But wait… Haven’t seen anything yet. Impact of today’s holy-moly mortgage rates won’t show up in the sales data for a couple of months. Here’s why.

By Wolf Richter for WOLF STREET.

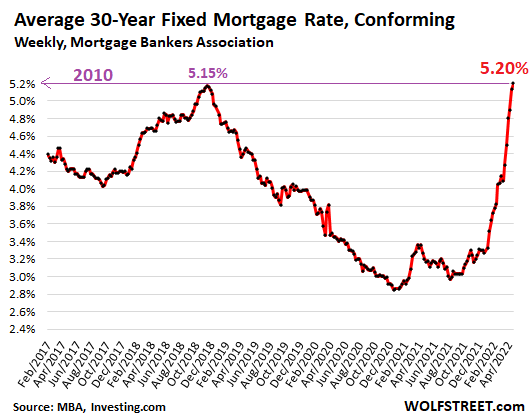

The spike in mortgage rates – a result of the Fed’s widely telegraphed future crackdown on inflation – would sooner or later have to impact the crazy housing bubble. We knew that. Now the average 30-year fixed mortgage rate has spiked to well above 5%.

For example, the Mortgage Bankers Association reported this morning that its weekly measure of the 30-year fixed rate jumped to 5.2%, the highest since April 2010, two full percentage points higher than two years ago, “causing a pullback or delay in home purchase demand,” the MBA said. “Home purchase activity has been volatile in recent weeks and has yet to see the typical pick up for this time of the year.”

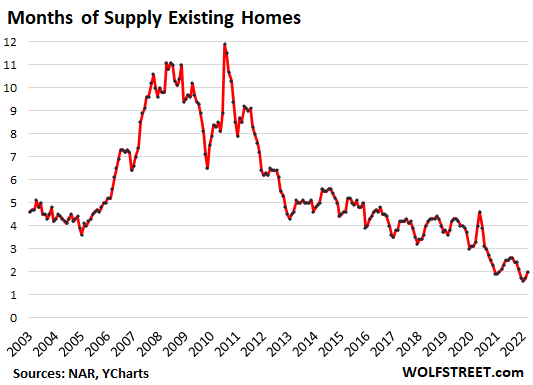

Given the huge increase in house prices, to be financed with these much higher mortgage rates, well, we know how this goes: Sales will decline because there are fewer buyers that can still afford to buy, and inventories will rise because there are fewer sales and because fidgety owners of multiple homes who hung on to those homes to ride up the market all the way are starting to put them on the market.

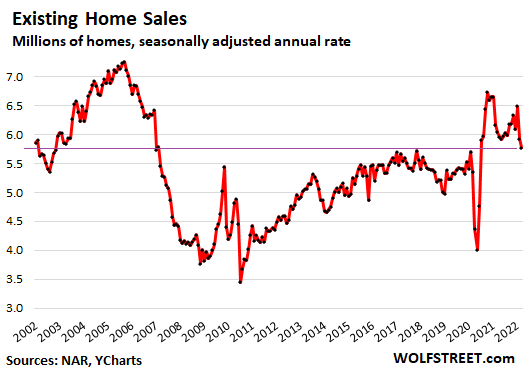

So today, the National Association of Realtors reported that sales of previously-owned homes – houses, condos, and townhouses – fell to the lowest since June 2020, down 4.5% from a year ago, the eighth month in a row of year-over-year declines, even as supply of homes listed for sale rose.

The NAR expects home sales “to contract 10%” this year, it said, and it blamed mortgage rates and inflation: “The housing market is starting to feel the impact of sharply rising mortgage rates and higher inflation taking a hit on purchasing power.”

But wait… We haven’t seen anything yet. It’ll be two months before the effects of today’s holy-moly mortgage rates show up in the data.

The sales figures today are based on sales that closed in March, meaning that many of the deals were made in February with mortgage rate locks from February or January or even prior, when mortgage rates were much lower. In February, the average 30-year fixed rate rose from 3.7% to 4.1%. In January, it was around 3.5%.

Many homebuyers today and in the coming weeks still have rate locks with lower rates from prior months. They’re still able to buy with those lower mortgage rates. But buyers now entering the market and who get a rate lock from today on are looking at mortgage rates above 5%.

In other words, we won’t see the bulk of the effects on home sales from today’s holy-moly mortgage rates until the sales data for May is released in June.

Sales of single-family houses dropped by 2.7% in March and 3.8% year-over-year, to a seasonally adjusted annual rate of 5.13 million houses, the lowest since June 2020.

Sales of condos dropped 3.0% in March and by 9.9% year-over-year to a seasonally adjusted annual rate of 640,000 condos, the lowest since August 2020.

By Region, the percent change of the seasonally adjusted annual rate of total home sales in March from February, and year-over-year (yoy):

- Northeast: -2.9% from February, -11.8% yoy.

- Midwest: -4.5% from February, -3.1% yoy.

- South: -3.0% from February, -3.0% yoy.

- West: no change in February, -4.7% yoy.

Supply of homes listed for sale rose to 2.0 months, the second month in a row of increases, from the record low in January (data via YCharts).

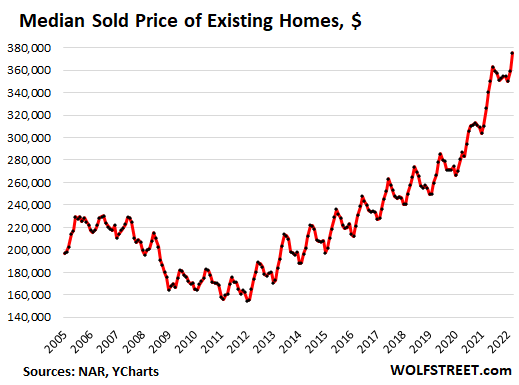

The median price rose 15% from a year ago, to $375,300. The year-over-year spikes had peaked last May and June 2021 at over 23% (data via YCharts):

Investor share of sales remained roughly in the same range. Individual investors or second-home buyers, who make up many cash sales, according to the NAR, accounted for 18% of the transactions in March, down from 19% in February and 22% in January, but up from March 2021 (15%).

“All-cash” sales rose to 28% of all transactions, compared to 25% in February and 23% in March 2021. As overall sales decline due to rising mortgage rates, and as sales to homebuyers who have to get a mortgage decline in particular because they cannot afford it anymore, the percentage share of all-cash sales increases automatically, even if those cash sales themselves don’t increase.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Read More:As Mortgage Rates Begin to Bite, Home Sales Fall to Lowest since June 2020, Supply Rises for Second Month

2022-04-21 00:06:29