CinemaHopeDesign/iStock via Getty Images

We’re nearing the beginning of the Q4 Earnings Season for the Gold Miners Index (GDX), and one of the first companies to report its preliminary Q4 results is Torex Gold (OTCPK:TORXF). True to form under Judy Kuzenzo’s leadership, the team continues to execute near-flawlessly, reporting record annual gold production of ~468,200 ounces and great safety performance. At a current share price of US$9.90, Torex trades at an enterprise value of ~$610 million, sporting a high double-digit free cash flow yield, and a P/NAV multiple below 0.50. While Torex isn’t without risks, which we’ll discuss later, I would view pullbacks below US$9.20 as low-risk buying opportunities.

Torex Gold ELG Mine Company Presentation

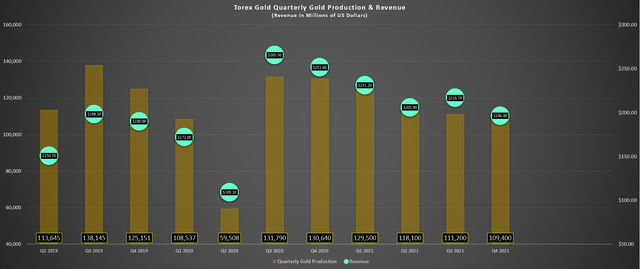

Torex Gold released its Q4 and FY2021 preliminary results last week, reporting quarterly production of ~109,400 ounces of gold, a sharp decline from Q4 2020 levels (~130,600 ounces). However, on a full-year basis, Torex reported record gold production of ~468,200 ounces, which not only beat the guidance mid-point by 4% but also trounced its pre-COVID-19 production record of ~454,800 ounces. Given the challenges operating in a post-COVID-19 environment (slightly higher absenteeism, social distancing), these results are incredible and a testament to the amazing job Chief Executive Officer Judy Kuzenko has done since joining in 2018 and being promoted to CEO in Q2 2020. Let’s take a closer look at the results below:

Torex Gold Production & Revenue Company Filings, Author’s Chart

As shown in the chart above, Torex Gold saw a decent finish to the year in Q4, producing ~109,400 ounces of gold and generating estimated revenue of $196.4 million. This is based on ~109,300 ounces sold in the quarter at $1,795/oz. It’s worth noting that in addition to record annual gold production of ~468,200 ounces, Torex also reported strong safety performance with nearly 6 million hours worked injury-free, which is the most important statistic.

Finally, Torex reported a record average throughput of 12,360 tonnes per day in FY2021 and record underground mining rates of 1,260 tonnes per day, a meaningful improvement from pre-COVID-19 levels. This allowed the company to produce close to 100,000 ounces from underground in 2021, supplementing production from its ELG pits. Given the solid finish to the year, Torex should finish the year with nearly $250 million in net cash, giving the company ample liquidity to complete its Media Luna [ML] planned transition in 2024. For those unfamiliar, Torex is looking to transition from mining at its El-Limon Guajes Mine to mining at Media Luna [ML] on the other side of the Balsas River, beginning in 2024.

