AlexSava/iStock via Getty Images

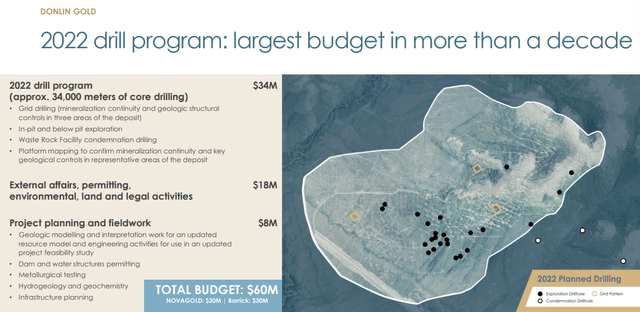

After another successful round of drilling at the Donlin Gold property in Alaska during 2021, 50/50 owners NovaGold (NYSE:NG) and Barrick Gold (NYSE:GOLD) have decided to up the ante. They have agreed to the highest level of exploration spending in 10 years to expand this huge Tier-1 reserve and resource base during 2022’s exploration season. The idea is a new feasibility study, with a longer mine life and hopefully lower upfront build cost will be the end result. The biggest hurdle to developing the asset and starting a mine is the previously estimated $7.4 billion construction cost in the middle of Alaska (using the June 2021 Technical Report), which is likely somewhat higher with inflation today.

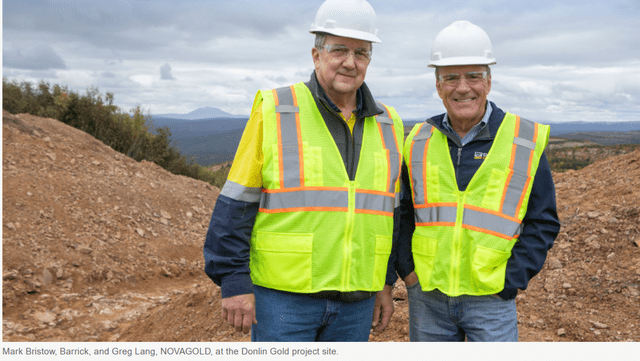

CEO Tour of Donlin, 2021 Barrick Annual Report

My view is Barrick should immediately scoop up Donlin to vastly increase its reserves on the cheap, and plan on developing the Donlin asset in 3-5 years to pump flatlined production growth. The NG stock quote has declined dramatically from almost $10 a year ago and $8 weeks ago to under $6 today, opening a great opportunity to acquire the remaining 50% ownership in the mine, consolidating 100% of its future value for Barrick stakeholders.

