The company’s Salar de Arizaro Project in Argentina is creating a global buzz and attracting potential buyers

Article content

By: Don Hauka

Advertisement 2

Article content

- In 2020, the global lithium market was valued at USD$2.7 billion, and is predicted to grow at a compound annual growth rate of 14.8 per cent through 2028

- Lithium Chile’s Salar de Arizaro Project is situated in Argentina’s largest salar and among the most significant in the region’s Lithium resources

- With promising results from its initial drilling program, Lithium Chile is attracting the attention of global players in the space

- Chengxin Lithium increased their shareholding to 19.86 per cent in Lithium Chile with an investment of over $34 million

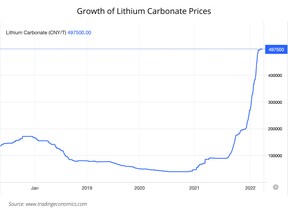

For several years, lithium prices wallowed in the doldrums of over-supply with prices sinking as the wind in the boom’s sails faded.

Now, the tide has turned. Huge demand and looming shortages are sending prices soaring past their 2017 highs. China is leading the pack with a benchmark index more than doubling in 2021 and key prices hitting records. Lithium carbonate prices reached 497,500 yuan per tonne in late March, an astonishing jump of 80 per cent in 2022 so far.

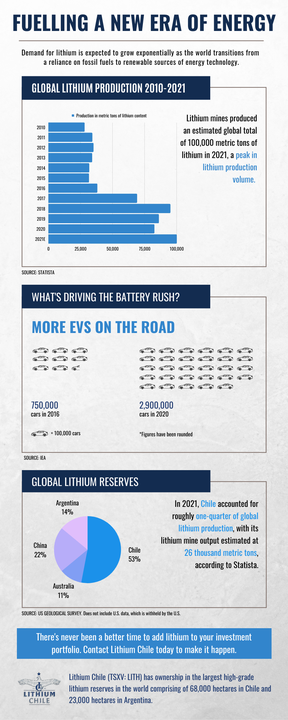

This boom cycle is being driven by the skyrocketing demand for electric vehicles (EVs). Not only is lithium a critical component of the batteries that power EVs, but it’s also the key ingredient in the electrification of transportation mechanisms and associated infrastructure.

With so much riding on this strategic metal, it’s little wonder it’s considered the commodity of the future. The global lithium market size was valued at USD$2.7 billion in 2020 and is expected to expand at a compound annual growth rate of 14.8 per cent to 2028.

The race is on to meet the burgeoning demand of the “white gold” rush.

Lithium Chile is poised to ride the wave as it expands operations in Argentina

One company that’s especially well-positioned to thrive in the rising tide of the current boom is Lithium Chile Inc. (TSXV: LITH | OTCQB: LTMCF). The Calgary-based company has ownership in the largest high-grade lithium reserves in the world comprising 68,800 hectares in Chile and 23,300 hectares in Argentina.

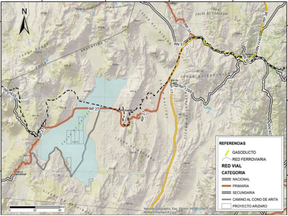

The company’s Salar de Arizaro Project in Argentina is generating excitement in the lithium space. It’s located in the Arizaro Salar, the largest salar in Argentina and one of the most important in the lithium-rich Puna Region. The project in Argentina’s northwest Salta province is about 170 kilometres from Salta, considered one of the best investment districts in the lithium triangle. It’s within a few hours of Chilean ports and the infrastructure in the area is strong and reliable.

Advertisement 3

Article content

The Salar de Arizaro Project consists of seven exploration and exploitation concessions and exploration permits totaling 23,300 hectares. The company’s exploration environmental impact study was recently approved by the Secretary of Mining in the province of Salta and a production well test was completed in mid-December 2021.

Our first production test demonstrated that this really is a significant discovery. The whole system is quite complex, and the grades are quite impressive.

Steven Cochrane, president and CEO of Lithium Chile Inc.

The results at Salar de Arizaro boast a huge, high-quality resource

Results from the test well showed grades as high as 555 mg per litre, higher than the average in the Salar. The average pumping rate of 21.94 litres per second was also above the Salar average. The NI 43-101 filed by Montgomery and Associates identifies a lithium carbonate equivalent resource of 1.4 million metric tonnes.

