DarrelCamden-Smith/iStock via Getty Images

We’re now more than two-thirds of the way through the Q4 Earnings Season for the Gold Miners Index (GDX), and one of the most recent companies to report its results is Wheaton Precious Metals (WPM). While the company had a decent year from an attributable production standpoint with 6% growth in gold-equivalent ounce [GEO] volume, it was an incredible year from a transaction standpoint, with the 5-year and 10-year outlook receiving a huge upgrade.

Combining this solid outlook with more ebullient metals prices, we could see significant growth in annual earnings per share [EPS] over the next few years, lapping what was already a solid year in FY2021 (17% growth). After a 20% in the past month, some giveback for the stock would not be surprising, but given the strong technical picture, I would expect the $42.50 level to provide a floor for the stock.

San Dimas Mine (Company Presentation)

Wheaton Precious Metals released its Q4 and FY2021 results last week, reporting attributable quarterly production of ~186,400 GEOs, a 2% decrease from the year-ago period. However, attributable production was up sharply year-over-year, coming in at ~753,000 GEOs, up 6% from 2020 levels. This was helped by a meaningful increase in silver production, offset by slightly lower gold production in the period (~342,500 ounces vs. ~366,300 ounces) due to a much weaker year for Vale’s (VALE) Salobo Mine. Let’s take a closer look at the results below:

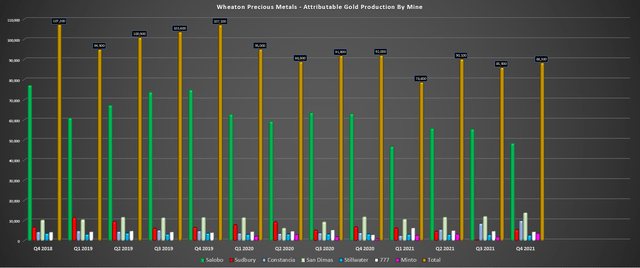

Wheaton Precious Metals – Attributable Gold Production by Mine (Company Filings, Author’s Chart)

Looking at Wheaton’s gold business above, we can see that it was a much softer year for Salobo (green bars), which saw lower grades, throughput, and recovery rates, with throughput negatively affected by an 18-day suspension following a conveyor belt fire in October. This affected concentration production, which came back online in late October. While Salobo recovered relatively quickly from the fire, this led to attributable production of just ~48,200 ounces in Q4, down more than 20% on a year-over-year basis (Q4 2020: ~62,900 ounces).

Unfortunately, the Salobo Mine has had to deal with another negative development in Q1, with heavy rainfall causing a landslide that damaged part of a conveyor belt and blocked access to the project site in the region of the Salobo Phase 3 Expansion. A full assessment of the impact is ongoing and will be available in Q2, but despite the hiccup, the Phase 3 Expansion is nearing completion (85%), which will push annual throughput to 36 million tonnes per annum (24 million tonnes per annum currently). Per the timing outlined in the 2019 Technical Report, the expansion is well behind schedule (January 2022 estimate), but this is simply deferring the timing of deliveries and incremental attributable production to Wheaton.

Fortunately, while Salobo, Sudbury, and Stillwater had weaker quarters due to lower throughput, San Dimas had a huge quarter, contributing ~13,700 attributable ounces of gold to Wheaton. This represented an 18% increase year-over-year. Meanwhile, Wheaton’s other category also saw significant growth, with higher grades mined at Minto, an incremental contribution from GCM’s (OTCQX:TPRFF) Marmato Mine (new stream), and a solid quarter from Hudbay’s (HBM) 777 Mine. So, despite the weakness at Salobo, which makes up a huge portion of Wheaton’s attributable production, attributable gold production was down just 4% in Q4.

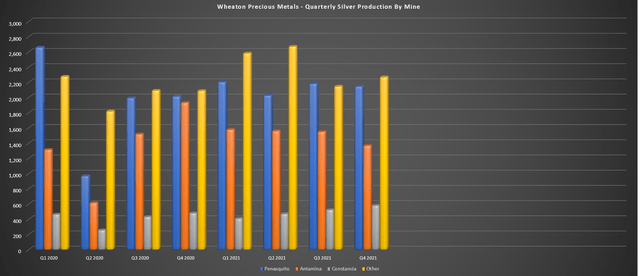

Wheaton Precious Metals – Quarterly Silver Production by Mine (Company Filings, Author’s Chart)

Moving over to silver production, Wheaton saw a much smaller contribution from Antamina in Q4, with attributable silver production down 29% year-over-year due to lower throughput and grades. This was partially related to a brief suspension in operations to ensure the safety of its workforce following protests in Peru. Fortunately, Penasquito contributed ~2.15 million ounces to Wheaton in Q4, while Constancia contributed ~580,000 ounces of silver, up more than 20% year-over-year. While this still led to a slight decrease in attributable silver production year-over-year, it was a relatively minor decline (~2%) despite a much lower contribution from a key asset (Antamina).