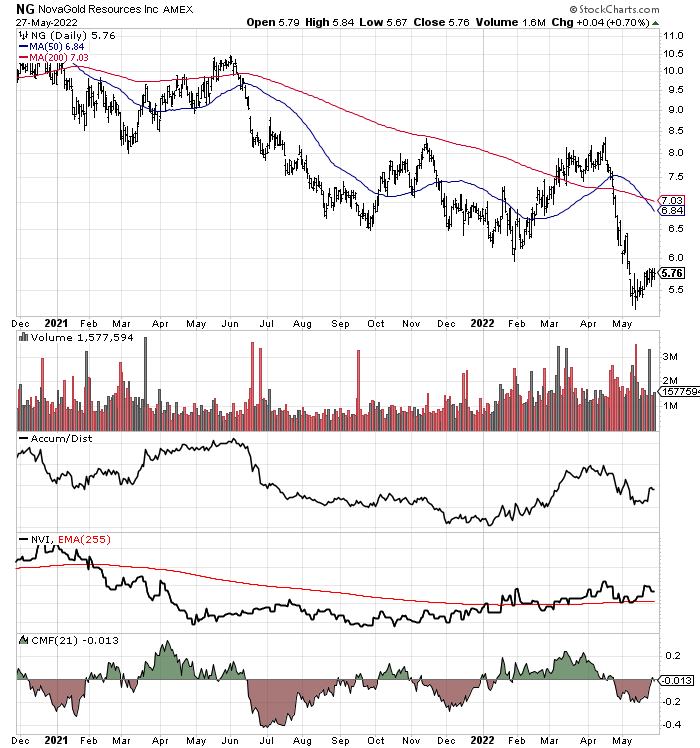

StockCharts.com

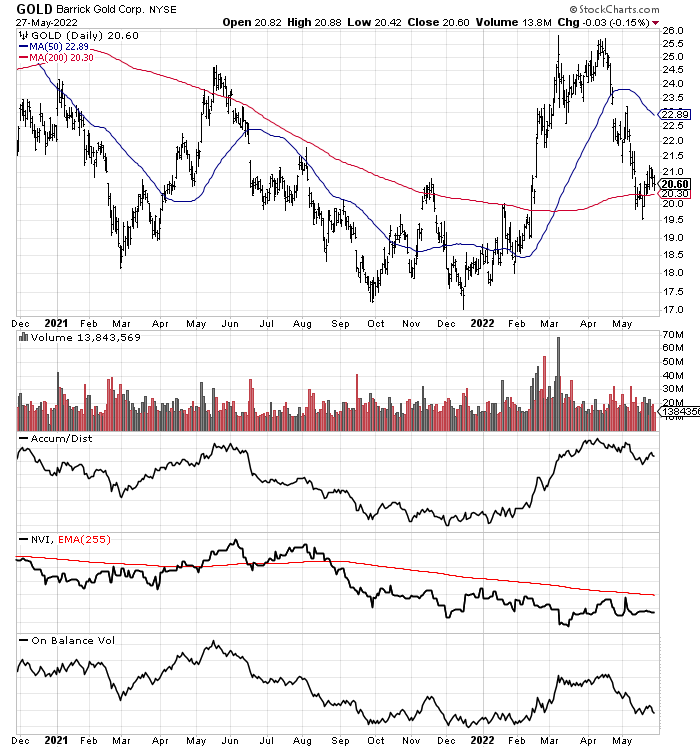

StockCharts.com

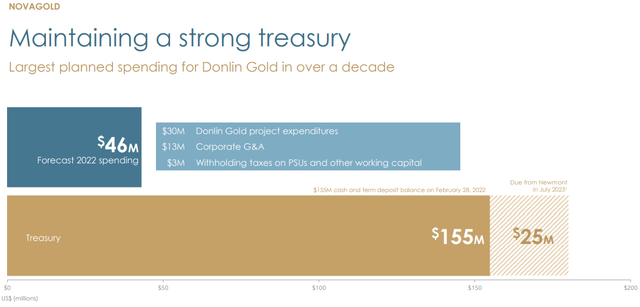

Today’s $5.76 NovaGold quote works out to US$1.8 billion in net value, after subtracting $155 million in cash, $25 million due from Newmont (NEM) for selling another resource deposit, and accounting for $120 million in total liabilities. This number represents less than one year of free cash flow for Barrick. Either a cash offer or an all-stock deal are possible deal terms, depending on Barrick management. CEO Mark Bristow has a history of deal-making when the math is right. So, a quick offer may be in order before the 2022 drill results become public and the price of gold rises toward my 2023 target price of $2500+ an ounce.

