RHJ/iStock via Getty Images

Introduction

The Vancouver, British Columbia-based GoldMining Inc. (NYSE:GLDG), a junior exploration company, announced results for its annual financial statements, management’s discussion and analysis (“MD&A”), annual information form for the year ended November 30, 2021, and its annual report on Form 40-F, on April 13, 2022.

1 – GoldMining Inc. assets

Since my last article on GoldMining a year ago, a lot has changed, as shown below. GoldMining has grown its assets significantly. The company owns two distinct entities:

GLDG: Company presentation (GoldMining Inc.)

1.1 – The US GoldMining

It is a new separate public company focused on advancing the Whistler gold-copper project, located in Alaska, USA.

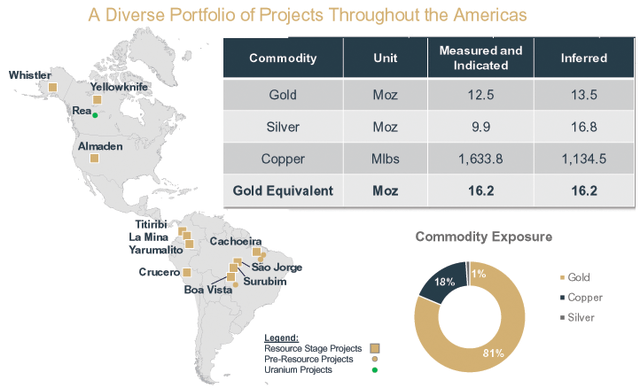

GoldMining owns 14 projects in the Americas (Au and Cu), including three in North America. A total of 11 projects are at the mineral resources stage.

The company’s total gold mineral resources measured and indicated are 16.2 Moz, and 16.2 Moz inferred.

GLDG: Map Presentation (GoldMining Inc.)

The Whistler gold and copper project:

GLDG: Whistler Project Presentation (GoldMining)

1.2 – Gold Royalty Corp.

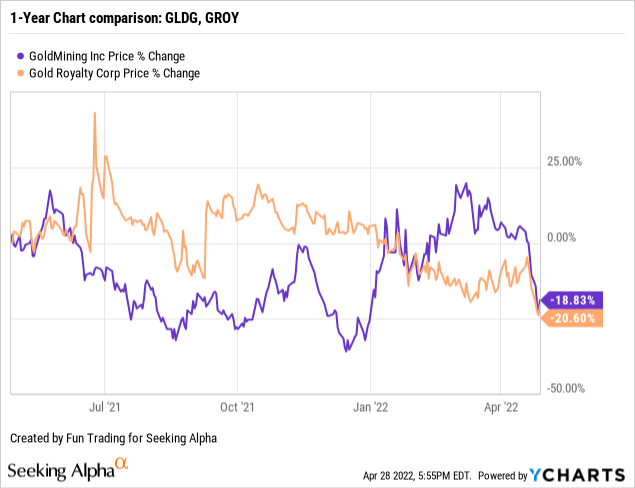

The company owns 20.25 million GROY shares, or 18.4% ownership in Gold Royalty Corp. (GROY). GLDG and GROY have dropped significantly recently and are down 19% and 21%, respectively, on a one-year basis.

Note from the company: “On April 12, 2022, the Company acquired 250,000 common shares of GROY at an average price of US$4.23 (C$5.33) per share through open market purchases over the facilities of the NYSE American.” It was not a wise decision.

Gold Royalty has an extensive portfolio:

GLDG: Gold Royalty (GoldMining)

Gold Royalty is now providing cash flow to GLDG through its royalties and streams extensive portfolio. Gold Royalty pays a dividend expected to be US$800,000 per year in cash flow to GoldMining and is predicted to grow.

2 – Investment Thesis

As I said in my previous article, the investment thesis is based mainly on faith in those junior exploration companies, and investing in such stocks is risky.

The massive assets portfolio is pretty confusing and not convincing. The company has too many projects and ongoing goals, which translates to a lack of clear strategy.

The company would benefit greatly by reducing its assets portfolio and focusing on very few projects.

