gchapel/iStock via Getty Images

Barrick Gold (NYSE:GOLD) had a tough year in FY2021, with production down year-over-year due to challenges at Hemlo, a mechanical mill failure at Goldstrike, and having no contribution from Porgera. However, 2022 has started off on the right foot, with the company announcing a more attractive dividend framework, enjoying much higher metals prices, and reporting exceptional reserve replacement. As we close out Q1, the most recent news has strengthened the bull thesis, with the Reko Diq Project getting a second lease on life. Given Barrick’s attractive valuation and an upgrade to its development pipeline, I would view sharp pullbacks as buying opportunities.

Barrick – Cortez Complex Operations (Company Presentation)

Barrick Gold released news last weekend that the company has reached an agreement on a framework to provide for the reconstitution of the Reko Diq project in Pakistan. This project has a long history following the joint acquisition of a 75% interest in the project (Tethyan Copper Company) by Barrick and Antofagasta (OTC:ANFGF) in 2006, translating to a 37.5% interest for each company. The project lies in the western Chagai region of the province of Balochistan in Pakistan, roughly 35 kilometers south of Afghanistan. Let’s look at the project below and what this means for Barrick.

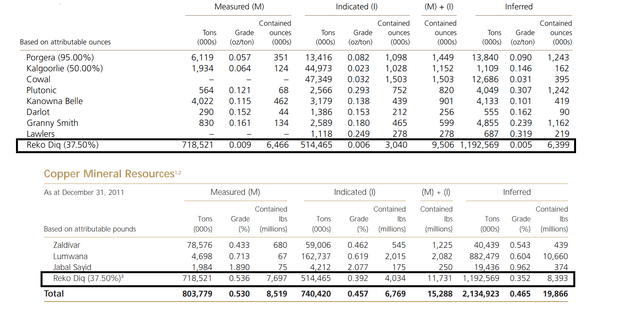

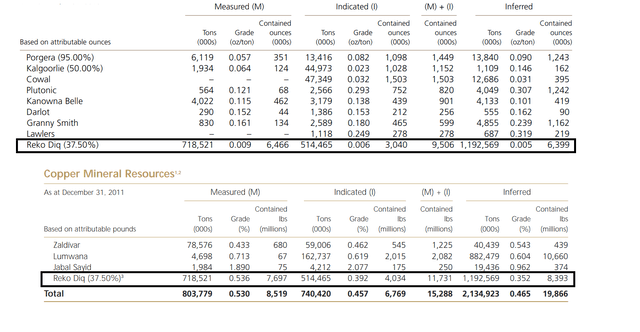

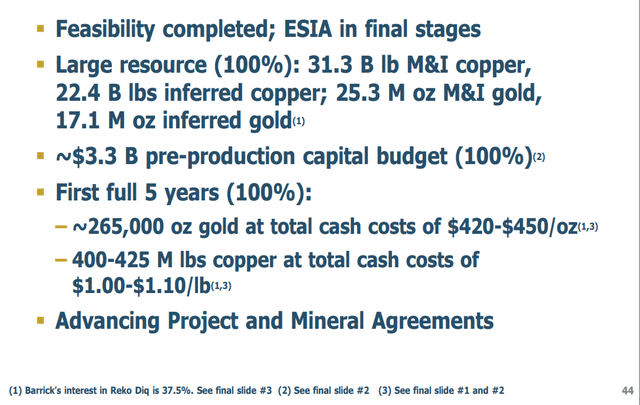

At the time of the 2006 acquisition of Tethyan Copper (company holding 75% interest in Reko Diq), the Reko Diq gold-copper project was home to ~15 billion pounds of copper and 10 million ounces of gold, with an additional ~12 billion pounds of copper and ~12 million ounces of gold in the inferred category. This made it one of the largest porphyry ore deposits globally. However, continued drilling was able to upgrade this resource to ~31.3 billion pounds of copper and ~25.3 million ounces of gold, in addition to ~22.4 billion pounds of copper and ~17.1 million ounces of gold in the inferred category.

Barrick Gold – Attributable Gold/Copper Resources (Annual Report 2011)

Reko Diq rivaled the current Pebble Project in Alaska based on this upgraded resource size, albeit with slightly lower grades. This is based on a resource base of ~5.9 billion tons at an average grade of 0.41% copper and 0.22 grams per tonne gold vs. Pebble which is home to over 6 billion tons of material at an average grade of 0.40% copper and 0.34 grams per tonne gold. Barrick’s attributable portion of the resource is shown below from its 2011 Annual Report.

Barrick Gold – Attributable Mineral Resources (Annual Report – 2011)

The most exciting part about the Reko Diq District is that it was part of the 400-kilometer long and 140-kilometer wide Chagai Magmatic belt of calc-alkaline suite volcanic, plutonic, and associated sedimentary rocks, with more than a dozen targets identified. This included a leachable supergene copper target at Tanjeel of 214 million tonnes at 0.60% copper. However, the focus of Barrick and Antofagasta (Tethyan Copper Joint-Venture) was on the Western Porphyries, where the company delineated a massive resource base that would be the focus of a Feasibility Study completed in 2010, with an application for a mining lease in Q1 2011.

