- Mine life of 35 years and after-tax payback of 4.0 years

- After-tax net present value (“NPV”) (8%) of US$1.72 billion and internal rate of return (“IRR”) of 18.3%

- Average nickel production of 99 million lbs. per year

- Average C1 operating costs of US$2.74/lb nickel and all-in sustaining costs (“AISC”) of US$3.12/lb nickel

- Average US$481 million of annual earnings before royalties, taxes and depreciation

Cautionary Statement: The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that the conclusions or results as reported in the PEA will be realized.

“This PEA establishes Baptiste as a premier large-scale nickel project,” commented FPX Nickel’s President and CEO, Martin Turenne. “The Project has the potential to be a significant global nickel operation, with a multi-generational operating life and average annual production of 99 million pounds of contained nickel. Baptiste’s enormous scale, combined with low C1 operating costs of US$2.74/lb, has the potential to deliver robust operating margins throughout the nickel price cycle, generating average earnings (before royalties, taxes and depreciation) of US$481 million per year and an after-tax NPV of US$1.7 billion. With its proximity to zero-carbon hydroelectric power, the fact that its nickel product can bypass smelters for direct sale to end users, and the carbon-absorbing properties of Baptiste host rock, the Project is well positioned to address the growing market demand for environmentally sustainable nickel production.”

The Company has also identified a number of optimization opportunities to be investigated in the next phase of project development, including but not limited to:

- Potential suitability of Baptiste nickel products for the electric vehicle battery market

- Sale of by-product iron ore concentrate or pellets

- Additional drilling to expand the Baptiste Deposit, which remains open with strong grades at depth over the entire mineralized footprint

- Potential discovery of additional large-scale nickel deposits within the 245 square kilometre Decar Nickel District on three known targets, most notably at the Van target

- Ongoing research in collaboration with the University of British Columbia on the ability of Baptiste waste rock and tailings to naturally sequester atmospheric carbon dioxide (“CO2”)

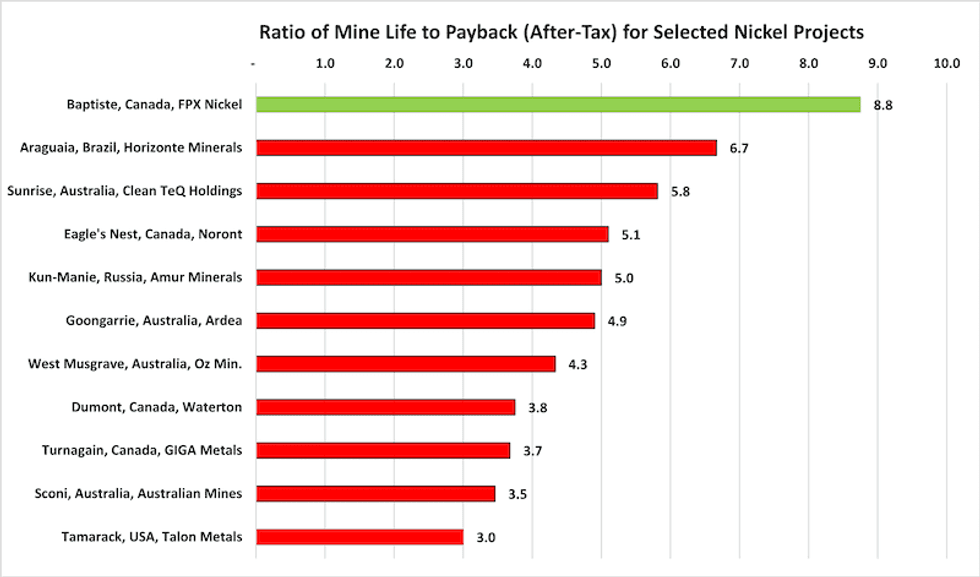

With its lengthy mine life and rapid payback, Baptiste ranks favourably among global development-stage nickel projects, providing potential exposure to multiple cycles in the nickel market while efficiently repaying upfront capital. Figure 1 demonstrates the strategic value of Baptiste in comparison to other pre-production nickel projects, as expressed by its high ratio of projected mine life (35 years) to after-tax payback period (4 years).

