UK economy grew 0.2% in July

Just in: The UK economy returned to growth in July.

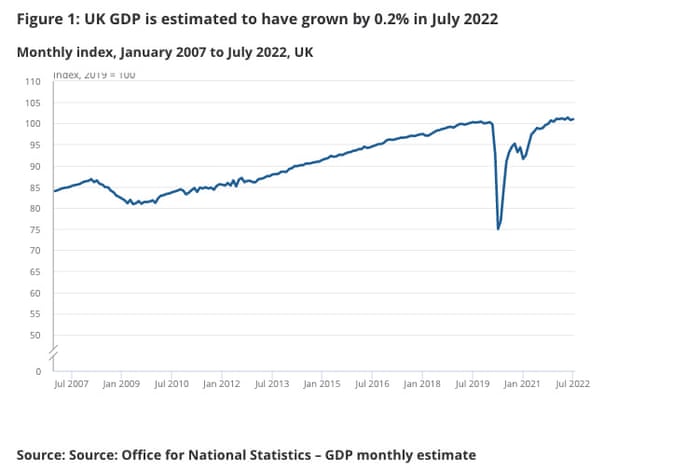

UK GDP rose by 0.2% in July, the latest data from the Office for National Statistics shows, a smaller increase than expected.

That’s a welcome return to growth, after the economy shrank by 0.6% in June – as the extra bank holidays to mark the Platinum Jubilee hit economic output.

But it could only be a temporary respite, with the cost of living crunch hitting households and businesses this autumn and winter.

More details to follow….

Key events

Filters BETA

Rising interest rates may also hit the economy this winter, warns Suren Thiru, Economics Director for ICAEW (which represents chartered accountants).

Here’s his take on this morning’s GDP report:

“Although output rose in July this more reflects a flattering comparison with June where the extra bank holiday limited activity than a meaningful upswing in the fortunes of the UK economy.

“Despite July’s uptick, with warning lights of recession flashing red on most economic indicators and next week’s bank holiday likely to limit September output [see earlier post for details], the chances of the economy slipping into a downturn in the third quarter is growing.

“The support for households and business should mean that any downturn is shorter and shallower than previously expected. However, with such an intervention likely to be accompanied by a punishing rise in interest rates, many are still facing a harsh winter.”

EY: UK economic outlook remains very challenging.

The UK’s energy bill freeze announed last week will “greatly reduce” the risk of a deep recession, says Martin Beck, chief economic advisor to the EY ITEM Club.

But even so, the next year will still be very challenging for the economy, as inflation will bite into household incomes:

Beck says:

Households still face a further decline in their real incomes during the second half of this year which, even if some can save less and borrow more, will weigh on consumer spending.

And though business investment may be buoyed by firms spending before the super-deduction finishes, their ability to do so will be compromised by rising costs. As things stand, the economy is unlikely to do more than stagnate over the coming year.”

PwC: UK still on track for recession

Jake Finney, economist at PwC, fears the UK economy will shrink in the July-September quarter – despite the ‘modest’ 0.2% rise in GDP in July.

That would put the economy into recession, he explains:

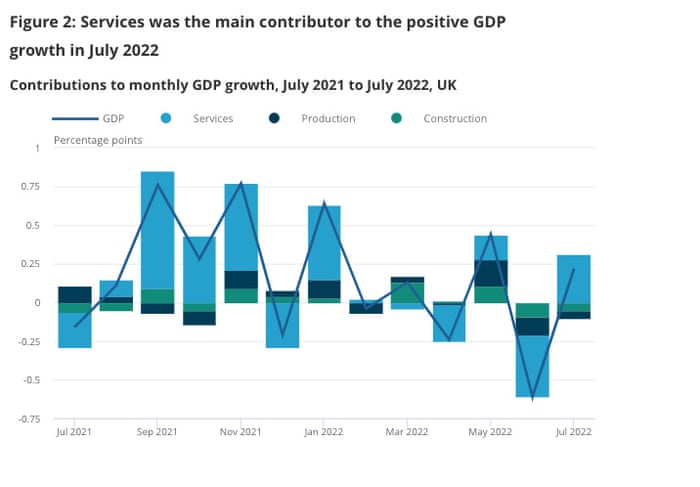

“The UK economy grew by a modest 0.2% on a month-on-month basis in July, following its 0.6% contraction in June 2022. However, looking beneath the headlines it’s clear this positive growth rate was primarily led by the performance of the services sector. Two of the other main engines of economic growth – production and construction – contracted in July.”

“Consumer-facing services grew by 0.6% in July, following a flat month in June. The sector was helped by record-high temperatures and one-off events, such as the UK’s hosting of the Women’s Euros and the Commonwealth games. This saw the ‘sports activities and amusement and recreation activities’ sub-sector grow by 8.1%.

However, this strong growth rate was partially offset by a fall of 4.5% in other personal service activities, in part owing to the cost-of-living crisis that is starting to weigh on consumer demand.”

“Despite today’s positive growth figures, our expectation is that the UK economy will contract in Q3 2022, following its -0.1% contraction in Q2 2022. This would mean that the UK enters a technical recession for the first time since lockdown restrictions ended.”

