It’s not that mortgages are bad, it’s that mortgage volume collapsed. And the stocks of the biggest mortgage lenders collapsed after IPO or SPAC merger.

By Wolf Richter for WOLF STREET.

The latest entry in the long litany of mortgage-lender layoffs is Citibank, which let go some people in its mortgage unit. Well Fargo, JPMorgan Chase, and numerous other banks, along with the non-bank mortgage lenders, have laid off staff starting late last year.

The biggest mortgage lenders aren’t banks. They’re nonbanks: Rocket Companies (owns Quicken Loans), United Wholesale Mortgage (owns United Shore Financial), and LoanDepot have cut their staff by thousands of people. LoanDepot also exited its wholesale business. AI-powered mortgage lender startup Better.com became infamous when its CEO mass-fired people via Zoom, which was followed by more layoffs. Some mortgage lenders have filed for bankruptcy. Others have shut down.

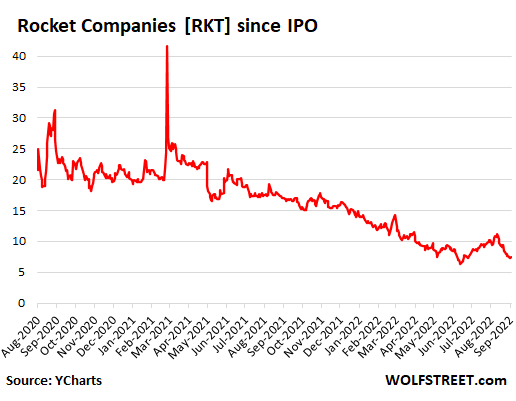

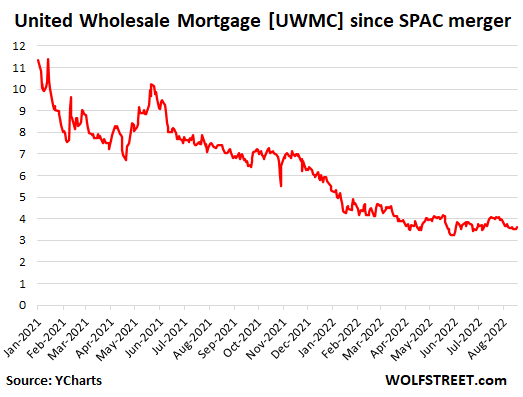

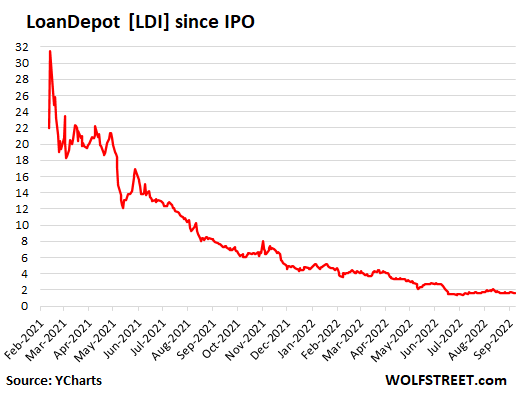

The stocks of the three biggest mortgage lenders have collapsed: Rocket Companies by 82%, United Wholesale Mortgage by 75%, and LoanDepot by 95%. All three went public either via IPO or via merger with a SPAC during the housing mania over the past two years amid immense hype and hoopla. All three have been inducted into my Imploded Stocks.

But mortgage lenders are not getting in trouble because homeowners are suddenly defaulting on their mortgages or whatever.

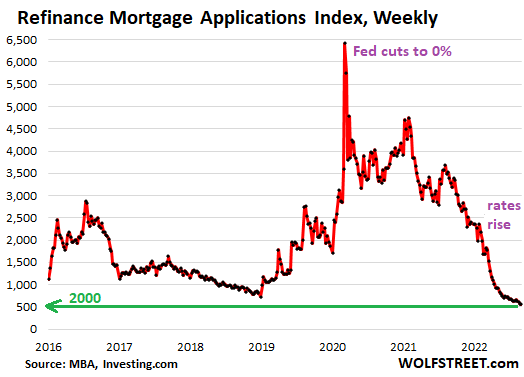

They’re getting in trouble because their revenues have collapsed because mortgage origination has collapsed, particularly refinance mortgages, where origination has collapsed to 22-year lows because few homeowners are going to refinance an old 3% mortgage with a new 6% mortgage, unless they have to in order to draw cash out, and that can be done more cheaply with a HELOC.

Applications for mortgages to refinance an existing mortgage fell by 1% in the latest week, having collapsed by 83% from a year ago, to the lowest level in 22 years, according to the Mortgage Bankers Association’s weekly Refinance Mortgage Applications Index, released today:

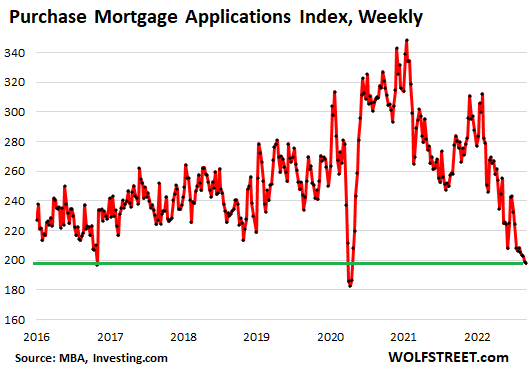

Applications for mortgages to purchase a home dropped by 3% in the latest week, as the newly returned 6% mortgage rates put a further damper on home purchasing activity. The MBA’s Mortgage Purchase Index has now plunged by 23% from a year ago and is approaching the lows during the April 2020 lockdowns:

The plunge in applications for purchase mortgages has for months shown up in home sales: Sales of new houses plunged by 30% year-over-year in July; and sales of existing homes plunged by 20%.

