FIRST LAW OF THERMODYNAMICS – The law of conservation of energy states that the total energy of an isolated system is constant; energy can be transformed from one form to another, but can be neither created nor destroyed.

What fuels a bull run? Much talk has been made this month on the futures market of bitcoin, with a groundbreaking paper ETF now multiple weeks in existence and a filing of a spot ETF from Grayscale with a presumed imminent approval by mid-December. While futures were initially designed as a way for agricultural business owners to hedge their crops due to seasonal variances, they quickly made their way to Chicago and developed into the battleground of bears and bulls we call the Chicago Mercantile Exchange, or CME. This speculative market rapidly grew to dominate dollar-denominated markets and became a wildly volatile technology for “somewhat” accurate price finding across a liquid and “somewhat” open market. As the technology and market grew, and as the leaky entropy of 2% annual inflation compounded, Americans found themselves in need of speculating and investing in order to offset the energy loss of their dollar-denominated savings. Now with zero-fee broker apps and near zero-fee bitcoin exchanges, the accuracy of said price finding has grown, mostly due to a vast expansion of market participants.

While the glory days of the 100x BitMEX casino have seemingly diminished the amount of multiplied leverage in the system, the amount of actual capital deployed to play in the bitcoin market has greatly increased. The approval of a spot ETF could bring trillions of dollars of inflow into the market, and despite the writings on the wall, many of these zeros will be deployed in short positions — bets against the appreciation of bitcoin versus the U.S. dollar. As more and more of these bears get slaughtered by the mass awakening and understanding of the truly free market that is Bitcoin, their sacrifice will be shown in the liquidation tweets and fast, upward green candles across the many exchanges and markets connected by the open monetary network that is Bitcoin — its price made increasingly accurate by arbitrage bots and the aforementioned free market effects.

To put it bluntly; bearish shorters fuel bitcoin’s wild and violent upward movements. As Bitcoin education and understanding begins to saturate the globe, we get a more and more accurate reflection of bitcoin’s role in the free market of human energy; the more people bet on doubting bitcoin with their capital, the more potential fuel bitcoin has to make upward headway into the vast skies of dollar-denominated purchasing power. With every bear slain, the bull grows stronger, and as the bull grows stronger, so, too, does its necessity for caloric energy; and as the apex predator of money gains mass, it sets its sights on its next meal, the duck curve of energy demand and generation.

In 2013, CAISO, or the California Independent System Operator, an energy non-profit in charge of overseeing operations for the state’s bulk electric power system, lines and markets, produced a now-infamous chart on the utility-scale use of solar photovoltaic power.

This chart demonstrates the discrepancies between the electrical demand of the largest state economy and the electrical output of available solar energy during the sunny parts of the day. The graph is lovingly referred to as the duck curve; itself is a single-day snapshot of a Californian spring day, which exacerbates the spread of energy supply from demand due to it being neither hot enough for air-conditioning nor cold enough to necessitate heat. High solar usage materializes a new challenge for energy providers to balance cheap, context-sensitive supply with the actual, human demand represented in the energy grid. Precisely as the sun sets, working folks come home and turn on their lights — an increase in the demand occurs at the same time solar panels stop generating energy.

A now-emerging need for new and advanced storage technology could help minimize these financial risks of over-generation during the day, and allow the ever-cheaper solar energy market to expand its role in the energy mix. Batteries and advanced electrical grid updates are most likely years away, but perhaps this energy, from an economic standpoint, could be converted into a digitized form, capable of traveling vast distances cheaply while retaining nearly all its entropy and thus the monetized capital spent on its production. With an emerging global remittance market for energy that is Bitcoin, this “over-generation” can be monetized and funneled into cost-effective and profitable ventures that spread their deflationary effects onto the consumer themselves. The beauty of Bitcoin’s proof-of-work governance, token issuance and security model, is its utilization of a truly universal and forgetful function; no matter how much time or energy has been spent attempting to solve the next block, there is still an equal mathematical opportunity for any active participant on the network to succeed.

This is very unlike proof-of-stake systems that rely on a phaux-lottery-esque system of momentary authorization based on shares owned to order and validate transactions, and thus any attempts to compare energy usage are unfounded and disingenuous. This works both ways; a miner can theoretically turn on a single ASIC and solve a block in its first attempt, while also turning off its ASIC in a matter of seconds, sending the needed energy back to the grid, without limiting its potential for finding blocks when demand lowers and energy can once again be spent on mining. Bitcoin becomes a buyer and seller of energy of last resort. To put this in perspective, aluminum processing, historically one of the industries countries with an abundance of energy participate in, costs significantly more in basis costs to turn production off then on again on a whim, due to the human labor, the operation costs of a safe and executing processing plant, and the many basis points of transporting and finding buyers of a physical metal. A Bitcoin miner can turn thousands of ASICs off and on in a matter of seconds without any relative loss of productivity in block discovery.

Bitcoin is the global free market of energy, be it human, solar, gas or coal. Bitcoin simply doesn’t care if the energy spent producing hashes comes from “renewables,” a misnomer that ignores the concepts of the first law of thermodynamics, cheap and bountiful sources like solar, or even the high capacity means of geothermal energy from a volcano. The universal, forgetful function of Bitcoin’s proof-of-work is the great equalizer of the energy market, putting to bed the popular but misconstrued environmental, social and corporate governance (ESG) narratives of the day.

