Natural gas futures flirted early with a loss for the first time this week on the heels of a bearish storage report but quickly turned a corner and rallied again on Thursday as traders fixated on supply/demand imbalances. The June Nymex gas futures contract settled at $8.783/MMBtu, up 36.8 cents day/day. July rose 36.9 cents to $8.841.

At A Glance:

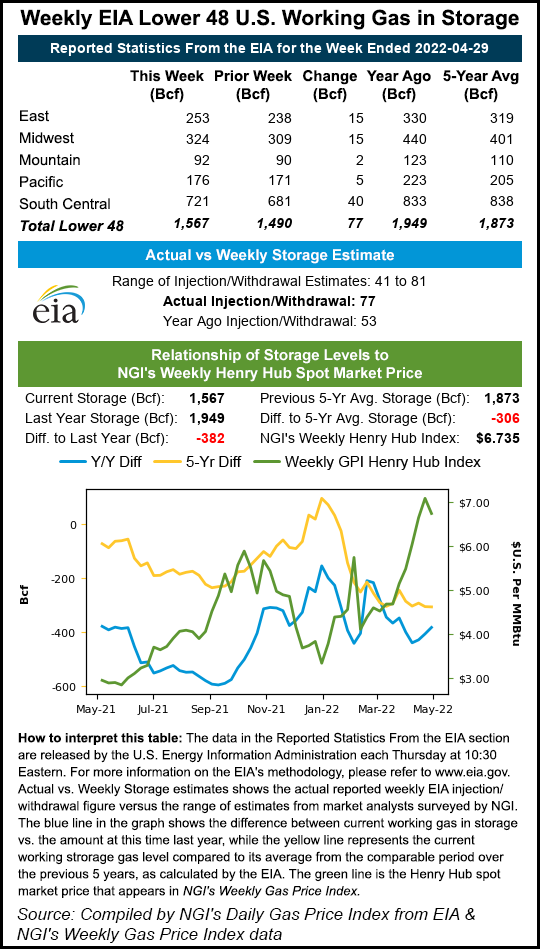

- EIA posts 77 Bcf storage increase

- Forecasts point to intense heat

- Export demand holds strong

NGI’s Spot Gas National Avg. dipped lower for the first time this week, falling 15.5 cents before finishing trading at a still lofty $8.000.

Markets have rallied from late April through this week on intensifying concerns about supply weakness globally and in the United States. This comes as the summer cooling season nears and demand for American exports hovers near record levels amid Russia’s invasion of Ukraine.

U.S. output has held about 2 Bcf or more below the 2022 peak over the past couple weeks from a combination of harsh weather and spring maintenance projects.

Despite maintenance work at export facilities, U.S. liquefied natural gas (LNG) volumes have held above 12 Bcf this week – roughly within 1 Bcf of capacity. Volumes are widely expected to return to record levels after the seasonal repair work culminates.

The Kremlin’s war in Ukraine has countries across Europe scrambling to gather more gas from the United States to wean themselves from Russian supplies. European stocks were already low following robust demand in 2021, resulting in steady calls for U.S. exports. The war amplified the trend.

Hotter-Than-Normal Summer?

Now, forecasts are calling for a hotter-than-normal U.S. summer that may arrive across large swaths of the South as soon as this weekend.

South Central cooling degree days (CDD) “are forecast to hit daily records potentially on several days over the next week to 10 days, with risk of 98- to 100-degree highs in cities such as Houston this weekend,” Bespoke Weather Services said Thursday.

“Given the relevance of this region to Henry Hub, it definitely gives the weather component a bullish skew. We do see some solid above-normal warmth spread up into the rest of the eastern half of the nation next week…Should this pattern persist into the back of the month, it would grow even more bullish.

“Without production making significant gains, the market will not be able to handle things if this kind of heat sticks around,” Bespoke added. “If that pans out, we feel we easily can go over $10 in prompt-month [pricing] over the next several weeks, barring massive supply gains.”

EIA Prints 77 Bcf Injection

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 77 Bcf natural gas into storage for the week ended April 29. The print proved bearish relative to market expectations and temporarily put pressure on Nymex futures Thursday morning.

Prior to the report, major polls found estimates coalescing around a mid- to high 60s Bcf increase for the week. The EIA result briefly pushed bulls to the sidelines.

After further review, though, futures rebounded quickly as the increase was in line with the five-year average injection of 78 Bcf and not nearly enough to dent storage deficits.

The injection lifted inventories to 1,567 Bcf. That still left stocks below the year-earlier level of 1,949 Bcf and the five-year average of 1,873 Bcf.

The EIA print does “not take away from what is an extremely problematic state of undersupply,” said one analyst on The Desk’s online energy platform Enelyst.

Criterion Research’s James Bevan expects output to climb this summer, though he said it may prove difficult for exploration and production (E&P) companies to keep pace with demand. In the Enelyst discussion Thursday, he said E&Ps are grappling with inflation, which recently reached a 40-year high. This is making it difficult to cover costs and quickly increase output.

“Costs have been increasing quite a lot, and it’s led to multiple E&Ps increasing their 2022 spending budgets by 11-16% while leaving their production forecasts unchanged,” Bevan said.

Longer term, higher interest rates imposed by the Federal Reserve this spring to combat inflation could make it more expensive for producers to finance expansion projects. The Fed on Wednesday approved a half-percentage-point interest rate increase. It marked the biggest one-time increase since 2000 and followed a quarter-point bump in March.

Policymakers said during a press conference that additional half-point increases could prove necessary in June and July to prevent runaway inflation.

“Inflation is much too high…and we are moving expeditiously to bring it back down,” Fed Chairman Jerome Powell said in televised remarks.

Cash Called Lower

Spot gas prices fell Thursday, marking the first decline of the week.

Cash had surged by nearly $2.00 over the course of the three prior trading days, fueled by broader market sentiment and expectations for stronger cooling demand.

Physical markets took a breather on Thursday, however, with mostly modest declines across the Lower 48.

Chicago Citygate shed 11.0 cents day/day to average $8.105, while Carthage in Texas lost 16.0 cents to $7.920 and Florida Gas Zone 3 declined 14.0 cents to $8.340.

Still, demand drivers loom.

Senior meteorologist Michael Shuman of IBM’s The Weather Company expects heat to permeate the south-central and southwestern areas of the nation late this week and into next. High temperatures would regularly climb into the 90s, he predicted, driving seasonally strong cooling demand. Temperatures could peak above 100 in the Southwest and the southern reaches of Texas.

Meanwhile, AccuWeather forecasts above-average national heat this summer. It also noted that a dry winter across most of the western United States left the region grappling with drought and vulnerable to an “intense” wildfire season.

Widespread fires would add to heat severity and cooling demand, while drought would amplify stubborn headwinds battering hydropower capabilities in heavily populated California.

Hubs in the West, however, also gave up ground Thursday after solid gains earlier in the week.

KRGT Del Pool fell 22.0 cents to $8.205 and PG&E Citygate dropped 21.0 cents to $9.275.

Read More:$10 Handle in Sight For Natural Gas Futures, ‘Barring Massive Supply Gains’

2022-05-06 05:06:57