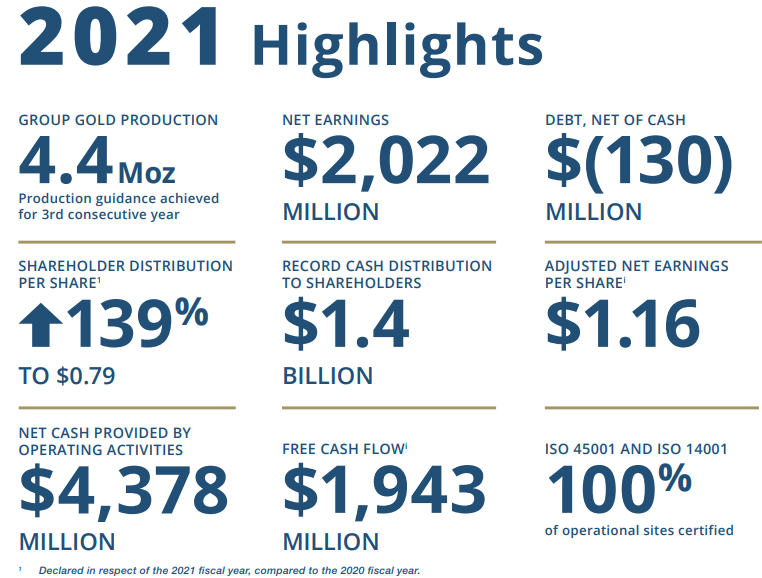

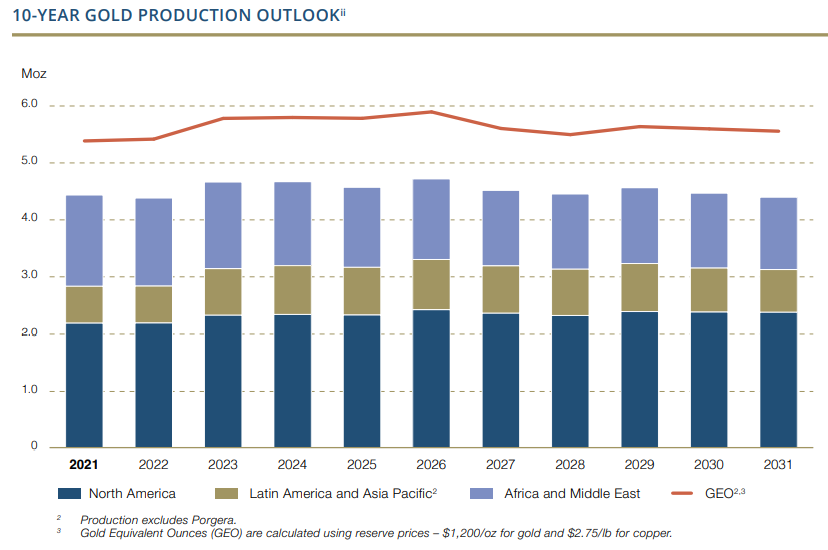

Barrick 2021 Annual Report

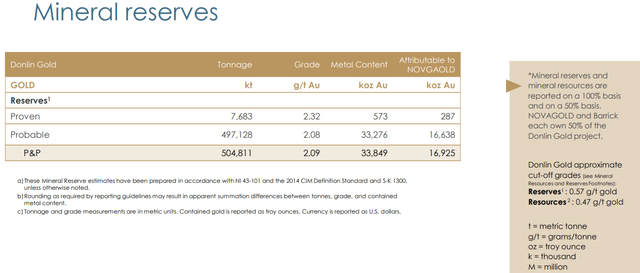

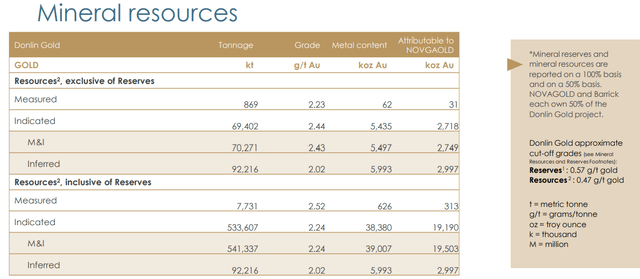

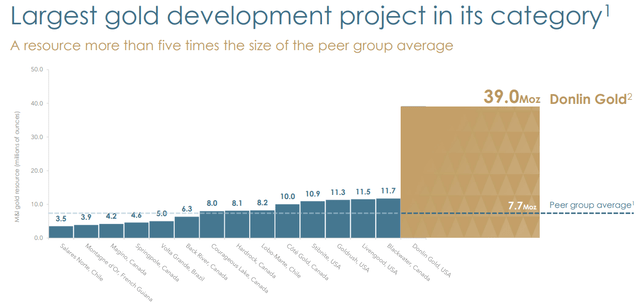

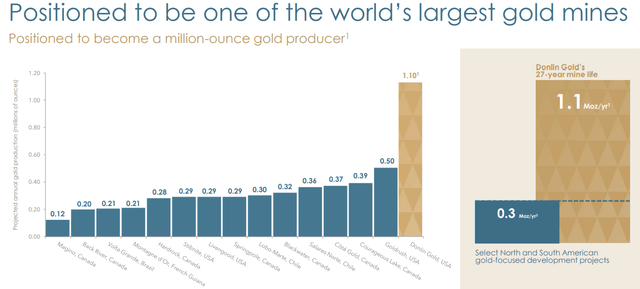

April Project Update – NovaGold Presentation

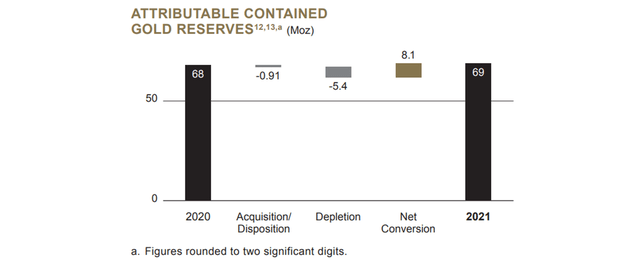

How important is Donlin to Barrick’s future? The accretive math argument is Barrick can increase its proven and probable reserves by at least 34 million ounces, from 69 million to 103 million (49% hike) with an all-cash offer or all-stock dilution of roughly 7% (assuming a 50% premium offer price) with Barrick’s equity market capitalization around $37 billion today. Barrick is holding the Donlin resource base as Measured & Indicated currently. So, a consolidation of ownership, on top of newly discovered resources in 2021-22, and a decision to build a mine would covert the ore into the proven and probable reserve category.

Barrick Gold Production Estimate – 2021 Annual Report

Barrick Gold Reserves – 2021 Annual Report