As noted above, Tethyan Copper identified a massive resource base on just a few of the several targets. However, just ~250,000 meters were drilled by previous operators (Mincor, BHP, Barrick, Antofagasta), suggesting the possibility for enormous upside to the resource and a major district by testing new targets. These additional targets include Tanjeel (supergene copper target), H2, H3, H7, H8, H9, and several other southern porphyry clusters. It’s also possible there could be additional resources proven up at H79 to the north and H13 to the south, which western porphyry targets. Finally, there lies H35, a porphyry intrusion east of the main resource within the district.

The potential to grow the current resource base and make new high-grade discoveries is supported by Barrick’s higher market cap, affording it a much larger exploration budget. Obviously, with a 50-year mine life, extending the mine life is not a huge priority. If Barrick’s current exploration licenses cover these targets, I would not be surprised if the company did some regional drilling over the coming years.

To summarize, while Barrick is already sitting on one of the most impressive undeveloped projects globally with a 50 year-mine life, there could be additional upside on targets east of the Western Porphyry Complex, all lying within a 10-kilometer radius.

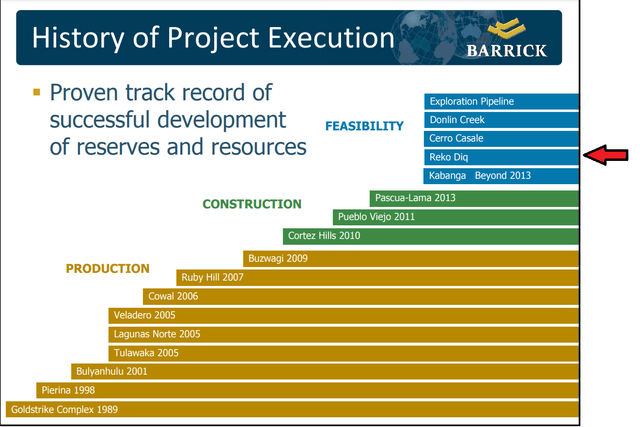

Barrick Gold – Development Pipeline (Company Annual Report)

Not surprisingly, Reko Diq easily was a key pillar of Barrick’s development pipeline in its 2010 Annual Report, with the Feasibility Study highlighting a project capable of producing ~265,000 ounces of gold and up to 425 million pounds of copper in its first five years at industry-leading costs, as well as an impressive 50+ year mine life. Unfortunately, these plans were cut short when the Government of Balochistan rejected the mining lease application after years of work by Barrick and Antofagasta.

Reko Diq Feasibility Study (Barrick Gold Annual Report, Tethyan Copper Company)

However, after a decade long legal dispute in which the International Centre for Settle of Investment Disputes handed down a multi-billion dollar penalty, a new agreement has been formed, under which Barrick will have a 50% interest (up from 37.5%), with the Balochistan government getting a 25% share, and the remaining 25% being held by state-owned enterprises. This is a huge deal for Barrick because Reko Diq previously received little value in the company’s portfolio, and it provides a massive boost to the company’s development pipeline. According to Barrick’s CEO, Mark Bristow, who has proven to be masterful at operating in jurisdictions where most companies won’t venture, the project could be in production within 5-6 years.

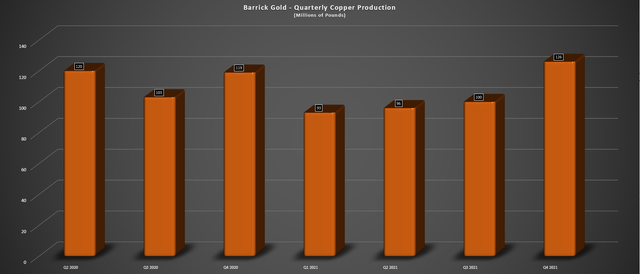

Barrick Gold – Quarterly Copper Production (Company Filings, Author’s Chart)

Based on Barrick’s upgraded 50% interest, Barrick could enjoy annual production of ~133,000 ounces of gold and ~206 million pounds of copper per annum, assuming the project goes ahead with its previous scale (~120,000 tonnes per annum). Comparing this to Barrick’s FY2021 production of ~415 million pounds of copper from its three copper assets (Jabal Sayid, Zaldivar, Lumwana) would translate to ~50% production growth in copper with an additional boost to gold output. At these metals prices, the copper revenue alone would come in at more than $900 million, with gold revenue of more than $250 million.

Obviously, Barrick must complete additional work on the project given that it’s been shelved for a decade, but this is certainly a very positive development for the company. Previously, Barrick’s biggest growth opportunity was its 50% interest in Donlin Creek, outside of near-term growth from Goldrush/Fourmile in Nevada. However, with Reko Diq getting a second lease on life, we should see a meaningful boost to revenue later this decade while opening up a new major region for exploration.