The results are even more impressive because that estimate covers only 30 per cent of the project’s main concession block, leaving a large area for resource expansion. The report also recommends a second program of USD$2 million and three holes aimed at establishing a measured resource and significantly increasing the lithium carbonate equivalent resource.

Impressive as those results are, they could have been even better. To get to the resource, the company had to first bore through a rock salt cap of 300 metres. Material from that upper zone might have diluted the rich results from below. Lithium Chile’s next drilling program will remove any doubts about just how high-grade the well is.

“We’re going to run steel casing down the wellbore and the upper halite zone will be cemented off to prevent dilution by lithium-poor brine from the upper zones. We’re hoping we’ll confirm higher grades and significantly increase the size of the resource to two million metric tonnes – it’s going to be an exciting next six months,” says Cochrane.

Lithium Chile is creating a global buzz

During those six months, Lithium Chile will conduct their next drilling program of three, 500-metre-deep exploration holes aimed to better define the size and quality of the resource at Salar de Arizaro starting in April if all goes to plan. Cochrane says the company will be releasing results as they come in.

The drilling program will be managed by José Gustavo de Castro Alem, nicknamed “Mr. Lithium Argentina,” who specializes in lithium exploration, engineering, mining and resource management and operations. Lithium Chile is conducting operations through its Argentinian subsidiary Argentum Lithium.

With such promising results from its initial drilling program, Lithium Chile is getting the attention of global players in the space. It’s a position the company welcomes to be in.

“Our initial resource discovery and our land holdings are significant, we’ve created a buzz – the word got around fast, and we’ve had lots of companies come to us and ask, how can we joint venture? How can we partner with you?” says Michelle DeCecco, Vice President, Corporate Development.

“We’ve been fortunate. It’s the right time, we’re in the right place with the right prices. It’s a huge win for us and our shareholders. It took us from being a speculative exploration company to being a resource company.”

Advertisement 4

Article content

With large Chinese players like Ganfeng acquiring companies like Bacanora Lithium for USD$391 million, Lithium Chile’s Salar de Arizaro Project is potentially a hot commodity. A report written by Fundamental Research in September 2021 notes that they expect further consolidation in the lithium space and that juniors in attractive mining jurisdictions like Lithium Chile will be likely targets.

“We initiated coverage on Lithium Chile in September and its share price has more than doubled since then, so it’s been one of our best picks in the last six months,” says Sid Rajeev, head of research at Fundamental Research.

“They’re getting a lot of attention from a number of large players, including recently some of the Chinese companies. It’s not often that a junior company attracts a large player like that and it’s a huge vote of confidence for Lithium Chile’s management.”

Just recently, the company completed a private placement with Chengxin Lithium Group Co., Ltd. to become a key strategic and cornerstone shareholder of Lithium Chile. The placement took Chengxin Lithium to a 19.86 per cent ownership with an over $34 million investment. This significant funding boasts many growth opportunities that can rapidly accelerate new exploration and development efforts while lending a hand in increasing their existing resources in a meaningful way.

Strong management is a key ingredient in Lithium Chile’s recipe for success

Tremendous test results and promising properties don’t amount to much if a company hasn’t got a solid management team. Cochrane and company have built a team with a strong track record of success and demonstrated operational efficiency in Chile and Argentina.

“We feel very comfortable, very confident with Lithium Chile’s management team,” says Rajeev.

“One thing we look for in a company’s management is skin in the game. You want to see management having their own money invested in the company and their management combined owns more than 25 per cent equity, which is quite strong.”

Cochrane has 36 years of investment industry experience during which he has been instrumental in raising more than $500 million for small-cap public companies. DeCecco has deep capital markets, investor relations and corporate development experience, with over 20 years of experience in the public sector. Executive chairman Al Kroontje has been active in mineral exploration activities for gold, copper, silver, and lithium in Chile since 2009.

Advertisement 5

Article content

Lithium Chile is spearheading the “white gold” rush thanks to rising prices and a rich resource

With surging demand threatening to dwarf supply, the prospects for the lithium space in general looks bright. DeCecco is confident that the white gold rush will establish lithium as the battery fuel of the future.

Read More:Lithium Chile is riding the rising tide of the “white gold” rush

2022-04-11 18:12:08