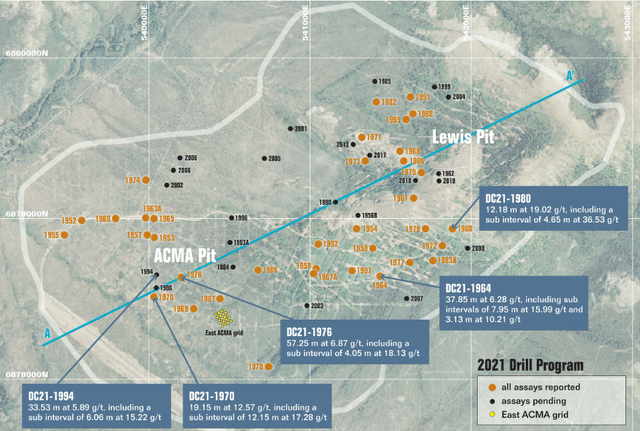

Below are maps of the 2022 drill program and the open pit, gold discovery area being developed since 1952.

April Project Update – NovaGold Presentation

Donlin Drill Results since 1952 – 2021 Barrick Annual Report April Project Update – NovaGold Presentation April Project Update – NovaGold Presentation

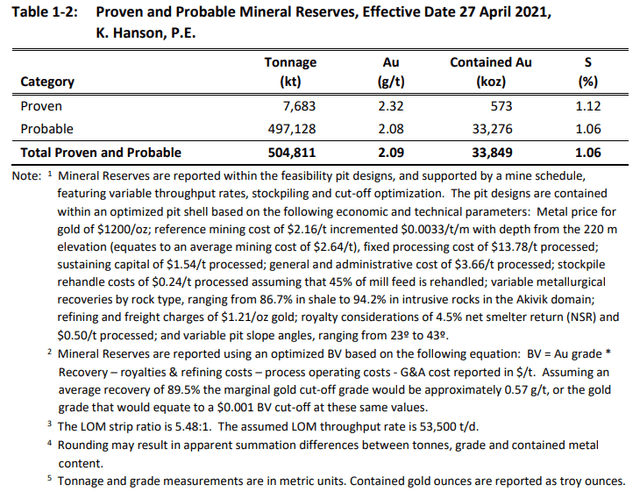

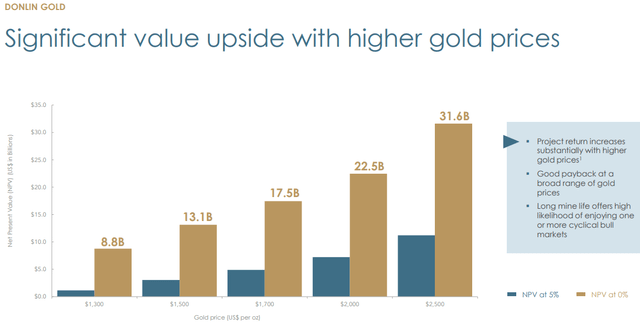

June 2021 NI 43-101Technical Report

The Donlin Gold property may be one of the most valuable undeveloped gold deposits available in the world currently, with high grades for an open pit, a projected 1+ million in annual production for 30-40 years, in perhaps the safest jurisdiction for mining claims, taxes, and basic business law – the U.S. The good news for NovaGold owners is the NPV calculation increases dramatically on higher gold prices, at a greater clip than Barrick’s profile. Using math from already discovered gold ore, the underlying value of gold in the ground almost doubles (on the current mine plan) with a bullion price jump to US$2500 an ounce, all other variables remaining the same.

