- Gold is on the verge of a test of the 78.6% Fibonacci retracement level but has stalled in USD resilience.

- US yields firmed from their lowest levels since Aug 5, supporting USD despite Retail Sales miss.

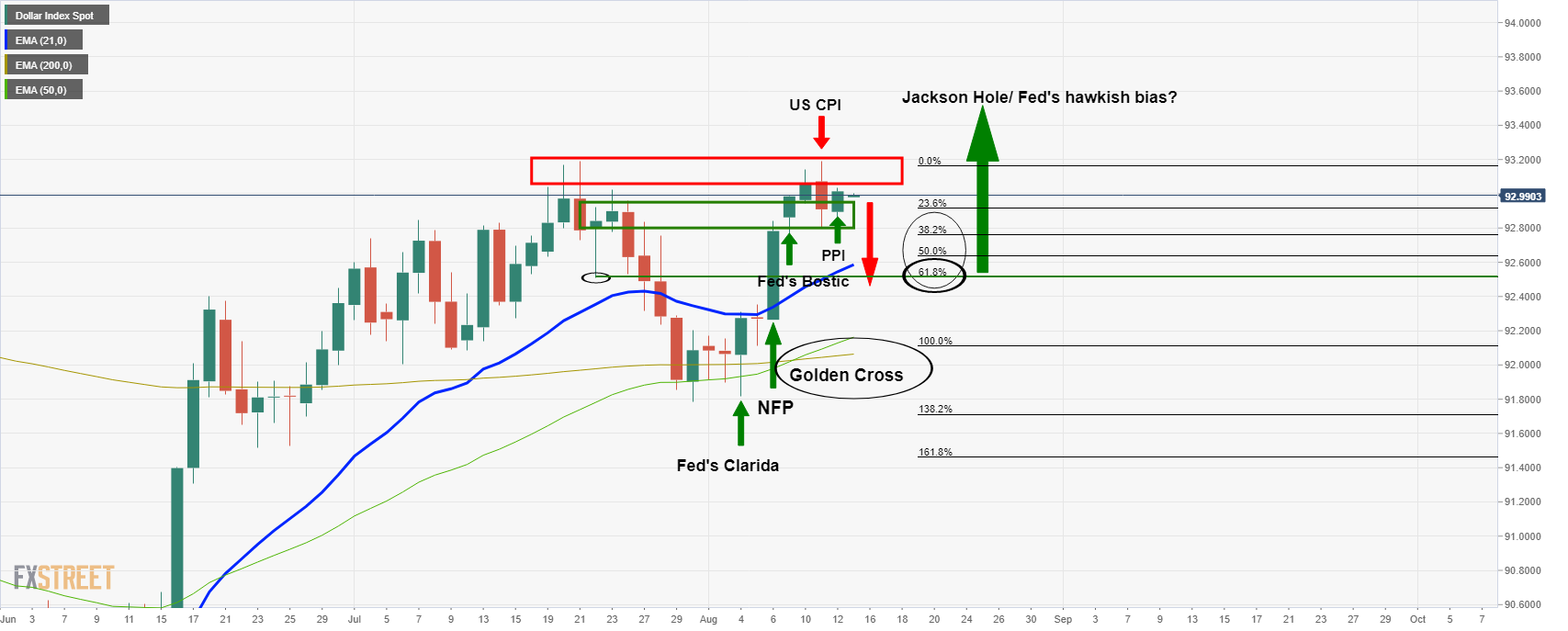

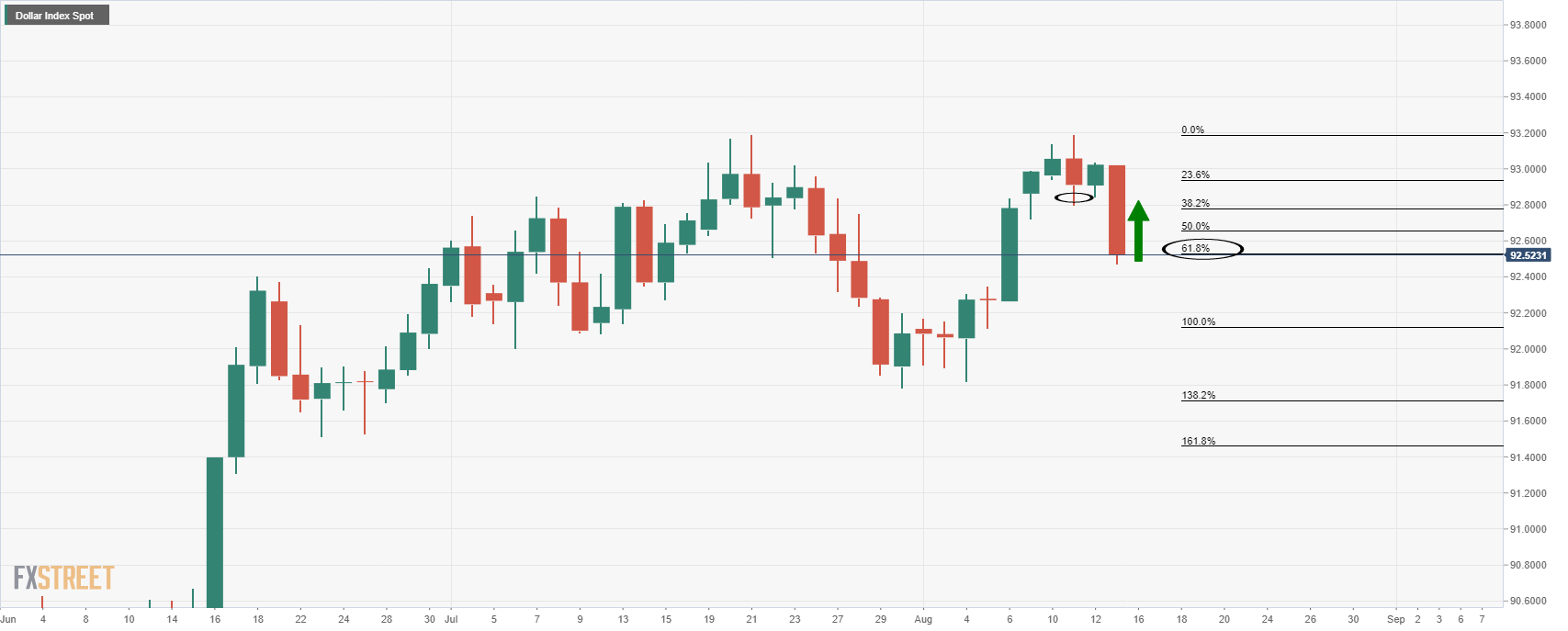

- DXY has rallied through near term resistance targets to take on another critical daily resistance.