Valuation & Technical Picture

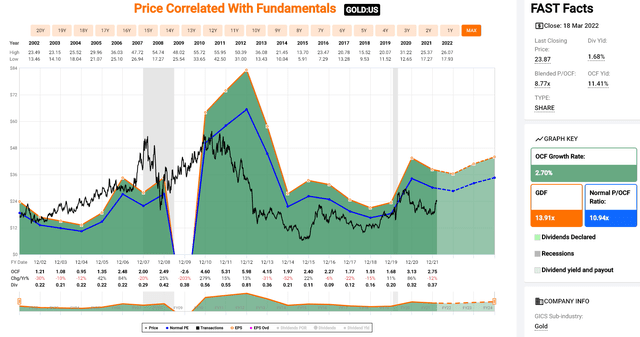

Looking at the chart below, we can see that Barrick continues to trade at a discount to its historical multiple. This is based on Barrick trading at $23.90, or ~8.1x FY2022 cash flow estimates (current estimates: $2.95). The current cash flow multiple is well below the company’s historical cash flow multiple of ~11.0 going back to 2004 and ~8.0x cash flow since gold’s 2015 secular bear market ended. However, with the gold price trading just shy of all-time highs and above its previous secular bull market peak (2011), a cash flow multiple at the high end of this range seems more than reasonable.

Barrick Gold – Historical Operating Cash Flow Multiple (FASTGraphs.com)

Even if we use a more conservative multiple of 10x cash operating cash flow, this points to a fair value for the stock of more than $29.00 per share. Therefore, I continue to see meaningful upside for Barrick from a valuation standpoint, even after its recent rally. However, given that I prefer to buy with a minimum 30% discount to fair value, the ideal buy-point for the stock continues to come in closer to $21.00 per share. Obviously, the stock may not drop this low if gold prices remain above the $1,900/oz level, but this is where the stock would enter a low-risk buy zone.

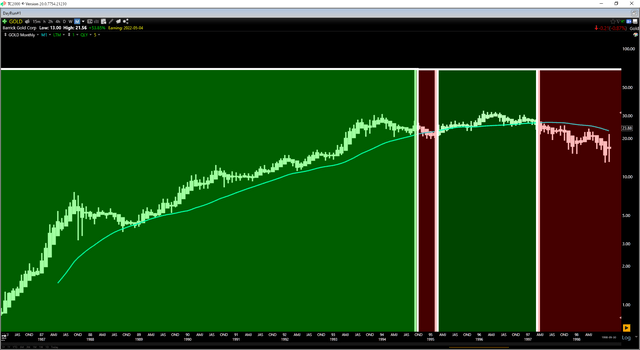

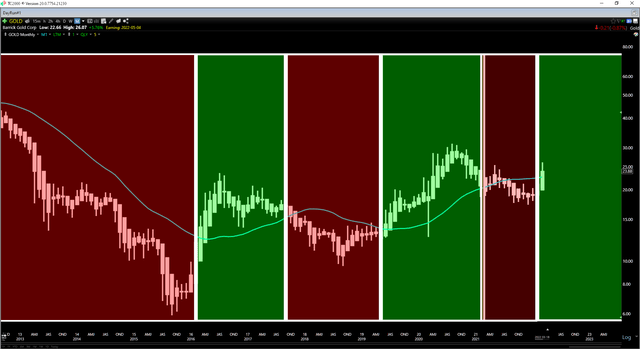

GOLD – Monthly Chart (TC2000.com)

Moving over to the technical picture, we’ve seen a positive development, with Barrick climbing back above its key monthly moving average as of March. If we look at the chart above, we can see that Barrick has historically performed its best when it’s been above this key moving average (green line), and this has been a time to hold the stock and buy the dips.

Looking at the chart below, we can see that Barrick lost its momentum in February 2021, which suggested the potential for the stock and the Gold Miners Index (GDX) have tough sledding again. This is one of the reasons I favored owning Newmont (NEM) last year, which was stronger than Barrick from a technical standpoint (above its long-term moving averages). However, with Barrick back above this key moving average now, this is a positive development for the Gold Miners Index (given Barrick’s large weighting) and Barrick, suggesting that dips have a higher probability of being bought.

GOLD – Monthly Chart (TC2000.com)

So, is the Stock a Buy?

Given the recent positive developments, including real rates deep in negative territory, a more generous dividend framework, and a second lease on life for Reko Diq, the thesis for owning Barrick continues to strengthen. Having said that, I prefer to buy dips, and while Barrick’s momentum has shifted back to positive on its long-term chart, the stock’s reward/risk ratio is less favorable than it was when I highlighted the stock as a Buy at $18.10 per share.

Barrick Gold Article (Seeking Alpha Premium)

Based on the conflicted short-term outlook (less favorable…

Read More:Barrick Gold Stock: Recent Developments Improve Investment Thesis (NYSE:GOLD)

2022-03-21 16:48:02