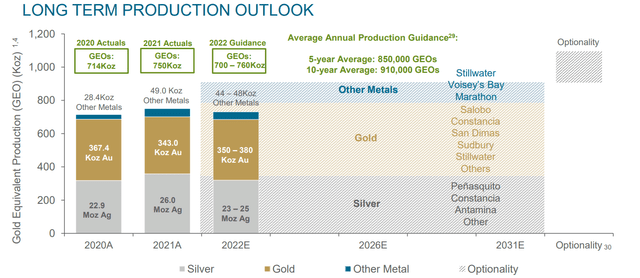

Wheaton Long-Term Production Outlook (Company Presentation)

While Q4 production certainly could have been better, the bigger story is Wheaton’s increased pace of transactions over the last year, which has boosted the 5-year outlook to 850,000 GEOs and the 10-year outlook to 910,000 GEOs. This is a massive upgrade from the previous 10-year guidance of ~830,000 GEOs and can be attributed to multiple deals that include streams at the Back River Gold Project, the Curipamba Copper-Gold Project, the Marathon PGM Project, and the Blackwater Gold Project in British Columbia.

Some investors might be disappointed with the slight decrease in attributable GEO production expected in 2022 (~730,000 GEOs vs. ~753,000 GEOs). Fortunately, it looks like higher metals prices will pick up any of the slack. It’s also important to note that the 10-year outlook does not include any contribution from Barrick’s (GOLD) Pascua Lama Mine, Pan American’s (PAAS) Navidad Mine, or Chesapeake’s (OTCQX:CHPGF) Metates Project.

Financial Results

Moving over to Wheaton’s financial results, we can see that revenue slid 3% year-over-year in Q4 to $278.2 million, but this was primarily due to the difficult year-over-year comps following the much higher gold prices in Q3/Q4 2020. The good news is that we should see growth in revenue in H1 2022, given that Wheaton is now up against relatively easy year-over-year comps from a gold price standpoint, with a similar average realized silver price. Hence, I don’t see any reason to get hung up on the decline in quarterly earnings per share ($0.29 vs. $0.33) and revenue ($278.2 million vs. $286.2 million) on a year-over-year basis.

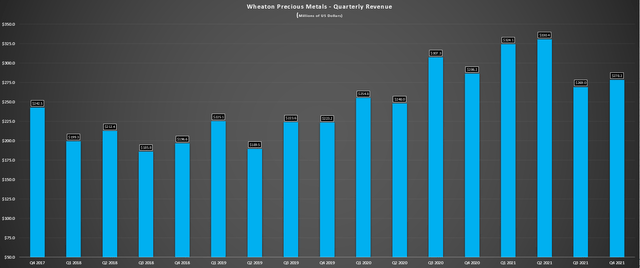

Wheaton Precious Metals – Quarterly Revenue (Company Filings, Author’s Chart)

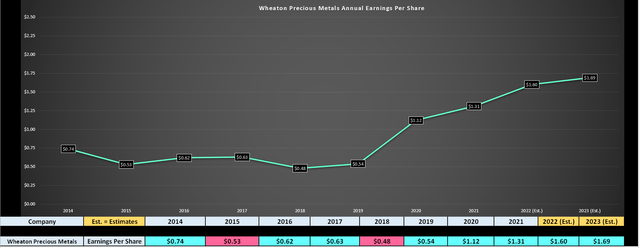

Despite the 12% decline in quarterly earnings per share, Wheaton reported annual EPS of $1.31, translating to 17% growth year-over-year. Looking ahead to FY2022 and FY2023 estimates, Wheaton is on track to see meaningful growth in annual EPS, attributed to higher metals prices and offset by a slight decline in GEO production in 2022. Assuming Wheaton can meet estimates of $1.69 in FY2023, this would translate to record annual EPS for the company, a very bullish development.

WPM Earnings Trend (FactSet, Author’s Chart, Author’s Estimates)

Valuation & Technical Picture

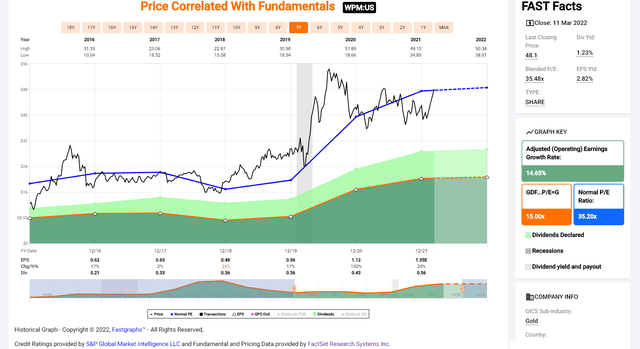

If we look at Wheaton’s long-term chart below, we can see that the stock has traded at an average earnings multiple of 31 over the past 15 years and a multiple of 35 since this secular bear market for gold ended in 2015. I would argue that a fair value for the stock is closer to 35x earnings, slightly above this historical earnings multiple, given that the gold price is in the upper range of its 10-year average. Based on a fair earnings multiple of 35 and estimated FY2022 earnings estimates of $1.60, I see a conservative fair value for the stock of $56.00.