But the concept of cheap energy is anything but a “narrative” and the economic costs of producing hashes will not lead to an overtaking of the energy grid as we see it constructed now, but rather geographic-independent energy sources that monetize formerly-stranded energy into productive outlets for human consumption. From a countrywide perspective, the main problem with cheaply-sourced energy is an old energy grid that prevents distribution over space and time; our transmission lines can only send energy so far efficiently, and our batteries can only prevent entropy leaks for so long. Bitcoin’s digitization of analog energy solves both of these dilemmas. From a local perspective, the main problem with cheaply-sourced environmental energy is apparent in the duck curve; the abundance of supply does not directly correlate with the practical human demand.

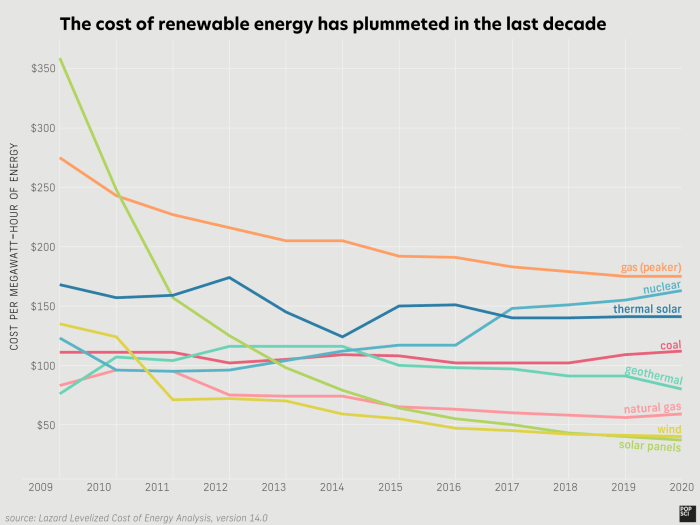

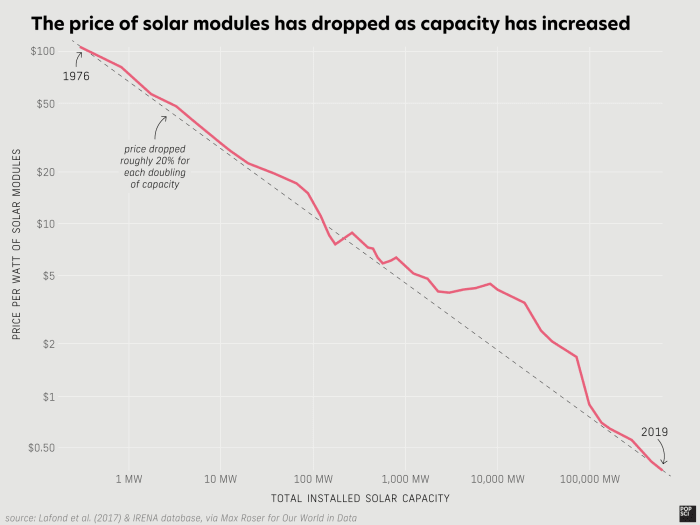

Ten years ago, solar energy was the most expensive way to develop new energy creation. Since 2011, the cost of solar energy production has dropped nearly 90%, and utility-scale solar arrays are now the cheapest method of building and operating power generation. Wind turbines have also decreased around 71% during the same time period, and natural gas nearly 32%, although one could argue that is from the increased usage of fracking and not from industrial efficiency and direct production-based deflationary effects. In contrast, coal has stayed nearly the same in economic cost per watt. For each doubling of solar capacity, a near 20% decline in solar panel pricing has occurred.

With the knowledge that within an average two-hour period, the sun sends enough solar energy to meet the entire energy demands of the earth in a calendar year, one can see how the emerging solar capacity production industry is set for a large role in our modernized energy grid.

In coal, nearly 40% of the cost of production is simply supplying the literal coal fuel for the plants themselves. There should be little economic surprise to see that in 2019, 72% of total new energy capacity came from these “renewable” sources, nearly tripling since the start of the millennium. In fact, in 2020, these sources surpassed coal for total output in the United States, a far cry from the below 1% metric for wind and solar respectively, as recently as 2007. This is not an attack on coal or the fossil-fueled industry, and in fact we will absolutely need these types of energy to even get to a time and place when we have a chance of modernizing and efficiently monetizing our grid. If the coal and fossil fuel markets are misunderstood in today’s narratives, then nuclear energy is even more poorly misrepresented as dirty, dangerous and useless. The advantages of nuclear power are vast and numerous over the many commonly-proposed solutions to the climate crisis narratives of the ESGers. For one, they require far less human maintenance, with refueling only needed on average every 18 to 24 months, in stark contrast to gas and coal capacity due to considerably more refueling and thus structural maintenance. But mostly, it is the large and reliable baseload of power that nuclear provides that sets it…

Read More:Forget Bears Bitcoin Duck Curve

2021-11-14 00:00:00