Figure 1 – Comparison of Global Nickel Projects

Source: Company economic studies; see Table 11 below.

Overview of PEA Results and Assumptions

The Baptiste PEA demonstrates the potential for establishing a greenfield open-pit mine and an on-site magnetic separation and flotation processing plant, using conventional technology and equipment. At a throughput rate of 120,000 tonnes per day (or 43.8 million tonnes per year), annual production is projected to average 99 million pounds nickel contained in ferronickel (“FeNi”) briquettes at C1 operating costs of US$2.74 per pound of nickel. It is anticipated that the Baptiste FeNi briquette will be sold directly to stainless steel producers and garner 98% of the London Metal Exchange (“LME”) nickel price, in line with payabilities earned by standard FeNi products in the global marketplace.

All amounts are in United States dollars unless otherwise specified; table totals may not sum due to rounding.

Table 1 – Baptiste Project PEA Results and Assumptions (all in US$)

| Results | |

| Pre-tax NPV (8% discount rate) | $2.93 billion |

| Pre-tax IRR | 22.5% |

| Payback period (pre-tax) | 3.5 years |

| After-tax NPV (8% discount rate) | $1.72 billion |

| After-tax IRR | 18.3% |

| Payback period (after-tax) | 4.0 years |

| Net cash flows (after-tax, undiscounted) | $8.73 billion |

| C1 operating costs 1 | $2.74/lb nickel |

| AISC costs 2 | $3.12/lb nickel |

| Assumptions | |

| Processing throughput | 120,000 tonnes per day |

| Mine life | 35 years |

| Life-of-mine stripping ratio (tonnes:tonnes) | 0.40:1 |

| Life-of-mine average annual nickel production | 99 million lbs. |

| Nickel price 3 | $7.75/lb |

| Baptiste product payability (% of nickel price) | 98% |

| Pre-production capital expenditures | $1.67 billion |

| Sustaining capital expenditures | $1.11 billion |

| Exchange rate | 0.76 US$/C$ |

- C1 operating costs are the costs of mining, milling and concentrating, on-site administration and general expenses, metal product treatment charges, and freight and marketing costs less the net value of by-product credits, if any. These are expressed on the basis of per unit nickel content of the sold product.

- AISC of all-in sustaining costs comprise the sum of C1 costs, sustaining capital, royalties and closure expenses. These are expressed on the basis of per unit nickel content of the sold product.

- Nickel price based on the average of six long-term analyst forecast prices.

Capital Costs

The total pre-production capital costs, including direct costs, indirect costs and contingency was estimated at $1.67 billion. This represents the pre-production capital expenditure required to support start-up of operations in year 1. The capital cost related to the implementation of in-pit tailings deposition in year 22 was estimated at $103 million. This is the capital expenditure specifically required to allow for finer primary grinding (resulting in improved nickel recovery) and for pumping tailings to the mined-out pits for in-pit deposition, and other associated costs (see further discussion under Metallurgy and Mineral Processing and Tailings Management below). Sustaining capital costs (which excludes the capital cost related to the implementation of finer primary grinding and in-pit deposition) were estimated at $1.01 billion. These costs include items such as mine equipment fleet additions and replacements, facilities additions and improvements and costs relating to tailings storage facility and surface water management which are incurred over the life-of-mine (“LOM”).

Table 2 – Capital Costs

| Category | Pre-Production US$ million | In-Pit Tailings Deposition (Year 21) US$ million |

Sustaining US$ million | Total LOM US$ million | ||

| Direct Costs | ||||||

| Mobile Equipment | $155 | – | $354 | $509 | ||

| Tailings | $138 | $15 | $534 | $687 | ||

| Mine and tailings site preparation | $96 | – | $90 | $186 | ||

| Mineral processing | $610 | $88 | $18 | $717 | ||

| Off-site infrastructure | $64 | – | – | $64 | ||

| On-site infrastructure | $66 | – | $7 | $73 | ||

| Total direct costs | $1,129 | $103 | $1,003 | $2,235 | ||

| Indirect costs | $292 | – | $8 | $300 | ||

| Contingency | $254 | – | – | $254 | ||

| Total project capital costs | $1,675 | $103 | $1,012 | $2,789 | ||

Operating Costs

Table 3 presents a summary of the estimated average operating costs for the initial Phase 1 (Years 1 to 21), Phase 2 (Years 22 to 35, during which period the Project will adopt finer primary grinding and in-pit tailings deposition) and for the life-of-mine, expressed in US$/tonne of dry material processed (milled).