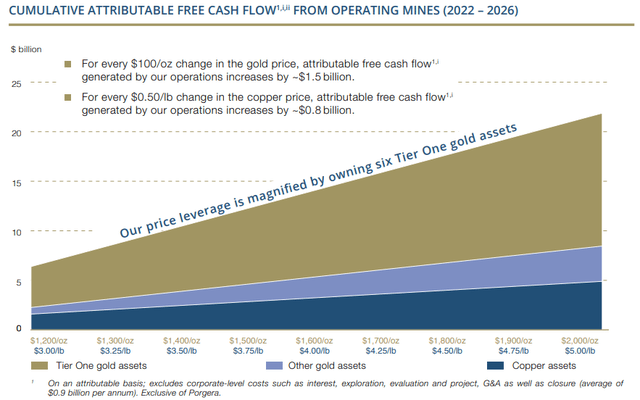

Metals Price Leverage – Barrick 2021 Annual Report

April Project Update – NovaGold Presentation

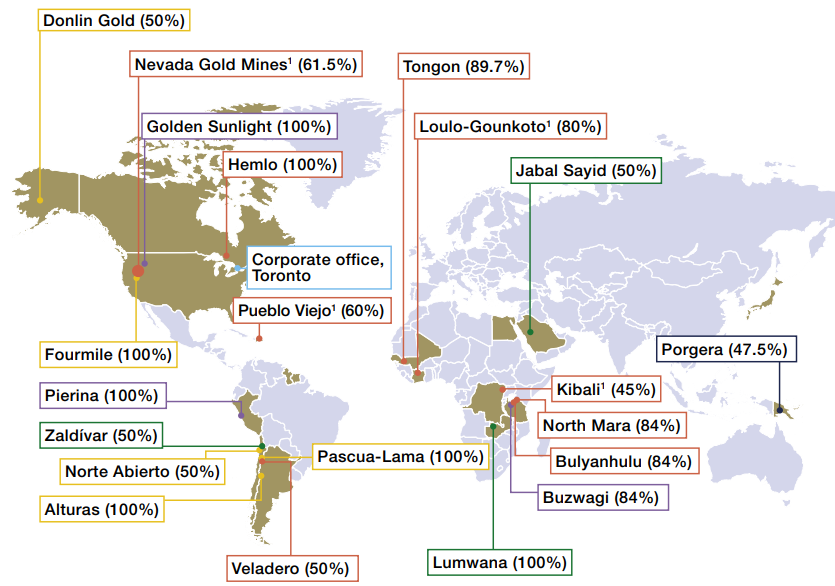

Barrick’s geographic diversification of mining assets is truly remarkable. Acquiring 100% of Donlin Gold would not be out of a character for CEO Bristow or Barrick’s mode of operation.

Barrick Mine Map, 2021 Annual Report

The pure size of the project and long-term plan of mining for many decades is unparalleled in the gold mining industry currently. You can tell Barrick management is keen on the asset, as it is mentioned more and more in their SEC filings, press releases and annual reports of late.

April Project Update – NovaGold Presentation April Project Update – NovaGold Presentation April Project Update – NovaGold Presentation

Buyout Logic

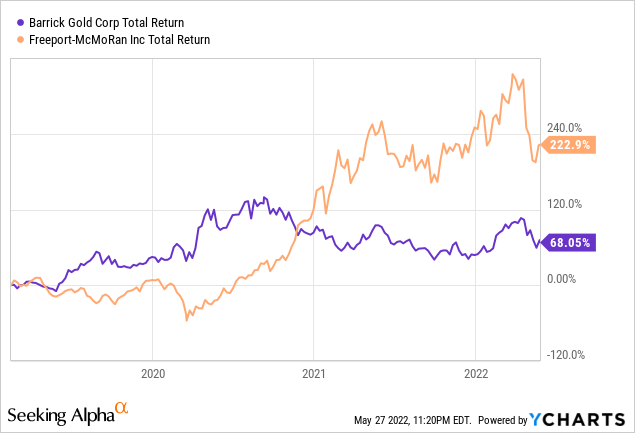

I made the suggestion in February 2019 here Barrick should acquire Freeport-McMoRan (FCX) to increase its exposure to copper as rumors of a shortage were hitting the market. In fact, Bristow had a solid year after my article to make this addition to its international portfolio, as the pandemic dragged Freeport into the giveaway valuation zone. On the graph of investor total returns below, you can see how inaction cost Barrick shareholders in this accretive proposition.