WPM Historical Earnings Multiple (FASTGraphs.com)

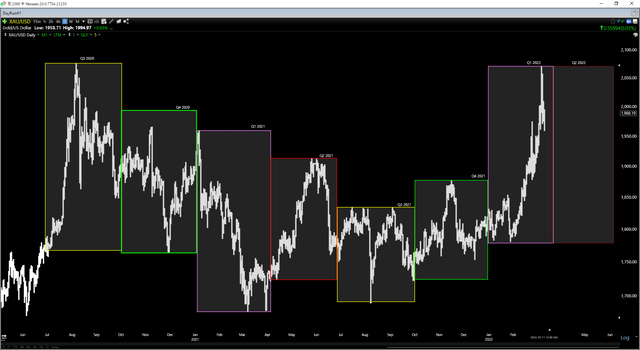

It’s worth noting that with gold recently waking up from its slumber and silver also beginning to catch a bid, there is some upside to these earnings estimates. In fact, with gold knocking on the door of a new all-time high and gaining more than 10% sequentially, we could see Wheaton Precious Metals report $1.65 or better in FY2022 annual EPS, assuming the gold and silver price don’t retrace much of their recent gains. Given that I prefer to err on the side of caution, I have no plans to adjust my price target and assume higher prices. However, I believe the fair value and 12-month target price of $56.00 for Wheaton could end up being conservative.

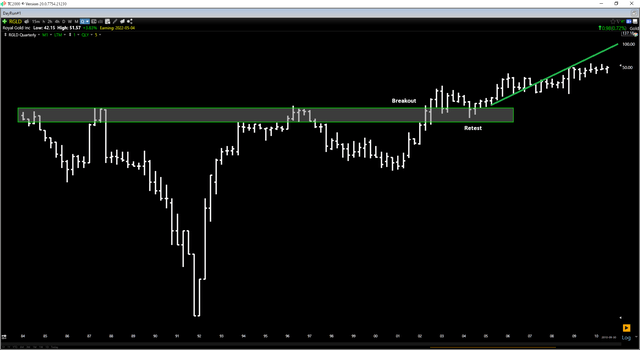

Gold Futures Price (TC2000.com)

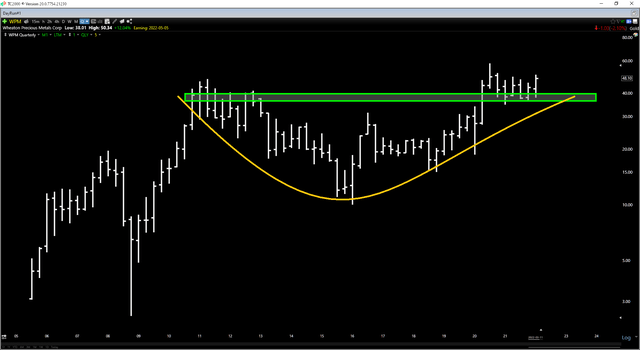

Moving over to the technical picture, Wheaton has finally turned up from its multi-year base-on-base pattern, a very bullish development for the stock long-term. In fact, while many producers were making new 52-week lows in Q4, Wheaton was simply re-testing a multi-year breakout level, showing clear relative strength to its peer group. This is a similar pattern to what we saw from Royal Gold (RGLD) nearly two decades ago, with the stock breaking out from a multi-year base in 2002 and then re-testing its breakout level in 2004. The stock enjoyed a more than 170% rally over the next five years, massively outperforming the S&P-500.

WPM Quarterly Chart (TC2000.com)

RGLD Quarterly Chart (TC2000.com)

Obviously, history does not have to repeat itself, and a move of this magnitude would be very surprising, given that WPM has a much higher market capitalization than RGLD did at the time of its 2004 breakout/backtest pattern. However, this very constructive pattern favors higher prices ahead medium-term and long-term. Given the strong support in the $38.00-$42.00 range and the improved earnings outlook due to higher metals prices, I would expect the stock to find strong buying support on any pullbacks below $44.00 over the coming months.

Yauliyacu Mine (Company Website)

With another strong year under the company’s belt and a very attractive 5-year and 10-year outlook, Wheaton Precious Metals continues to be one of the best ways to get gold and silver exposure. This is reinforced by the robust technical picture, with the stock trying to emerge from a massive base-on-base pattern and sporting one of the most attractive quarterly charts among large-cap stocks trading on the US Market. Given this favorable outlook from both a fundamental and technical standpoint, I would view sharp pullbacks as buying opportunities.

Read More:Wheaton Q4 Earnings: Wait For A Pullback (NYSE:WPM)

2022-03-12 13:29:00