Table 3 – Total Estimated Phase and Average LOM Operating Costs (US$/t milled)

| Estimated average LOM operating costs | Phase 1 (Years 1-21) |

Phase 2 (Years 22-35) |

Average (LOM) |

|||

| Mining | $2.28 | $2.66 | $2.43 | |||

| Mineral processing | $2.71 | $2.91 | $2.79 | |||

| Product transport | $0.19 | $0.18 | $0.19 | |||

| Rail terminal and access road | $0.05 | $0.05 | $0.05 | |||

| General site services | $0.62 | $0.62 | $0.62 | |||

| General and administration | $0.25 | $0.25 | $0.25 | |||

| Total operating costs | $6.09 | $6.66 | $6.32 | |||

Table 4 presents estimated phase and average LOM operating costs stated on a per unit of nickel production basis.

Table 4 – C1 costs and AISC costs (US$/lb nickel)

| Phase 1 (Years 1-21) |

Phase 2 (Years 22-35) |

Average (LOM) |

||||

| C1 costs | $2.61 | $2.94 | $2.74 | |||

| AISC costs | $3.13 | $3.11 | $3.12 | |||

Mineral Resource Estimate

The PEA incorporates an updated 2020 resource estimate for the Baptiste Deposit including all data from the 83 surface drillholes completed since 2010 and 2,053 samples from a re-sampling program of 2010/2011 drill core that was carried out in 2012. The estimate is geologically constrained within four mineralized domains and is reasonably comparable among different estimation methods (i.e., ordinary kriging, inverse distance squared weighting, nearest neighbour).

The 2020 resource model comprises a large, delta shaped volume that measures approximately 3.0 km in length and 150 to 1,080 m in width and extends to a depth of 540 m below the surface. The Baptiste Deposit remains open at depth over the entire system and is covered by an average of 12 metres of overburden.

Table 5: 2020 Baptiste Deposit Pit-Constrained Mineral Resource Estimate *

| Category | Tonnes (000’s) | Davis Tube Recoverable (“DTR”) Nickel Content | ||

| % Ni | Tonnes Ni | Pounds Ni (000’s) | ||

| Indicated | 1,995,873 | 0.122 | 2,434,965 | 5,368,173 |

| Inferred | 592,890 | 0.114 | 675,895 | 1,490,092 |

* See Notes for Tables 5 and 6 below.

Table 6: 2020 Baptiste Deposit Block Model Tonnage and Grades Reported at a Range of Cut-off Grades (Base Case 0.06% DTR Ni) *

| Cut-off Grade (DTR Ni %) | Indicated | Inferred | ||

| Tonnes (000’s) | DTR Ni Grade (%) | Tonnes (000’s) | DTR Ni Grade (%) | |

| 0.02 | 2,076,969 | 0.119 | 750,633 | 0.098 |

| 0.04 | 2,055,578 | 0.120 | 659,900 | 0.107 |

| 0.06 | 1,995,873 | 0.122 | 592,890 | 0.114 |

| 0.08 | 1,871,412 | 0.126 | 499,993 | 0.122 |

| 0.10 | 1,617,364 | 0.131 | 399,801 | 0.130 |

* Notes for Tables 5 and 6:

- Updated mineral resource estimate prepared by GeoSim Services Inc. using ordinary kriging with an effective date of September 9, 2020.

- Davis Tube magnetically-recovered (“DTR”) nickel is the nickel content recovered by magnetic separation using a Davis Tube, followed by fusion XRF to…

Read More:FPX Nickel Announces Appointment of Principal Metallurgist – Kyle Marte, Former Senior Process Engineer with Fluor

2022-03-08 01:10:46