smodj/iStock via Getty Images

It has been a couple months since my last article on Agree Realty (NYSE:ADC), one of my favorite net lease REITs. In that article I explained why Agree was a hold after a run up to $80 due to valuation. Since then, the company announced a dividend hike and Q3 earnings, and shares have become more attractive near $70.

Investment Thesis

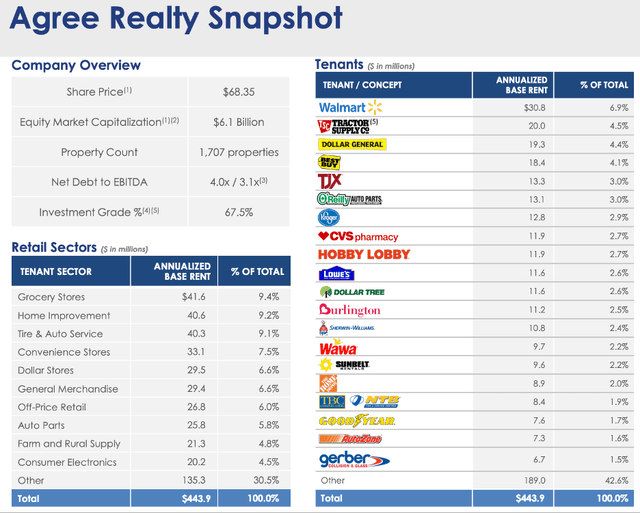

Agree Realty is a net lease REIT complete with a rock-solid balance sheet, an impressive real estate portfolio with primarily investment grade tenants, and a consistent track record of dividend growth. They continue to raise capital to grow the real estate portfolio, which we saw in Q3 as they continue to develop new properties for Gerber Collision, a new top tenant.

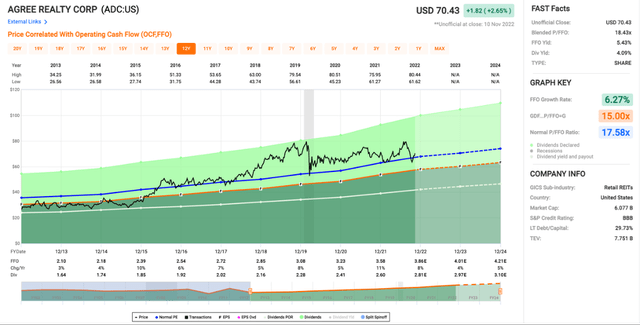

The valuation isn’t cheap at a price/FFO of 18.4x, but shares are more attractive today than a couple of months ago when they were trading a couple turns above 20x at $80 per share. Agree typically trades at a higher multiple than many net lease peers, especially over the last five or six years. The yield now sits at 4.2%, and the company has all the characteristics of a solid income investment with consistent dividend growth for its monthly dividend. Shares are attractive today, but a drop into the mid-$60s would be an attractive opportunity to buy shares for long term investors.

Q3 Earnings

The company continues to raise capital, with a $300M bond issuance (4.8% due in 2032) along with continued equity issuances. As long as they are getting attractive terms for debt and equity and putting the proceeds to good use, I think Agree will continue to raise capital at a solid pace. One of the other things that I found interesting on the company’s Q3 earnings release was the addition of Gerber Collision to the top tenants list.

ADC Snapshot (agreerealty.com)

When I was poking around the company’s website, the thing that stood out to me was the 25 properties being developed. 5 of these were finished by the end of Q3, and the rest are projected to be completed by the middle of 2023. Of the 25 development projects, 19 are for Gerber Collision, all of which have 15-year lease terms. I’m curious to see what percent of the portfolio Gerber is at by the middle of next year, but it will likely be higher than the current 1.5% at the end of Q3.

Valuation

The valuation is not as expensive as it was in August with shares at $80 (over a 20x multiple), but shares aren’t exactly cheap today either. With shares a tick over $70, the price/FFO multiple sits at 18.4x. I’m not adding to my position here, but I think the long-term future is bright for the company. Over the last couple years, any time shares dropped below $65 we saw insider buying. That pushes the yield well above 4%, and with Agree’s dividend growth, that makes for a very attractive income investment at $65 or below.

As you can see, Agree has spent most of the time since mid-2016 at or above its average 17.6x multiple from the last decade, showing that investors are willing to pay a slight premium for Agree compared to other net-lease REITs. One of the reasons besides the list of investment grade tenants is the solid and consistent dividend growth Agree has provided over the last decade.

Another Dividend Hike

Agree switched to a monthly payout at the beginning of 2021 and has hiked the dividend a couple times a year since then. I’m expecting that pattern to continue as the company has a solid balance sheet and a real estate portfolio filled with investment grade tenants. The most recent increase was a 2.6% hike. The yield currently sits at 4.2%, and when you add in mid-single digit dividend growth, Agree has the potential to be an attractive investment for investors seeking a solid combination of current yield and dividend growth.

Conclusion

Agree might not see explosive returns from $70, but I still think the risk/reward is attractive for investors with a yield over 4% and consistent dividend growth. The company has continued to raise capital for investments, and their developments, specifically in new Gerber Collision properties, should help the continued growth of the portfolio. While there are other good options with monthly dividends in the net lease space like Realty Income (O), Agree is a solid investment for conservative income investors.

Shares aren’t cheap today at $70, but they are certainly more attractive than they were just a couple of months ago. One thing that I have noticed is that any time shares get into the low-$60s range, they seem to bounce pretty quickly to $70. I’m not a short-term trader, but if you do see a drop below $65, I definitely think that is a solid opportunity to start a position or add to an existing one.

Read More:Agree Realty Stock: Another Dividend Hike (NYSE:ADC)

2022-11-13 13:00:00