Full story: Twitter takeover temporarily on hold, says Elon Musk

Dan Milmo

Elon Musk has said his $44bn takeover of Twitter is “temporarily on hold” after the social media platform claimed that less than 5% of its users were spam or fake accounts.

The Tesla chief tweeted on Friday morning that the deal was being frozen while he awaited details behind Twitter’s assertion.

Musk announced the move alongside a link to a Reuters article published on 2 May that referred to a filing with the US financial regulator, in which Twitter claimed that false or spam accounts represented less than 5% of its daily average users.

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of usershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

Musk has railed at automated Twitter accounts – which are not run manually – and said after announcing the takeover that he wanted to improve the platform by “authenticating all humans”. He has agreed to pay a $1bn break fee to Twitter if he walks away from the deal.

The news sent Twitter’s shares down about 23% in pre-market trading, on concerns that the deal could collapse.

Closing Summary

Time to wrap up.

Elon Musk’s $44bn (£36bn) takeover of Twitter is in doubt after he put it “temporarily on hold”, citing concerns over the number of spam and fake accounts on the social media platform.

The Tesla chief tweeted on Friday morning that the deal was being frozen while he awaited details supporting Twitter’s assertion that fewer than 5% of its users were spam or fake accounts.

In a subsequent tweet, Musk said he was “still committed to acquisition” – but Twitter’s share price has still tumbled around 9% today since Wall Street opened.

Twitter’s shares are trading below $41 each, roughly a 25% discount to the $54.20 per share price Musk agreed to pay in mid-April.

That suggests investors do not believe a deal will happen anywhere near that price, and might not happen at all.

Here’s the full story:

Analysts speculated that the world’s richest man was about to walk away from the deal or seek a lower price.

Wedbush Securities analyst Dan Ives was highly critical of Musk’s move, saying the tweet sent the whole deal “into a circus show”.

Because now, the Street’s initial reaction is going to be, ‘he’s looking for a way to get out of this deal’.

The latest twist came at the end of a choppy week in the markets, which saw heavy losses among tech stocks and turmoil in the crypto world.

TerraUSD, the “algorithmic stablecoin” whose collapse prompted a multibillion-dollar selloff across crypto markets, has turned off its blockchain and been delisted from major exchanges, in effect shuttering the project for good.

However, the wider impact of the project’s failure appears to have been constrained. TerraUSD was once valued at more than $40bn (£33bn).

Shockwaves swept through cryptocurrency markets on Thursday as tether, the largest stablecoin and a foundational part of the digital asset ecosystem, broke its peg to the dollar. On Friday, however, tether was back to within a fraction of a per cent of its $1 peg and has successfully processed more than $3bn worth of withdrawals without issue.

Bitcoin is also recovering, up around 8% today at around $30,900, but could still post its worst run of weeky losses on record.

European markets have rebounded, with the FTSE 100 index of blue-chip shares up 172 points or 2.4% this afternoon.

In New York, the Nasdaq composite index has now jumped 3.3%, as technology stocks recover some of their losses:

“T’was ever thus”

The crash in crypto and speculative tech now rivals internet bubble crash (Nasdaq -73% peak-to-trough) & GFC (banks -78%), says BofA.

“Trading pattern of post-bubble assets always furious bear rallies amidst dead sideways trading range for couple of years.” pic.twitter.com/N06vzKHlrQ

— Jamie McGeever (@ReutersJamie) May 13, 2022

But US consumer confidence has sunk to its lowest in a decade, as inflation hits America’s households.

Inflation is also causing pain in the UK, with warnings that the “golden era” of cheap food is coming to an end….

…although the era of multi-million pound pay packets for top executives is alive and well, with Tesco’s chief executive receiving £4.75m:

Have a lovely weekend. GW

Tesla is among the big risers on the S&P 500 today, with the electric car company’s stock jumping almost 6%.

Twitter is the top faller, though, down 9% this session.

Tesla’s shares have dropped by a quarter over the last month, as Musk sold some of his stock to help fund the Twitter deal, and used other shares as collateral for a loan.

Analyst Michael Hewson of CMC Markets explains:

Twitter shares have fallen sharply after Elon Musk said the takeover deal was on hold pending details supporting the calculation that spam or fake accounts represent less than 5% of total accounts. This appears to be fuelling concerns that Musk may be preparing the ground for backing out of the deal, although he will take a $1bn hit were he to do so.

The timing does seem curious given the lengths Musk has gone with respect to putting financing in place, after all why go to all that trouble securing secondary financing only to pull the plug at the last minute?

Of course, if Musk feels the deal doesn’t work for him then he will have to pay a $1bn break clause which will probably sting a bit, but he’ll probably view it as a cheap cut, especially since Musk made his bid for Twitter, Tesla shares have fallen over 20%. This fall in value potentially cuts his wriggle room in funding the deal from the value of his Tesla shares.

