a good source of low-cost deposits, will be paired with Sterling’s organic loan generation engine.

We exited Reinsurance Group of America (RGA) and Molson Coors (TAP) in favor of higher conviction names.

Market Outlook

After a strong rebound in 2021, global GDP growth is expected to moderate in 2022, with the potential for additional pressure from lingering supply chain disruptions, higher oil prices and other impacts from Russia’s invasion of Ukraine. Despite these headwinds, corporate earnings are expected to continue making new highs in 2022.

The sharp economic rebound in the US, along with unprecedented fiscal and monetary stimulus, an uptick in wage growth and instances of supply/demand tightness, has resulted in elevated inflation levels. The Federal Reserve has started to raise interest rates and end quantitative easing but may need to be more aggressive if inflation persists at elevated levels, which could be a headwind for equity markets.

Russia’s invasion of Ukraine has the potential to disrupt the flow of exports from these countries, which may impact global supplies and prices for a wide variety of end markets. The potential impact to individual businesses varies, and we are monitoring these risks closely.

While the year-to-date pullback in equity markets has created some investment opportunities, broad market valuations remain above historical averages. From current levels, equity market returns over the next five years are likely to be below historical averages.

Our primary focus is always on achieving value-added results for our existing clients, and we believe we can achieve better-than-market returns over the next five years through active portfolio management.

Mentioned Securities and Respective Weights (%)

|

Alleghany Corp. |

2.5 |

NVR, Inc. |

2.4 |

|

Cal-Maine Foods, Inc. |

3.4 |

PROG Holdings, Inc. |

1.1 |

|

Civitas Resources, Inc. |

0.6 |

Sensata Technologies Holding PLC |

Read More:Diamond Hill Small-Mid Cap Fund Q1 2022 Market Commentary

2022-06-05 03:24:00