But it’s not mortgages that are going bad…

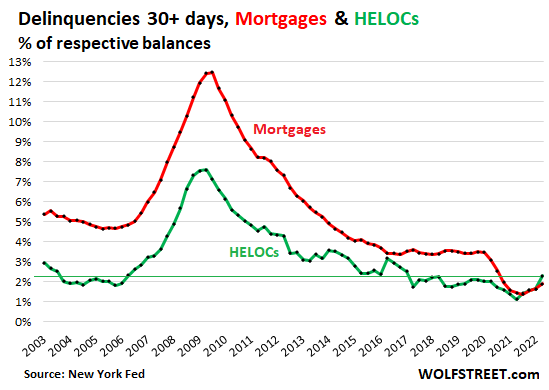

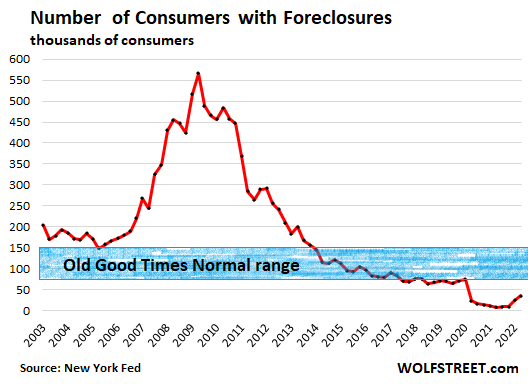

The mortgages that are outstanding have been holding up well. Delinquencies and foreclosures have started to tick up, but from the super record lows during the era of forbearance, when delinquent mortgages were moved into forbearance programs where homeowners didn’t have to make payments, and their mortgage was no longer considered delinquent.

The spike in home prices since spring 2020 allowed homeowners to exit forbearance in various ways, including by selling the home, paying off the mortgage, and walking away with extra cash. But the forbearance programs are being phased out.

So mortgage delinquencies have started their trip back to normal: Mortgage balances that were 30 days or more delinquent ticked up to 1.9% of total mortgage balances in Q2 but remain well below the lows of the Good Times (red line).

Foreclosures have also started to tick up but are still far below any of the prior lows before the pandemic:

For mortgage lenders: A collapse in revenues from mortgage origination.

The three largest mortgage lenders are nonbanks; they hold the mortgages they originate for only short periods of time, until they have enough mortgages together to sell them to Fannie Mae, Freddy Mac, the VA, Ginnie Mae, etc., which then securitize the mortgages and sell them to investors as MBS. These mortgage lenders, by not keeping mortgages on their balance sheet for long, slough off the credit risk to the buyers of their mortgages (and ultimately to taxpayers that guarantee many of these mortgages).

But during the period that mortgage lenders hold the mortgages, they’re exposed to the risk that mortgage rates spike, causing the value of the mortgage that has a lower interest rate to decline. This isn’t normally a big issue, but it was a big issue this spring when mortgage rates spiked by historic amounts in weeks, causing some losses among mortgage lenders.

These losses came just as revenues collapsed. Nonbank mortgage lenders get their revenues from net interest income (small portion of total revenues), gains on origination and sales of mortgages, origination income, servicing fees, etc.

At Rocket Companies, which surpassed Wells Fargo years ago as the largest mortgage lender – revenues collapsed by 48% in Q2, to $1.39 billion.

The company went public via IPO during the housing mania in August 2020 at $18 a share. Its shares [RKT] have collapsed by 82% from their high in March 2021, and by 59% from their IPO price, to $7.54 (data via YCharts):

United Wholesale Mortgage underwrites and provides closing documentation for mortgages originated by brokers, small banks, and credit unions. Its loan origination volume plunged by 51% in Q2 compared to a year ago.

It went public via merger with a SPAC. The merger closed in January 2021. The SPAC’s shares peaked after the announcement but before the merger closed, with an intraday high on December 28, 2020, of $14.38. From that high in December 2020, shares have collapsed by 75%. The chart only goes back to the date of the completion of the merger, to the first day the shares traded under their new ticker [UWMC]. From the closing high on that day, shares have plunged by 68%, to $3.61 (data via YCharts):

At LoanDepot, revenues in Q2 collapsed by 60% from a year ago, to $308 million, generating an astounding net loss of $223 million, compared to a net profit of $26 million in Q2 2021.

The company went public via IPO in February 2021 at $14 a share. During the first two days, shares performed a spectacular hype-and-hoopla “pop” intraday to $39.85, and then collapsed by 95% from that high, and by 88% from the IPO price, to $1.66 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Read More:Mortgage Lender Woes | Wolf Street

2022-09-08 03:00:51