Tesla shares, on the other hand, are on the up, perhaps on the prospect that a deal has become less likely, or that the deal price might get negotiated down.

Elon Musk sowed new chaos into the market today by putting his takeover bid for Twitter on hold, explains Bloomberg:

But they point out that doubts had already been swirling about the deal:

Doubts have grown in recent days that Musk would be able to pull off his acquisition of Twitter, and that the entrepreneur may consider dropping his bidding price for the micro-blogging site. The whole transaction has been a frenzied and untraditional affair, largely played out on Twitter.

Musk went from being “just” a prolific user to revealing a more than 9% stake in the company and then launching an unsolicited takeover offer — without detailed financing plans — within a matter of weeks. It all came together at breakneck speed in part because Musk waived the chance to look at Twitter’s finances beyond what was publicly available.

And on Musk’s concerns about spam accounts…the calculation that less than 5% of accounts are fake has been used by Twitter for close to a decade.

Bloomberg adds:

The proposed takeover includes a $1 billion breakup fee for each party, which Musk will have to pay if he ends the deal or fails to deliver the acquisition funding as promised. It is unclear whether an update by Twitter on the number of fake accounts — if materially larger than 5% — would trigger a so-called material adverse effect clause, releasing Musk from the breakup fee.

Some snap reaction to the slide in US consumer confidence:

Dismal US consumer confidence data – sinks to lowest since Aug 2011, current conditions index lowest since March 2009.

Back to the old ‘bad news is good news’ for risk assets as markets price in a less restrictive Fed? Nasdaq jumps 3%. pic.twitter.com/Ip8yqJywP0

— Jamie McGeever (@ReutersJamie) May 13, 2022

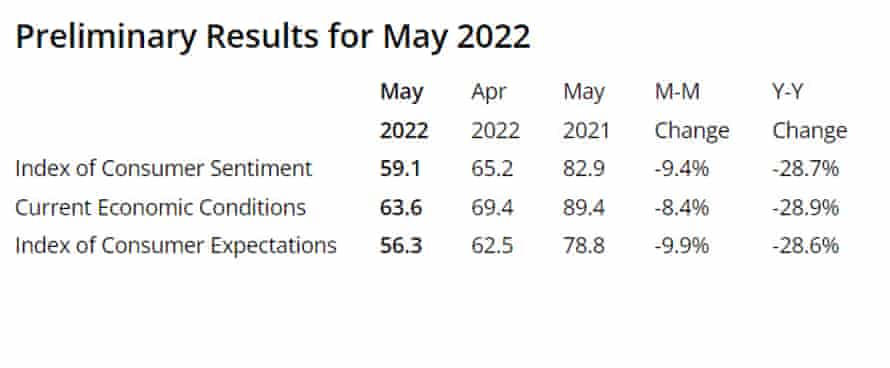

US consumer sentiment weakest since 2011

US consumer confidence has taken another hefty knock this month, as inflation hits households.

The University of Michigan’s index of consumer sentiment has declined by 9.4% from April, reversing last month’s gains, to hit its lowest since 2011.

It dropped to just 59.1 for this month, compared with 82.9 a year ago before price started their steep climb.

The Index of Consumer Sentiment fell from 65.2 in April to 59.1 in May, the lowest reading since August 2011, according to preliminary data from the University of Michigan and Thomson Reuters. pic.twitter.com/PG59WfYW1k

— Chad Moutray (@chadmoutray) May 13, 2022

The report says people haven’t been this downbeat on their financial situation in almost a decade, with inflation hitting confidence.

These declines were broad based–for current economic conditions as well as consumer expectations, and visible across income, age, education, geography, and political affiliation–continuing the general downward trend in sentiment over the past year.

Consumers’ assessment of their current financial situation relative to a year ago is at its lowest reading since 2013, with 36% of consumers attributing their negative assessment to inflation. Buying conditions for durables reached its lowest reading since the question began appearing on the monthly surveys in 1978, again primarily due to high prices.

Twitter shares slide 10%

Shares in Twitter have tumbled 10% in early trading.

They’ve dropped to $40.32, from $45 last night, on concerns that Elon Musk will walk away from the takeover, or attempt to renegotiate the price.

That widens the spread to Musk’s agreed offer of $54.20 — which shows a greater probability that it won’t happen, at least at that price:

$TWTR down 11.25% — with that in mind, The spread, a soft indication of how much Wall Street believes the takeover will be completed, has blown out to $13.80 at the open, the widest since deal announcement @elonmusk pic.twitter.com/MzZBLFs7B2

— Ed Ludlow (@EdLudlow) May 13, 2022

Wall Street has opened higher, on the final session of a turbulent week in which worries about slowing growth and rising interest rates hit stocks.

The S&P 500 index has jumped 1.4%, or 55 points, to 3,985 points, pulling away from bear market…

Read More:Elon Musk ‘still committed’ to Twitter deal after putting it on hold – as it happened | Business

2022-05-13 15:01:00