bodnarchuk/iStock via Getty Images

Introduction

Canada-based IAMGOLD Corp. (NYSE: IAG) provided preliminary operating results for the fourth quarter of 2021 on January 12, 2022.

The company commented on the 2022 operational outlook, a progress update for the Côté Gold Project, updated Mineral Reserves and Mineral Resources estimates, and a new life-of-mine plan for the Rosebel Gold Mine, including the satellite Saramacca Mine.

Note: We learned that President and CEO Gordon Stothart has stepped down from his role of President and Chief Executive Officer and has also resigned from the Board of Directors.

I was initially surprised, and the market reacted negatively to the news, fearing a possible unknown internal problem as the main reason for this abrupt and unexplained decision.

I do not see this departure as a huge issue. On the contrary, it could be considered a good move while completing the crucial Cote Gold project.

M. Gordon Stothart, who succeeded M. Steve Letwin, left without apparent justification for this swift departure.

Anyway, I was happy to learn that the Cote Gold project is still on schedule.

1 – Production Snapshot

IAMGOLD Corp. reported that it produced 153K ounces in 4Q21, down 9.5% from a year before and unchanged sequentially.

The 2021 attributable gold production was 601K ounces near the top of the updated production guidance.

All-in sustaining costs (“AISC”) are expected to be within the updated guidance range of $1,395 to $1,435 per ounce sold.

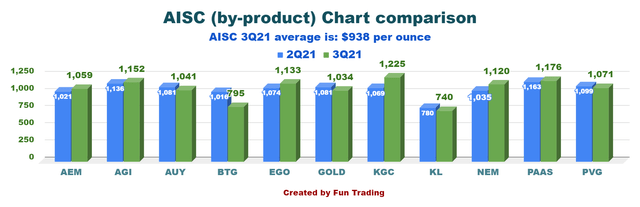

The AISC is a particular issue for the company. If we compare this AISC to the average for the sector, which is $980 per ounce, we see that the company has a recurring problem.

Chart AISC Fun Trading

Finally, the Fourth-quarter revenues were approximately $295 million based on attributable gold sales of 152K ounces in 4Q21.

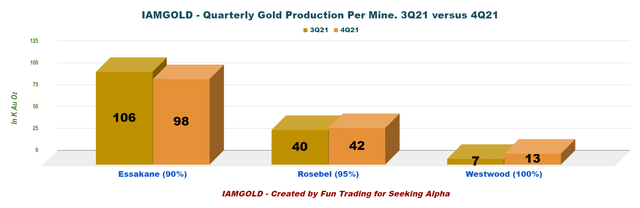

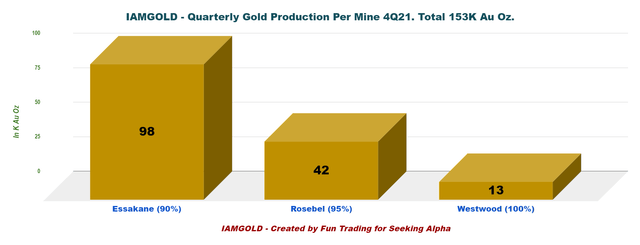

Below is the gold production per mine comparison.

Chart comparison Fun Trading

Essakane mine in Burkina Faso delivered solid results again in 4Q21. In the fourth quarter, attributable production was 98K ounces based on a record mill feed of 3.3 million tonnes at a head grade of 1.13 grams per tonne gold (“g/t Au”) and improved gold recoveries of 91%. The mine continued to benefit from the debottlenecking mill project completed earlier in the year.

Rosebel mine in Suriname delivered attributable production was 42K ounces based on a total mill feed of 2.4 million tonnes at an average head grade of 0.78 g/t Au and an average recovery of 86%. The Rosebel pits contributed 1.16 million tonnes with a strip ratio of 8.1 (waste to ore), and Saramacca contributed 1.03 million ore tonnes with a ratio of 2.1 (waste to ore).

In Canada, production at the Company’s Westwood mine operations produced 13k ounces, as ore production from Westwood underground ramped up and resulted in a higher average head grade of 1.83 g/t Au. Mill feed totaled 254k tonnes, and gold recoveries were 90%.