Torex Gold Operations & Plans Company Presentation

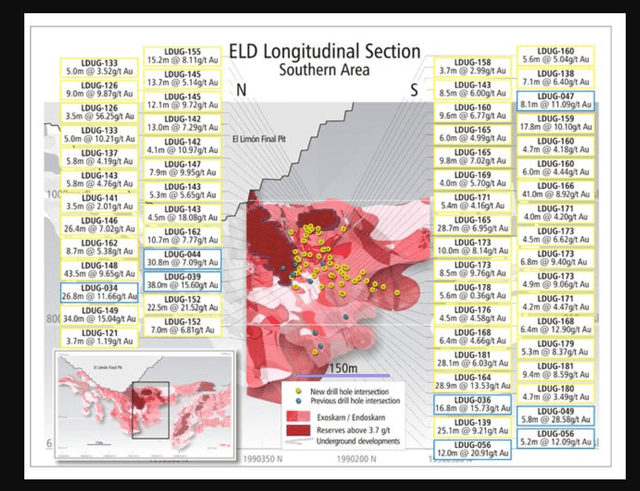

El Limon-Guajes Underground

In addition to outstanding operational and safety performance, Torex has also been releasing impressive drill intercepts from El Limon-Guajes Underground, reporting high-grade hits from El Limon Deep [ELD] and Sub-Sill. As shown below where new drill intersections are highlighted in yellow, it looks like we should see reserve and resource growth at ELD. Some highlight intercepts include 15.2 meters of 8.11 grams per tonne gold, 43.5 meters of 9.65 grams per tonne gold, 34 meters of 15.04 grams per tonne gold, and 22.5 meters of 21.52 grams per tonne gold.

El Limon Deep Long Section Company News Release

Moving to the Sub-Sill area, which lies next to ELD, Torex also reported very solid results here, including 4.0 meters of 30.02 grams per tonne gold, 9.0 meters of 4.63 grams per tonne gold, and 6.1 meters of 4.83 grams per tonne gold. As of the most recent reserve update, El Limon Underground (ELD + Sub Sill) held a combined reserve base of 413,000 ounces at 6.32 grams per tonne gold. However, with the strong results from both areas, reserve and resource growth looks likely, which should support underground contribution from ELG Underground post-2025, providing an incremental boost to production from ML, which will begin in 2024.

Sub Sill Cross Section Company News Release

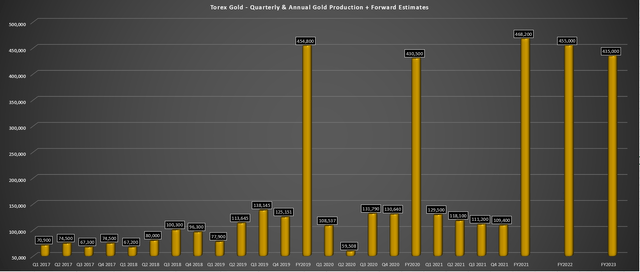

The only negative to having such strong performance in FY2021 is that Torex is now up against difficult year-over-year comps, with what looks to be peak production in FY2021. This is based on the most recent guidance outlook of closer to 450,000 ounces of production in FY2022, and closer to 430,000 ounces in FY2023. This dip in production is not a huge deal, given that this is still a very profitable operation generating over $300 million in operating cash flow at a 400,000-ounce run rate. Still, investors shouldn’t be surprised to see year-over-year declines in production in Q1 2022 and FY2022. Let’s look at Torex’s valuation below:

Torex Gold Quarterly & Annual Production + Forward Estimates Company Filings, Author’s Chart & Estimates

Valuation & Technical Picture

Based on Torex’s 86 million shares outstanding and a share price of US$9.90, it currently trades at a market cap of just ~$850 million and is generating up to ~$150 million in annual free cash flow. Meanwhile, the company should finish the year with up to $250 million in cash, translating to a market cap of $600 million. This translates to a high double-digit free cash flow yield, which is well above that of most of its peers in the mid-tier and intermediate producer space. On a P/NAV basis, Torex’s net asset value comes in near ~$1.45 billion, even after factoring in inflationary pressures at Media Luna, leaving Torex trading at less than 0.50x P/NAV.

These metrics make Torex one of the cheapest producers sector-wide by a wide margin, with the sector average P/NAV multiple closer to 0.80x. Having said that, the stock may have a less clear path to a re-rating than its peers, given that there are multiple risks. These include being a single-asset producer; being in one of the least attractive jurisdictions in Mexico (Guerrero State); having execution risk related to delivering ML on schedule, and production conforming to the mine plan.

