DaveAlan/iStock Unreleased via Getty Images

After another bullish corporate update from Delta Air Lines (NYSE:DAL), shareholders continue to face a stock stuck in the doldrums. The market continues to fear the worst from an airline sector set to generate substantial profits and cash flows in the years ahead. My investment thesis remains ultra Bullish on the stock and the airline sector in general.

Boom Times Are Just Starting

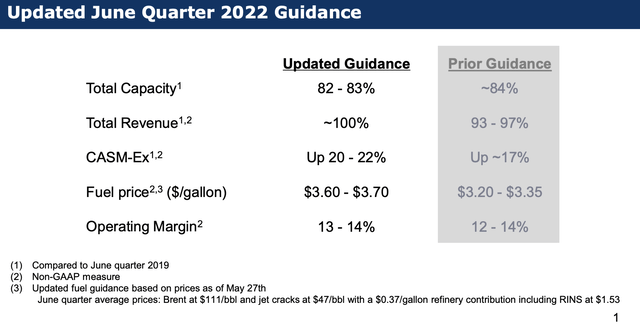

The market appears to be missing that Delta is now forecasting to produce Q2’22 revenues matching the levels of 2019 while total capacity was cut to only 82.5% of 2019 levels. The airline continues to eat higher fuel prices with ease while producing strong margins.

Source: Delta June 1 Investor Update

Delta guided to fuel costs jumping another 10% to 15% above the prior quarter provided along with the Q1’22 earnings report in late April. At some point, the market will be forced to realize the airlines are far better operators in the last few years. A lot of people conveniently want to forget that the government shutdown all avenues and reasons to fly causing the covid financial hits, not bad operating models from the airlines.

The legacy airline is now guiding to an operating margin of 13.5% on revenues of up to $12.5 billion. Delta will produce up to $1.7 billion in operating income under this scenario in what still remains a challenging environment of lower capacity and substantially higher fuel costs.

Regardless, the airline is producing massive profits and cash flows in what amounts to a tough environment. Investors shouldn’t fret a possible small recession in the near future.

What Is The Market Waiting On?

With China still involved in covid lockdowns and monkeypox fears, the market is naturally cautious on being too aggressive on airline stocks. Regardless, investors need to understand an airline such as Delta is not in any materially worse financial situation than before covid shutdown airline passenger traffic.

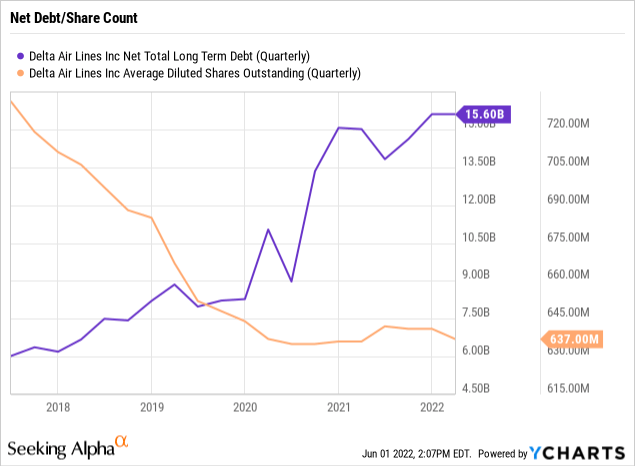

Delta now has net debt of ~$15.6 billion, up from levels below $9.0 billion heading into covid. A company with $7 billion in additional debt isn’t vastly different than prior to covid considering the airline is on pace for $50 billion in annual revenues.

A big key to higher valuations is possibly a quarter or two where an airline pays down net debt. Delta doesn’t have materially higher diluted share counts outstanding to impact stock prices, so the equity equation isn’t materially different now. The airline forecasts spending $1.2 billion on capex in the quarter in what should provide excess cash for the initial net debt reductions.

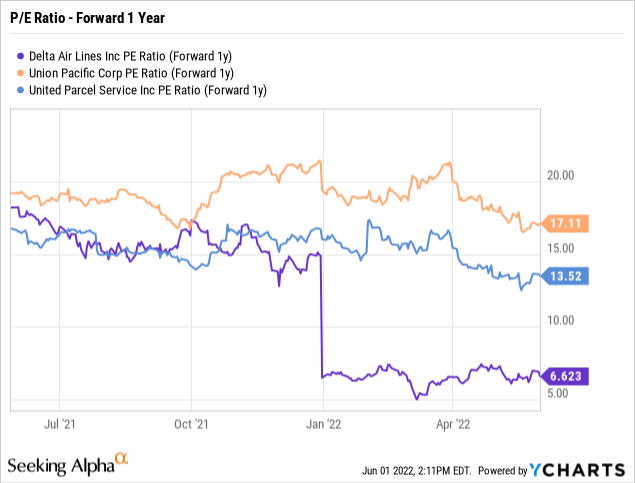

Of course, the big key to unlocking value in the airlines is for Delta to acquire a market multiple for the stock. Analysts already predict the airline reaching a $6+ EPS next year to approach the levels originally predicted for 2020.

Amazingly, Delta only trades at 6.6x these 2023 EPS targets. Not only did the airline trade closer to a 10x multiple in prior periods, but also industrial transport stocks continue to grab more market type forward P/E multiples such as United Parcel Service (UPS) at 13.5x and Union Pacific (UNP) at 17.1x.

The stock reaching the UPS multiple would provide a near double for Delta shareholders from here. Note though, this would be just the start with analysts forecasting a $7.52 EPS in 2024. A continuation of this multiple on 25% EPS growth in 2024 would drive the stock up to $100+.

The airline still needs to produce the cash flows to begin the debt repayment process. The bookings numbers suggest this will indeed be the case over the summer months, but another covid variant could always again reduce travel levels.

Takeaway

The key investor takeaway is that Delta Air Lines is crazy cheap here despite another strong corporate update. The airline sector can’t get any traction due to irrational fears regarding the impact of higher fuels costs and a future recession.

The ultimate solution is for Delta to start repaying debt via cash flows while still investing in new equipment. The market will eventually catch on and award a market type P/E multiple to the stock similar to other strong industrial transport stocks.

Read More:Delta Air Lines: Market Won’t Ignore Forever (NYSE:DAL)

2022-06-01 22:43:00