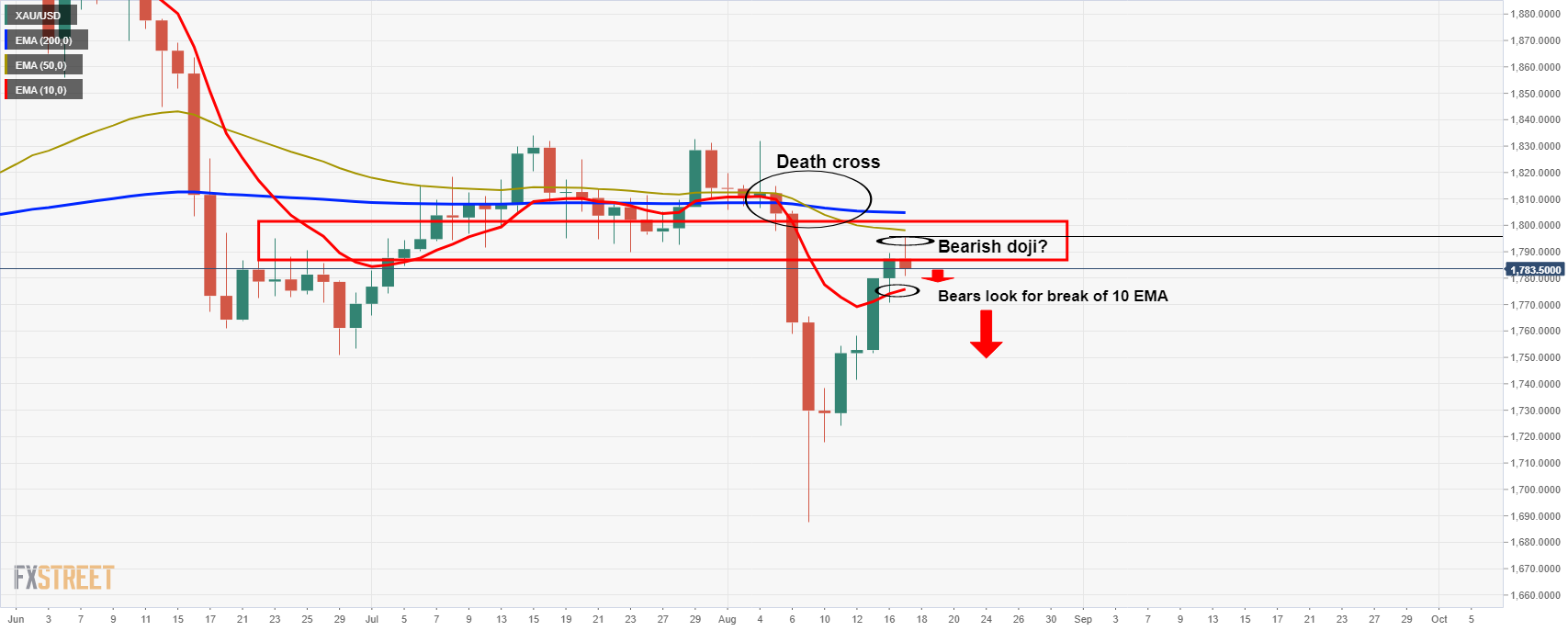

- Gold’s daily chart is being monitored for a Bearish Doji and subsequent test of 10 EMA support.

Update: Gold prices remain virtually unchanged below $1,800 on the recent fears of the rising coronavirus cases globally. The stronger US dollar also weighs on the prospects of the prices. The weaker-than-expected US Retails Sales data pointed at the consumer worries about the rapid increase in the Delta variant of the coronavirus, and weak consumer morale eased some pressure off an early tapering by the Federal Reserve. The 10-year benchmark US Treasury yields trade higher at 1.26% with 0,69% gains, exerting pressure on the non-yielding asset. Global equity sell-off triggers some bottom buying opportunities in the precious metal. The higher USD valuations make gold expansive for the other currencies holders. US Federal Reserve Chair Jerome Powell said uncertainty lingers on the impact of the recent outbreak of the coronavirus Delta variant on the economy, which raised doubts about the timing of the Fed’s tapering and eventual interest rates hike.

The price of gold has been bid-up due to short-covering of late despite a resurgence in the US dollar.

However, at the time of writing XAU/USD is off the $1,795.60 highs scored in the London session, with progress towards a 78.6% Fibonacci level, (1,798), cut short following a sudden rally in the greenback.

This leaves XAU/USD -0.22% on the day at $1,783 and nestled between its hourly 200 SMA, the lows of the day at $1,780.67 and where the hourly 10 and 20 EMAs align as resistance.

The market would be expected to consolidate in the absence of shocks, but the Federal Reserve’s chairman Jerome Powell is participating in a University Q&A currently, 17.35 GMT.

While it likely does not serve as a platform for the Fed to make any official announcements, traders are scanning for Fed speakers and their outlooks for the US economy, covid risks and will be looking for clues for when the Fed will taper.

However, where more clarity is most likely will be during the Jackson Hole on 26-28 Aug.

Meanwhile, the US dollar is picking up a bid due to the central bank divergence theme.

