| Workers observe St Barbara Ltd.’s Simberi gold mining operation in Papua New Guinea. Some gold sector players are looking to improve the tracking of the precious metal throughout the supply chain. Source: St Barbara Ltd. |

Gold producers are working together to squeeze out bad actors and assure buyers they are receiving gold that has been sourced responsibly and sustainably.

New technology and programs coming out of the sector will enable gold investors and consumers to track the source of gold more closely. Companies that can prove responsible and ethical gold production down the supply chain can seek a premium in a market increasingly scrutinizing social and environmental risks. The gold mining sector has struggled with its reputation over the years with environmental, social and governance concerns such as the tie between illegal gold mining and the funding of groups that perpetrate violence in the Democratic Republic of Congo. However, groups critical of the gold mining sector are skeptical that a relatively controversial and high-polluting industry earnestly wants to clean up its act.

In late March, industry groups London Bullion Market Association and World Gold Council jointly announced a collaboration to develop and implement a system to track the origin of gold bars and maintain a chain of custody, known as the Gold Bar Integrity Programme.

“My goal is to try and create a completely impenetrable global system that will slowly, but surely, squeeze out nefarious practices,” World Gold Council CEO David Tait said in an interview. “It’s hugely optimistic but better than where we are now.”

Bringing industry together around technology

In the initial phase of the Gold Bar Integrity Programme, the organizations are working with aXedras and Peer Ledger to demonstrate how a blockchain-backed ledger can “create an immutable record” of a gold bar moving through the supply chain. While a product such as a gold bar can be physically indistinguishable from another gold bar, blockchain is a digital technology that stores information across a distributed ledger or database that can be tied to each bar. The unique code can be transferred along with the physical gold in such a manner that participants in the blockchain can confirm and certify the accuracy of information without the need for a centralized authority. The aim is to allow a buyer to know the source of gold, its quality and who has traded it.

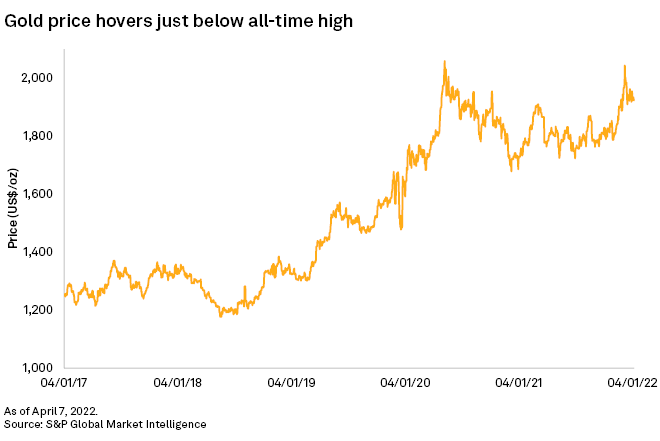

While there have been various technologies aimed at tracking gold over the years, this initiative now has the support of the entire gold value chain, said London Bullion Market Association CEO Ruth Crowell. With gold prices over $1,900 per ounce after exceeding $2,000/oz in August 2020, there is more pressure than ever on responsible sourcing.

“There’s been a lot of solutions, looking for problems. It’s nice to have a solution that’s really solving a problem,” Crowell said. “We can’t ignore the challenges that are out there if you think about ESG.”

Other segments of the mining and metals sector are also exploring blockchain ledgers to trace materials. In 2019, for example, Ford Motor Co. announced a partnership with other companies, including International Business Machines Corp., to create a blockchain-driven system for validating key raw materials used by the automotive and consumer electronics industries.

“This industry is about to make a big step in the right direction,” Tait said.

Increasing transparency in gold transactions allows consumers to make an informed decision about their purchases. The ability to reliably guarantee the source and history of gold could fetch a higher price for sellers of the metal. For example, the Fairmined Initiative by Alliance for Responsible Mining promotes an additional economic benefit for artisanal mining operations.

Those that meet the requirements for Fairmined-certified gold around things such as labor practice and supply traceability can expect a price premium of up to $4,000 per kilogram of gold, or about $113.40/oz. Those meeting additional standards regarding the use of toxic substances to recover gold can fetch an additional $2,000/kg, or $56.70/oz, premium through its Fairmined Ecological Gold standard.