Here’s a good summary of today’s GDP report, from Andy Bruce of Reuters:

UK GDP grows 0.2% m/m in July, less than expected (0.4%)

• Weakness centred on industry, construction

• No big bank holiday effect

• ONS says anecdotal evidence of reduction in demand for power because of cost, but was also a hot month— Andy Bruce (@BruceReuters) September 12, 2022

Women’s EURO Championship and Commonwealth Games lifted growth

The Women’s European Women’s Championship, and the Commonwealth Games in Birmingham, both gave the UK economy a boost in July.

The ‘sports activities and amusement and recreation activities’ sub-sector grew by 8.1% in July, making it the second-largest driver of growth among consumer-facing services.

The Women’s EURO Championship, hosted by the UK, ran through July. It was a successful event with record crowds at a series of games (before being won, dramatically, by England!).

The first few days of the Commonwealth Games fell within July too, and will also have contributed to the sector’s growth.

Overall, consumer-facing services grew by 0.6% in July, following a flat month in June.

The UK #economy grew by 0.2% in July after a 0.6% fall in June. It’s not much (and below expectation) but it’s positive #GDP

Services up, production and construction down

Car sales and repairs a big driver 🚗

Commonwealth Games and Women’s EUROs also contributed ⚽️— Danni Hewson (@dannihewson) September 12, 2022

Marcus Brookes, chief investment officer at Quilter Investors says the pick-up in growth in July will ease concerns that a recession is on the immediate horizon.

Services saw a month of positive growth, boosted by the Women’s Euros and the Commonwealth Games, while production and construction fell. However, given this data is from July, the outlook could be bleaker given it comes before a potential slowdown in activity during the period of mourning in the UK.

“Ultimately, the next few months are still likely to be a very difficult environment for everyone – governments, corporates and households alike, Brookes adds.

Shortages of workers continued to hold back growth in July.

In today’s GDP report, the ONS says:

Businesses… reported staff shortages as being an issue.

Hotels and hospitality services were particularly badly affected, but comments were also received from manufacturers of health and beauty products, sheet metal fabricators, haulage companies, solicitors, and cleaning companies.

Economic growth has been choppy this year, as this chart of monthly GDP shows:

After 0.6% growth in January, the UK economy stagnated in February, then grew 0.1% in March.

April saw a 0.2% fall, before a 0.4% recovery in May – wiped out by June’s 0.6% drop, which meant the economy shrank slightly in Q2.

The big picture – even after July’s modest recovery, is that growth has been mediocre.

KPMG: economy faces downbeat outlook after ‘feeble’ recovery in July

The “feeble 0.2% bounce back in July” was driven by weak GDP in June due in part to the loss of working days from the Jubilee long weekend, says Yael Selfin, Chief Economist at KPMG UK:

More concerning, July’s GDP remains below the level seen in May, pointing to an overall contraction over the first two months of summer.

“This ties into a downbeat outlook for the UK economy which could see another shallow recession from the end of this year, driven by the ongoing squeeze on households’ income and a rising cost burden for businesses.

“While nearly £170bn worth of fiscal measures announced last week may be sufficient to avoid a deeper economic slump, these will be partly offset by tighter Bank of England monetary policy focussed on combating the high levels of inflation.”

The UK economy is now 1.1% above its levels in February 2020, before the pandemic hit the economy.

Small uptick for GDP in July: 0.2%. Mainly driven by a boost in services.

“Monthly GDP is now estimated to be 1.1% above its pre-coronavirus (COVID-19) levels (February 2020).” pic.twitter.com/bNOVp34JoC

— Kate Andrews (@KateAndrs) September 12, 2022

UK econony stagnated over the last quarter

The broader picture is that Britain’s economy failed to grow over the last quarter, weighed down by economic headwinds.

GDP was flat in the three months to July compared with the previous three months, the ONS reports.

The UK’s construction sector shrank again in July too – wth a 0.8% drop in output, after a 1.4% in June 2022.

This was due to a drop in repair and maintenance work.

Power production fell, hitting industrial output

Manufacturing only expanded by 0.1% in July.

And the wider production sector actually contracted again – by 0.3% after a fall of 0.9% in June 2022, due to a fall in output in the electricity, gas, steam, and air conditioning supply.

The ONS says people may have cut back on electricity use following the surge in prices this year.

According to anecdotal evidence from the Department for Business, Energy and Industrial Strategy (BEIS), demand for electricity was 2.3% lower than seen in July 2021 (that may have been influenced by the higher than usual temperatures).

Anecdotal evidence suggests that there may be some signs of changes in consumer behaviour and lower demand in response to increased prices. This is further shown in our recent Consumer price inflation, UK: July 2022 bulletin where electricity prices rose by 54% in the 12 months to July 2022.

Britain’s services sector led the recovery in July, growing by 0.4%

The information and communication sector grew by 1.5% and was the largest contributor to the services growth in July.

UK economy grew 0.2% in July

Just in: The UK economy returned to growth in July.

UK GDP rose by 0.2% in July, the latest data from the Office for National Statistics shows, a smaller increase than expected.

That’s a welcome return to growth, after the economy shrank by 0.6% in June – as the extra bank holidays to mark the Platinum…

Read More:UK economy returned to growth in July with ‘feeble’ 0.2% rise in GDP – business live | Business

2022-09-12 05:39:00