The Federal Reserve is expected to tighten monetary policy at a time where the Delta variant is hampering such prospects in other nations where their central banks are less hawkish, such as Australia.

Following the Reserve Bank of Australia’s minutes, for example, where there the bank warned of the risks to their ability to hike rates due to the uncertainty about the economy following covid-related lockdowns. (AUD/USD dropped on the divergence between the Fed and RBA to the Oct 2020 resistance and lowest levels since Nov 2020).

In contrast, the FOMC recently raised its inflation forecast considerably for 2021, and most members see the risks to inflation as skewed to the upside which leaves a hawkish bias at the Fed.

USD smile theory in play

Indeed, the US dollar smile theory, which is something that has been written about in previous articles for some weeks, continues to play out.

More on this from such prior articles as this: US dollar teases reversal traders, Golden Cross underpins

In short, broadly stronger US data are feeding into increased dollar bullishness and the Fed continues to take tentative steps towards tapering. On the other hand, risk-off and uncertainty pertaining to the global pandemic are also expected to support the US dollar recently.

Therefore, the greenback is likely to benefit in either situation. Hence, the ”dollar smile” as the dollar turns up at both ends of the risk spectrum.

US IP offsets Retail Sales miss, USD stays bid

Meanwhile, the US Retail Sales on Tuesday were hugely lower than expected and prior, yet, the US dollar held on to the top spot on the forex leader board, second to the risk-off yen and CHF on the day.

However, regardless of the 1.1% month-on-month drop, the bigger picture involves the re-opening of the economy and the implications of rising household incomes.

Spending across both goods and services would be expected to continue to grow and feed into the inflation loop as well as the jobs market on which the Fed is most concentrated.

Hence the resilience in the US dollar and US yields managed to correct from the late Asian market lows on Tuesday despite the mixed US data.

A much better-than-hoped Industrial Production release went some way to offset the miss in Retail Sales. Total industrial output climbed 0.9% month-on-month in July versus market expectations of a 0.4% gain.

Gold accumulated by central banks

As for the gold price, ”while speculators have been growing more anxious of the looming taper, they have likely been selling to central banks which have recently been growing their appetite for the yellow metal,” analysts at TD Securities said.

The analysts argued that this, in turn, likely points to short-covering as the market aggressively added shorts during the breakdown.

Gold & DXY technical analysis

In a prior analysis, US dollar teases reversal traders, Golden Cross underpins, it was anticipated that there would be some let-up in the greenback’s strength ahead of the Jackson Hole:

However, the deterioration was fast on the back of a big miss in Consumer Sentiment last Friday:

In the prior analysis, it was stated that there would be a bias to the upside while above 92.351 which will be a headwind for the gold price going forward.

As of Monday, the DXY had been making tracks as anticipated:

On Tuesday, the greenback took off and has taken out a major resistance of 92.80 and is now embarking on making a move a test of daily highs ahead of the more critical March 2021 93.43 highs.:

It was also explained in prior analysis that gold was headed towards prior support and a test of the 78.6% Fibo at 1,798 as follows:

As of Monday, while the price had made headway, there was still $10.00 to go to the upside:

On Tuesday, gold has continued to make headway towards the target but it has fallen short by $3.00 as of the time of writing:

While the death cross is less significant, perhaps more psychological than anything at this juncture, the Doji candle information could be the catalyst for supply in the coming days.

Since October 2001 selling gold after a death cross has failed more than it has succeeded, but the Bearish Doji Star appears in an uptrend and belongs to the bearish reversal patterns group.

Traders will be looking for additional confirmation such as a subsequent break below the 10 EMA and confluence of the 4-hour support of 1,770.

Meanwhile, a break of resistance opens risk back into the 1,800s.

However, failures will likely lead to a downside continuation of the broader bearish trend to target the 50% mean reversion and the confluence of the 200-day Smoothed MA near 1,755 and then 1,677 daily swing lows will be key in this regard.

Read More:XAU/USD remains subdued below $1,800 on mixed clues, risk-off sentiment

2021-08-17 23:05:00