YCharts, Total Returns from February 18, 2019

My feeling is management at Barrick has been hoping for lower prices in NovaGold before making a bid. And, the present opportunity may not last long if gold prices are destined to rise sharply on another round of Federal Reserve money printing later in 2022. I firmly believe the global economy is cooling quickly, and the only way to prevent deep recession in 2023 is to restart money printing this summer, no matter the consequences for inflation. I have been screaming about the box the Fed has created for itself for a month now. The U.S. central bank has to wake up to the fact our economy is addicted to free or nearly free money to continue functioning. If they continue raising rates and talking tough, we will get both inflation and recession, something called stagflation. Higher interest rates will not solve the shortages that have appeared in commodities and many manufactured products from the pandemic first, and the Russia/Ukraine war second.

Why not wait another year or two to take over NovaGold? Barrick and Freeport actually had talks around the time of my article on the benefits of combining the two companies. Failing to act has cost Barrick shareholders around $20 per share in underlying value. That’s right, had Bristow acted, Barrick would be a $40 stock today, using the changes in market caps as a proxy since my story was posted in early 2019.

YCharts, Market Cap Comparison from February 18, 2019

The same “opportunity cost” of failing to act in the coming months to purchase NovaGold and its 50% of Donlin is staring Barrick management right in the face again. For example, positive drill results and a new feasibility study that adds 5-10 million ounces to proven and probable reserves, alongside a rising gold price later this year WILL encourage outside investors to look at acquiring NovaGold for themselves. Major gold mining competitors like Newmont, Agnico Eagle (AEM), even Freeport-McMoRan and other base-metal firms will be interested. I cannot rule out an eccentric billionaire, with fortunes based in paper dollars, will want to hedge his/her wealth by owning a piece of arguably the most valuable undeveloped American gold deposit. Stagflation will be a wake-up call that ultra-easy monetary policies have consequences. Warren Buffett, Bill Gates, Elon Musk, Jeff Bezos come to mind as potential outside suitors. The $2 or $3 billion price tag is quite a small sum for them.

Final Thoughts

Remember, only 5% of the land claims in the Donlin Gold area have been drilled and explored. What if tens of millions of ounces exist close to the proposed open pit, or even more resources are found at depth? At that stage, the current $1.8 billion cash-adjusted valuation for 50% ownership will look incredibly cheap when looking back. My point is waiting is no longer a good option for Barrick shareholders. The decision to get serious about developing the Donlin asset and building a mine needs to be made ASAP.

I own shares in both companies as leverage to gold prices. I have written a number of articles since September here on why I believe sharply higher gold prices are approaching. $1800 gold is far too cheap vs. the amazing advances in the U.S. money supply and Treasury debt issuance over the decades. In past stories I have explained how gold hedges fiat/paper money devaluations. Using 50+ years of trading history since leaving a gold standard for dollars in the 1970s, I come up with a fair value for gold today above $2700 an ounce.

The bullish news for precious metal owners is gold could be ready to climb materially higher if the Fed is forced to quit tightening and begin easing again. A price target of $2500 to $3000 is not farfetched for 2023. Pulling all the pieces of the Donlin buy proposition together, such a hard-money price move could propel NovaGold’s underlying value to $15 or $20 per share (assuming more gold is discovered this year). It’s up to Barrick management to figure out now is the time to add this future market value increase for its shareholders.

What’s the downside risk owning either gold miner? The main risk for gold mining ownership is the price of gold declines, and mining it becomes a less profitable enterprise. If my assumption of a substantial jump in gold prices does not play out, the share quotes for both Barrick and NovaGold will stagnate or drop some.

In my opinion, long-term risk is incredibly low of Barrick investing $2+ billion now (using a premium offer) into consolidating the Donlin project, and witnessing meaningful value destruction in the future.

For Barrick, owning and developing the whole asset at low cost now will only help shareholder worth, if new gold is discovered. The second largest gold miner globally could regain the #1 holder position for proven reserves from Newmont (93 million ounces), and add 1 million in annual production 3-5 years out for decades, from a safe-jurisdiction Alaska mine. At the very least, a rising gold price trend should increase…

Read More:Barrick Should Acquire NovaGold’s Remaining 50% Of Donlin Now (NYSE:GOLD)

2022-05-29 19:36:00