Gold’s environmental, social footprint

The idea of the new initiative is that informed buyers can push gold out of the market if it has undesirable connections to environmental destruction, human rights abuses or other issues. Ecological concerns around legal mining practices include the use of the toxin cyanide in the extraction process.

“Gold mining is one of the dirtiest industries in the world,” said Bonnie Gestring, Northwest program director for the environmental group Earthworks. “It can displace communities, contaminate water, harm workers and destroy pristine environments.”

While many gold companies are quick to point to high standards addressing mining’s social and environmental impacts, the sector has had its share of environmental and human rights disasters.

For example, a blast at an informal gold mine in Burkina Faso in February killed about 60 people and injured dozens more, Reuters reported. Health researchers also recently linked illegal gold mining activity in the Brazilian Amazon to a 700% increase in malaria cases found among Yanomami Indigenous people due to ecological modifications that led to an increase in mosquito populations.

On March 17, the U.S. Department of the Treasury imposed sanctions on Belgium-based Alain Goetz and the African Gold Refinery in Uganda related to illicit gold valued at hundreds of millions of dollars from Congo. Transactions in gold from Congo are one of the largest revenue streams for armed groups that threaten the peace, security and stability of the country, a Treasury news release stated.

“Treasury has been very clear: global gold markets, at every step of the supply chain, must engage in responsible sourcing and conduct supply-chain due diligence,” Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian Nelson said in the March 17 statement.

Many of the gold industry’s impacts can be challenging to spot, let alone track, particularly in remote areas. For example, the U.S. and Peru started collaborating in 2017 to combat illegal gold mining deep in the Amazon.

The Amazon Conservation Association’s Monitoring of the Andean Amazon Project tracks the impacts of illegal mining using real-time satellite data. The project uncovered illegal operations that are often remote, dangerous and spread over vast areas, said Matt Finer, senior research specialist and director of the monitoring program.

“Overall, illegal gold mining deforestation has decreased, indicating some success of the government’s continued crackdown on the most severely impacted areas,” Finer said of the Peruvian Amazon region where the program is focused. “However, several new hotspots have emerged, most notably Indigenous territories.”

A better means for tracking gold, particularly if it can precisely identify its source, could help further cut illegal mining activity around the world, Finer said.

READ MORE: Sign up for our weekly ESG newsletter here, read our latest coverage of environmental, social and governance issues here and listen to our ESG podcast on SoundCloud, Spotify and Apple podcasts.

An eye on small, artisanal mines

Roughly 20% of global gold production comes from “artisanal and small-scale” gold miners, according to a report from the World Gold Council. The segment of miners also generates employment and income for an estimated 20 million workers worldwide, who can earn more money in mining than in other sectors such as fishing, farming or forestry. However, some of these smaller operations are also rife with environmental and social challenges, including the uncontrolled use of mercury, deforestation, water contamination and financial ties to criminal groups.

Dillon Gage Metals, a Texas-based metals wholesale trading firm, announced March 29 that it partnered with the nonprofit Alliance for Responsible Mining to refine and sell Fairmined-certified gold from artisanal and small-scale mining operations. Among other guarantees, the Fairmined standard ensures the mine source pays a fair wage, regardless of gender, does not use child labor and has no links to conflict situations. Fairmined also requires that all gold stamped with its branding is 100% traceable.

While there may be an assumption that mines operated by large mining companies are more likely to abide by higher standards, that is not always the case, said Alejandro Esponda, global sales director for Dillon Gage’s refinery business unit. Ensuring that artisanal and small-scale mining is also held to higher operating practices opens up a big swath of the market to ESG-minded investors, Esponda said.

Fairmined gold fetches a premium for the miner, and buyers are willing to pay it for the peace of mind of knowing the product has met the program’s certification requirements, Esponda said. Fairmined gold is also a way to support economic activity in places located near the mining operation, Esponda added.

“The impact that you have in those communities is way more impactful than just buying from a bigger company that’s based somewhere in Toronto,” Esponda said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Read More:Gold industry groups aim to ‘squeeze out nefarious practices’ with tracking tech

2022-04-09 07:57:26