Torex Gold Valuation Company Presentation

As pointed out in the company’s presentation, the company trades at a massive discount to peers, and with the above figures based on November results, these discounts have become even more significant. However, as noted, Torex has a difficult investment thesis to get behind due to the three risks pointed above, so while a re-rating is absolutely overdue, the market might not be willing to re-rate until it’s clear Media Luna is on schedule and closer to production. This means that the most likely path to a re-rating would be an acquisition, and with the stock trading at an enterprise value of just over $600 million as a ~450,000-ounce producer, I certainly would not rule out an acquisition at this point.

The other potential way to help with a re-rating would be if the company were to buy another mine with a mix of cash and shares, given that this would shed the company’s single-asset profile. This might be riskier during the capital-intensive period while the company builds ML and transitions production from ELG to ML, but I would think it would help to make the company more investable. To summarize, while CEO Judy Kuzenko has done an incredible job, and the company is absolutely correct that a re-rating is in order, I remain on the sidelines given that I think there are several other very attractively priced producers out there (albeit not as undervalued as Torex) but with less risk.

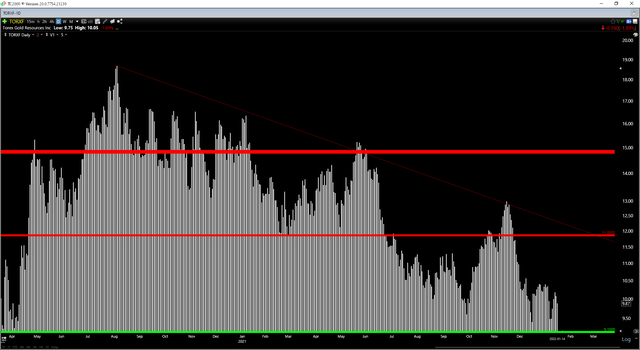

Torex Gold Technical Chart TC2000.com

Moving over to the technical picture, it saw a slight downgrade recently, with prior support near US$10.00 broken on two occasions and the new support level coming in at US$9.15. Meanwhile, we now have a new resistance level at US$11.85, which lines up with the downtrend line off the August 2020 highs. If Torex were to dip below US$9.25, I would view this as a low-risk buying opportunity, where the stock would be right against key support and trading closer to 0.40x P/NAV.

So, why has Torex not acquired yet?

With a massive operation, plus near-mine/regional exploration upside on the Morelos Property and industry-leading costs, Torex checks many boxes. However, it’s no secret that Guerrero State is a less desirable mining jurisdiction due to past security issues. This includes kidnappings in the past in the area, which could be impeding a hostile or friendly takeover offer.

Having said that, Torex has had no real issues in years at its operations from a security standpoint, so I think the reward more than outweighs the risk for a suitor. This is because there are few options where a producer can pick up an extra ~350,000 – 400,000 ounces of annual production at a single mine for these prices.

Torex Gold Land Package Company Presentation

To put Torex’s production profile in perspective, Newcrest (OTCPK:NCMGF) paid over $2.7 billion for Pretium (PVG), which was a ~450,000-ounce per annum producer at similar costs, albeit in a much more attractive jurisdiction. Obviously, British Columbia, Canada, ranks miles ahead of Guerrero State, Mexico, from a jurisdiction standpoint, explaining the discrepancy. Meanwhile, Pretium also had more attractive exploration upside, just recently making a major regional discovery at Golden Marmot and putting up incredible from the North Block Zone. Regardless, with Torex valued at less than one-fourth of this acquisition price, I am surprised we haven’t seen a hostile takeover by a larger producer.

In summary, Torex continues to execute near flawlessly. Still, there are risks in place (ML capex increase, ML execution, single-asset producer) that have likely contributed to the stock being out of favor relative to peers. With Torex now down nearly 50% from its 2020 highs, these risks are more than priced in, and the stock looks to be becoming a takeover target. So, for investors with a long-term horizon that don’t mind single-asset producers, it’s hard to find a better value than Torex. Given that I see the stock as more of a…

Read More:Torex Gold Stock: A Potential Takeover Target If Weakness Persists

2022-01-16 10:33:00