The Company’s consolidated cash costs and consolidated AISC for the three operating mines are expected to be between the 2021 updated guidance ranges of $1,115 and $1,150 per ounce sold and $1,395 and $1,435 per ounce sold.

CapEx for 2021 is expected to come in line with expectations, with Côté Gold preliminary spending in the fourth quarter estimated at $147 million, below guidance estimated at $150 million.

Finally, the Côté Gold project remains on track for commercial production in H2 2023. CapEx for Cote Gold is expected to be $590 to $620 million in 2022, which is all the company’s cash today.

Gordon Stothart, President, and CEO of IAMGOLD, said in the press release:

IAMGOLD finished with a strong quarter bringing production for the year to the upper end of revised guidance as we strive to deliver on our commitments… Looking ahead, we are fully focused on bringing Côté Gold into production and we remain on track to commence commercial production in the second half of 2023.

2 – Stock Performance

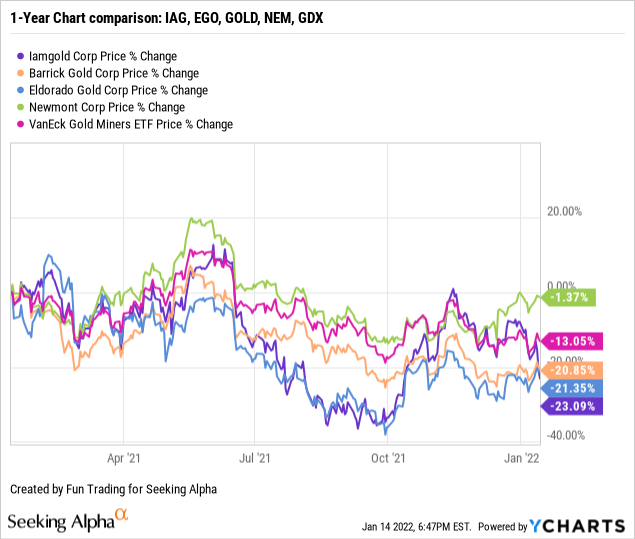

IAMGOLD has underperformed the VanEck Vectors Gold Miners ETF (NYSEARCA: GDX) and is down 23% on a one-year basis. The Company had more than its fair share of technical issues in 2021. However, the stock has performed in line with a few of its peers (e.g., GOLD, EGO).

Ycharts Chart comparison Ycharts

3 – Investment Thesis

The investment thesis for IAG remains the same quarter over quarter. I am not impressed with the stock performance in general, even if the Company managed a constant gold production sequentially due to Rosebel and Westwood mines.

I recommend trading LIFO about 60% of your overall position and keeping a core long-term position for much higher targets or eventually a potential takeover or merger in 2022-2023.

I believe IAG looks attractive at or below $2.60.

IAMGOLD – Financial Snapshot 3Q21 And Preliminary 4Q21 Available Data – The Raw Numbers

| IAMGOLD | 3Q20 | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Total Revenues in $ Million | 335.1 | 347.5 | 297.4 | 265.6 | 294.1 | 295 |

| Net Income in $ Million | -11.60 | 59.0 | 19.5 | -4.5 | -75.3 | – |

| EBITDA $ Million | 72.30 |

161.1 |

114.7 |

86.2 |

15.8 |

– |

| EPS diluted in $/share | -0.02 | 0.13 | 0.04 | -0.01 | -0.16 | – |

| Operating Cash flow in $ Million | 105.10 | 128.7 | 101.7 | 37.3 | 78.5 | – |

| Capital Expenditure in $ Million | 73.2 | 106.8 | 102.9 | 161.1 | 139.1 | – |

| Free Cash Flow in $ Million | 31.90 | 21.9 | -1.20 | -123.8 | -60.6 | – |

| Total cash $ Million | 897.2 | 947.5 | 967.8 | 829.8 | 748.3 | 553* |

| Long-term Debt in $ Million | 471.2 | 466.6 | 466.7 | 456.5 | 466.8 | – |

| Shares outstanding (diluted) in Million | 473.8 | 496.3 | 480.9 | 476.6 | 476.8 | – |

Data Source: Company release

* It is the cash and cash equivalent for the 4Q21, which may differ slightly from the total cash. The company said in the press release.

