MicroStockHub/E+ via Getty Images

Bitcoin (BTC-USD) and ethereum (ETH-USD) traded in negative territory in Friday morning trading and look to close out the week with losses, while equities pushed higher and on track for a week of gains, in an infrequent relationship that has speculators pondering.

Some investors have been taking note of bitcoin (BTC-USD) and ether’s (ETH-USD) falling volatility in recent weeks, compared with the jumpy stock market, as the price of the two largest cryptocurrencies by market cap continue to trade rangebound after big drops seen at the beginning of the year.

Looking at intraday price action, bitcoin (BTC-USD) slipped 1.6% to $19.01K at 10:34 a.m. ET compared with its $68.9K November 2021 peak, and ether (ETH-USD) drifted down 2% to $1.28K versus its $4.64K all-time high in November a year ago. All three major stock indices each rose less than 1%, with Dow Jones (DJI) +0.7%, S&P 500 (SP500) +0.5%, and Nasdaq (COMP.IND) +0.2%.

Jim Bianco, the president of Bianco Research, pointed out that the old Wall Street adage, “never short a dell market,” now applies to bitcoin (BTC-USD) as the token’s 30-day realized volatility (vol for short) fell to its lowest in more than two years, he wrote in a series of Twitter posts. That may be even more of the case for ether (ETH-USD), which has seen its realized vol plunge to its lowest point in over five years. These vol drops could be seen as a negative because it implies that speculative demand is slowing down.

However, “this is an unquestionably good thing as it means that more people are holding Bitcoin as an investment, and fewer people are holding it as a speculative hot potato,” said Seeking Alpha contributor Logan Kane, who views BTC as a Buy. “Should volatility continue to decline, this means that investors can expect a smoother ride and likely a higher fair value as more people get comfortable allocating.”

The stock market, though, is keeping market participants on their toes as the S&P 500’s (SP500) realized vol changes hands at one of the highest marks in the past decade against a backdrop of the Federal Reserve’s aggressive monetary tightening campaign as well as growing recession risks.

“Markets bottom on apathy, not excitement. BTC and ETH have apathy. The S&P 500 is nearly the opposite, as prices move around like a video game. This might also be another sign of the TradFi/Crypto tight relationship breaking. If so, this is long-run bullish for crypto,” Bianco contended.

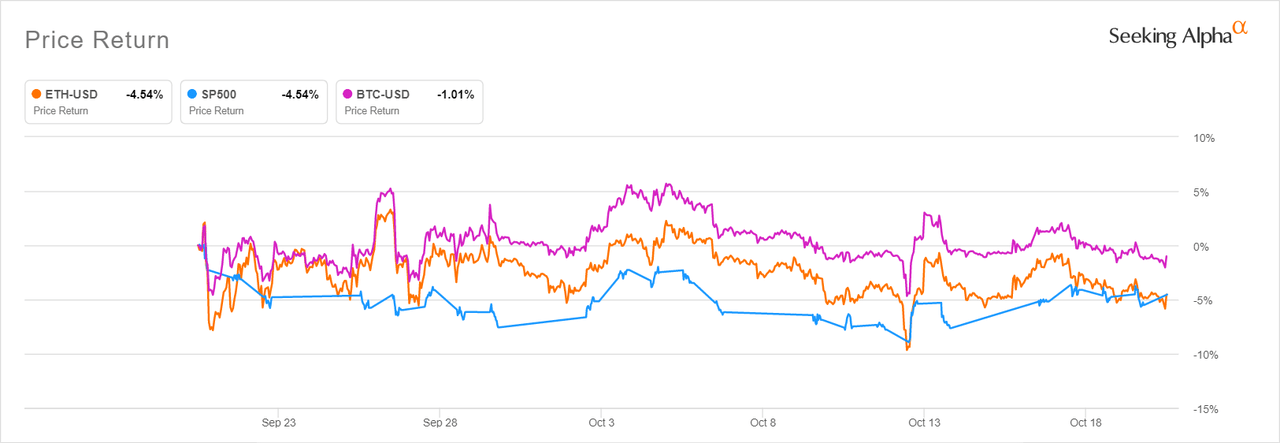

Note that the S&P (SP500) has dipped more in the past month (-4.9%), although by a small margin, than ether (ETH-USD) (-4.8%) and bitcoin (BTC-USD) (-1.1%), as seen in the chart below. That’s a relatively unusual dynamic as the tokens, which are seen as a gauge for risk tolerance and overall sentiment, easily saw over 5% swings in a single session, historically speaking.

Fellow SA contributor The Digital Trend believes bitcoin is set to escape its month-long quiet period and return to its typical volatile state.

Read More:Bitcoin, ether slipping even with stock market higher (Cryptocurrency:BTC-USD)

2022-10-21 14:34:00