Dilution is a threat to shareholders, and the company announced on December 10, 2021, that it entered into an equity distribution agreement with a syndicate of agents for a total of $50 million (ATM Program).

Pursuant to the ATM Program, the Company may distribute up to US$50 million of its common shares. The ATM Shares sold under the ATM Program, if any, will be sold at the prevailing market price on the TSX or the NYSE American, as applicable, at the time of sale…

Subsequent to the quarter ended February 28, 2022, a total of 1,482,505 ATM Shares were distributed by the Company under the ATM Program through the facilities of the TSX and NYSE American

Furthermore, the gold and PGM prices are crucial components and should always be analyzed before deciding on an investing strategy adapted to GLDG.

Hence, I suggest keeping a small long-term GLDG holding as a long bet, but it is vital to trade short-term LIFO over 75% of your position regularly.

This dual strategy can be generalized to any stock and is the primary strategy in my Gold and Oil marketplace. The only component that varies is the portion allocated to short-term trading.

GoldMining – Financial Snapshot 1Q22 – The Raw Numbers

Note: All numbers are indicated in $US. Filings for the company are in C$.

| GoldMining | 1Q21 | 2Q21 |

3Q21 |

4Q21 | 1Q22 |

| Total Revenues in $ Million | 0 | 0 | 0 | 0 | 0 |

| Net Income in $ Million | -2.25 | 86.00 | -5.54 | 4.71 | -2.42 |

| EBITDA $ Million | -2.26 | 93.49 | -6.42 | 5.67 | -2.55 |

| EPS diluted in $/share | -0.02 | 0.56 | -0.04 | 0.03 | -0.02 |

| Operating Cash flow in $ Million | -1.76 | -1.69 | -1.63 | -1.24 | -2.00 |

| Capital Expenditure in $ Million | 0.00 | -0.01 | -0.04 | 0 | -0.03 |

| Free Cash Flow in $ Million | -1.78 | -1.69 | -1.67 | -1.24 | -2.03 |

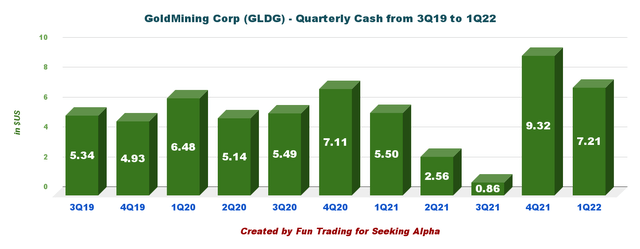

| Total Cash $ Million | 5.50 | 2.56 | 0.86 | 9.32 | 7.21 |

| Total Long term Debt (including current) In $ Million | 0.24 | 0.17 | 0.10 | 9.96 | 9.92 |

| Shares outstanding (diluted) in Million | 148.7 | 152.57 | 149.63 | 152.16 | 150.34 |

| Fully diluted | 159.5 | – | – | – | 162.7 |

Source: Company release

The company has $9.92 million in debt and $7.21 million in cash. GLDG owns approximately 18.4% of GROY.

GLDG: Quarterly Cash history (Fun Trading)

For the three-month ended February 28, 2022, the Company incurred a total operating loss of C$3.321 million, compared to C$2.786 million on February 29, 2021. The increase in operating loss was due to general and administrative expenses.

Technical Analysis and commentary

GLDG: TA Chart short-term (Fun Trading)

GLDG forms a descending channel pattern with resistance at $1.75 and support at $1.25.

The trading strategy I suggest is to sell between $1.70 to $1.75 and accumulate a small position at or below $1.25.

I am not ultra-bullish about the gold price entering May. The Fed has already said that it will hike interest rate by 50 points and continue hiking aggressively to fight rampant inflation.

Thus, I believe GLDG will probably experience some weakness in the next few months. I would not be surprised if GLDG drops below $1.25 and retests the range of $1.15-$1.05.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Read More:GoldMining Inc.: Sometimes, Too Many Is Too Much (NYSE:GLDG)

2022-04-30 08:01:00