IAMGOLD ended 2021 with approximately $545 million in cash and cash equivalents, $42 million in restricted cash, $8 million in short term investments and $498 million in its undrawn credit facility.

Gold Production Details

1 – Total Production Was 153K Au Oz In 4Q21

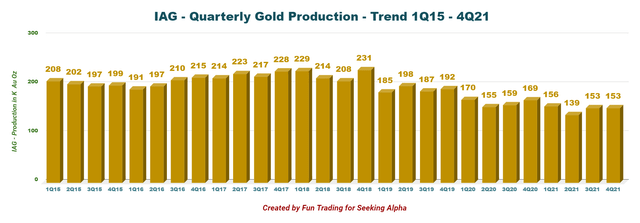

Chart Production history Fun Trading

IAMGOLD produced 153K Au oz during the fourth quarter of 2021 compared to 169K Au oz during 4Q20, as you can see in the graph above. 4Q21 production was unchanged sequentially.

Chart production per mine Fun Trading

The press release indicated a total CapEx for 4Q21 of $147 million, with cash, cash equivalents, and short-term investments totaling $553 million on December 31, 2021.

2 – Mineral Reserves

- The gold mineral reserves P1 and P2 are good with 13.937 Moz and could translate to an excellent cash flow down the road.

3 – Guidance 2022

- Attributable gold production of 570K to 640K ounces with Cash costs between $1,100 and $1,150 per ounce sold and AISC between $1,650 and $1,690 per ounce sold.

- Sustaining CapEx has increased due to a higher proportion of stripping costs categorized as sustaining capital due to the particular areas that are mined and the stage of the mine’s life to align with World Gold Council guidelines;

- Sustaining CapEx is now $310 million (± 5%), of which the majority is related to capital waste stripping and underground development;

- Côté Gold expenditures are estimated to be between $590 to $620 million;

- Other expansion capital expenditures (ex-Côté Gold) of approximately $70 million (± 5%), including roughly $20 million at Boto Gold project;

- And Exploration expenditures of roughly $35 million, including near-mine and greenfield programs.

Technical Analysis (Short Term) And Commentary

IAMGOLD’s production was better-than-expected this quarter, but the stock did not react positively. It is probably because Gordon Stothart decided to resign so abruptly without any apparent reason, which is not a good omen and a sign of an internal problem.

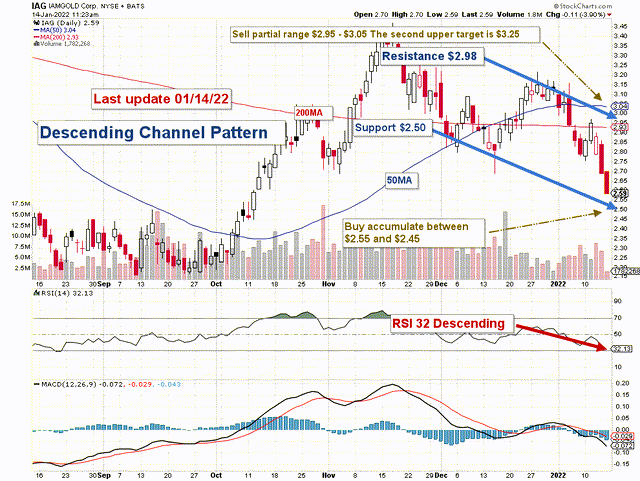

Stockcharts Fun Trading TA analysis Fun Trading

IAG forms a descending channel pattern with resistance at $2.98 and support at $2.50.

The trading strategy is to trade LIFO about 60% of your total position. Trading LIFO allows you first to sell your most recent purchases while keeping your core long position for a higher target.

I suggest selling 30% between $2.98 and $3.05 and waiting for an eventual breakout to sell another 30% above $3.25.

However, if gold turns bearish again, IAG will likely drop below $2.50 and could even cross the support (breakdown) to retest $2.3-$2.2 again, worst-case scenario.

I suggest accumulating IAG below $2.60.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Read More:Iamgold Corp.: Gold Production Report With No Major Surprise (NYSE:IAG)

2022-01-16 04:47:00