chonticha wat/iStock via Getty Images

Gold Standard Ventures Corp (NYSE:GSV) is a small exploration company developing the South Railroad project in Elko County, Nevada, USA. On March 15, 2022, the company released a new feasibility study for this project. In my opinion, the results of this study are deeply disappointing. In this article, I discuss this thesis.

Investment thesis

According to the just-published feasibility study, the South Railroad project should generate an after-tax net present value of $486M. It means that one share of Gold Standard Ventures is worth $1.41. Today these shares are trading at $0.50 a share so, at first sight, they seem to be undervalued.

However, compared to the previous study (a preliminary feasibility study released in March 2020) I see deep deterioration in terms of basic technical and financial measures. In other words, although the current valuation seems to be attractive, a conservative investor should sell the stock when its price approaches $1.4 a share.

South Railroad basics

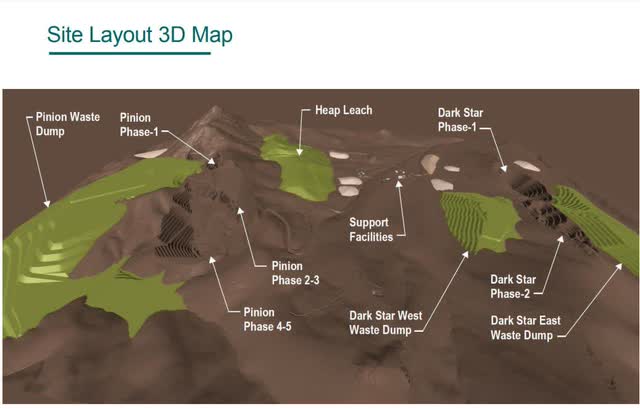

The South Railroad project consists of three gold deposits: Dark Star, Pinion and Jasperoid Wash. However, only the first two are discussed in the current economic study as a basis for the future mine. This mine will be an open pit operation using a classic heap leach mining technique where the rock excavated from Dark Star and Pinion will be converted into gold doré as a final product. By the way, gold doré is not a market product. To convert it into a market product the company will have to outsource this process to a refinery which costs money (I discuss this issue below).

Now, let me get to the point.

Reserves

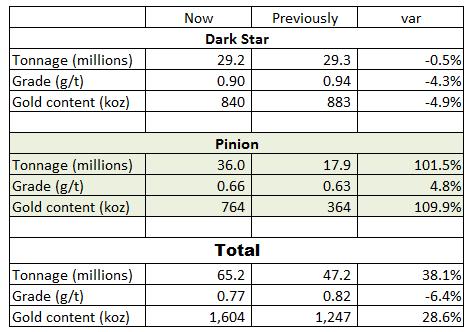

The table below compares mineral reserves reported in the current study and the former one (released in 2020):

Simple Digressions

Note that the total gold reserves increased from 47.2 million tons of ore to 655.2 million (an increase of 38.1%). However, due to a bit lower gold grade, the gold content went up by 28.6% (from 1,247 thousand ounces in 2020 to 1,604 thousand now).

Moreover, the entire growth in reserves is attributable to the Pinion deposit where the gold content went up from 364 thousand ounces to 764 thousand.

Summarizing, the company has definitely replenished the Dark Star/Pinion reserves but…the South Railroad gold camp is still pretty small. I expected more impressive results after two years of drilling. To be honest, I am very skeptical that any big gold miner will be interested in taking over an exploration company developing a 1.6 million ounces gold deposit…It means that, in my opinion, Gold Standard Ventures will have to build a mine on its own.

New and old economic study

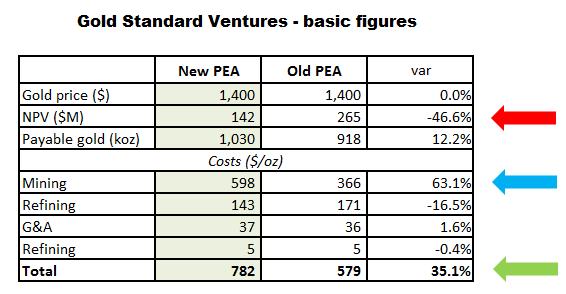

Another negative – in my opinion, the project’s economics deteriorated compared to the previous study. Look at this table:

Simple Digressions

Firstly, using the same gold price as assumed in the previous study ($1,400 per ounce), it is evident that the value delivered by the project has dropped (the red arrow) from $265M (previously) to a mere $142M (now). Paradoxically, an after-tax net present value dropped despite more gold ounces to be produced by the future mine. What happened?

The answer is easy – according to the new PEA, the operating cost has gone up from $579 per ounce of gold in the previous study to $782 now (the green arrow). What is more, the main factor behind this large increase (35.1%) is the cost of mining. As the table shows (the blue arrow), this cost jumped by 63.1% compared to the previous study.

I have taken a closer look at this figure and found out that:

- As mentioned above, the new study shows that the future mine will produce more gold than the previous study assumed (1,604 thousand ounces vs. 1,247 thousand)

- However, to produce this higher amount of gold the company will have to mine out 366 million tons of rock (ore + waste) while in the previous study this measure stood at 192 million tons; it means a huge increase of 90.6%!

- Moreover, the amount of gold ore to be mined out has gone up by 53% while the amount of waste by 103%. It means that there is more waste to mine than before. As a result, the strip ratio (defined as waste/ore) has gone up from 3.1 to 4.1. To remind, the higher the strip ratio, the higher costs of mining

- Keeping in mind that the operating cost has not changed compared to the previous study ($11.23 per ton of ore now vs. $11.54 per ton previously), a higher amount of rock to be mined out will drive up the operating cost per ounce of gold from $579 to $782

- Finally, the so-called “Payable amount of gold produced” deteriorated as well. At first sight, there is an improvement – in the previous study, this figure stood at 918 thousand ounces while now it is 1,030 thousand. However, it means that to produce a marketable product (i.e., high-quality gold bars) the company will have to pay as much as 35.7% of the gold market price to a refiner instead of 26.4% as depicted in the previous study

Note: basically, a payable amount of gold produced is defined as the total gold produced less part of the gold paid to a refiner in exchange for its services. For example, according to the current study, the future mine will produce 1,604 thousand ounces of gold but only 1,030 thousand ounces will be sold at market prices and classified as the company’s revenue. The difference (574 thousand ounces or 35.7%) will go to a refiner.

Summarizing – I am negatively surprised with the new study. Despite higher gold reserves, the project’s economics has strongly deteriorated.

What about the value of the stock?

Now, despite these negatives we have to remember that using a gold price of 1,900 per ounce, the project is supposed to generate an after-tax net present value of $486M which translates into the company’s share value of $1.41 (assuming the current share count). Today these shares are trading at approximately $0.50 a share so they are undervalued.

However, a conservative investor should, in my opinion, sell this stock when its price gets closer to its net present value of $1.41 a share.

Summary

For a few years, I used to be a big fan of Gold Standard Ventures. The South Railroad gold project is located in one of the world’s best gold jurisdictions (Nevada) so I thought it would be a great success. The preliminary feasibility study released in 2020 supported my optimism. However, after two years of intensive drilling, the company released another study that, in my opinion, shows no progress. Moreover, as discussed above, it shows deterioration.

Hence, I recommend selling the stock when the price, driven up by the current bull market in gold, approaches $1.4 a share.

Read More:Gold Standard Ventures: The New Economic Study Is A Failure (NYSE:GSV)

2022-03-23 22:48:13