Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Another bout of bond yield jitters are weighing on the markets today, just a day after chancellor Rishi Sunak’s budget highlighted that UK government borrowing is at a post-war high, with debt to its highest level in sixty years.

European markets have opened lower as a rise in bond yields rattled markets across Asia.

Japan’s Nikkei has fallen 2%, while China’s CSI 300 slumped 3% in a volatile session.

Investors are once again looking nervously at the bond market, where last night benchmark 10-year U.S. Treasuries rose to 1.477% — back towards the one-year high of 1.614% seen last week.

Jim Reid of Deutsche Bank says these bond market gyrations are worrying:

Global risk appetite was subdued, with equity markets moving lower, especially in the US. As we’ve been saying for a while now I suspect this huge liquidity and recovery story is going to repeatedly lock horns against the risk of higher inflation and higher yields in 2021. This year won’t be for the faint hearted.

By the close, US Treasuries had witnessed another big selloff, with 10yr yields up +8.9bps to 1.481%, marking the 3rd biggest daily increase we’ve seen so far this year, with the moves higher driven by increases in both real rates (+6.6bps) and inflation expectations (+2.5bps).

Last night, the US Nasdaq index slumped 2.7%, extending its recent losses as tech shares took another hammering (Apple fell 2.5% while Tesla shed almost 5%).

Joe Rokop

(@jr_strikezone)Bonds have become the main event for the stock market, and today was no exception. Stocks were were down substantially for a second straight day. The Nasdaq Composite fell 2.7%, giving the tech-heavy index a two-day decline of 4.3%. The S&P 500 was off 1.3%. #barronsonline

Bonds are under pressure for good reasons — predictions of a strong economic recovery aided by government stimulus and progress in vaccination programmes. But if bond prices keep falling, then the cost of borrowing to cover the cost of the pandemic will rise.

UK borrowing costs are still low — the 10-year gilt is trading below 0.8%, meaning London can borrow pretty cheaply for the next decade.

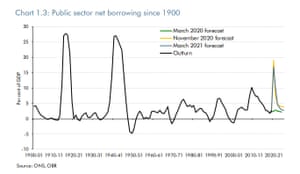

But as the OBR reported yesterday, UK public sector net borrowing is forecast to reach 16.9 per cent of GDP (£355 billion) this year, its highest level since 1944-45.

That pushes the national debt to 100.2 per cent of GDP, its highest level since 1960-61, with further rises ahead:

Office for Budget Responsibility

(@OBR_UK)Headline debt peaks at 109.7% in 2023-24 but historically low interest rates make it relatively cheap to finance.

However, the recent rises in market interest rates highlight this significant risk to the public finances#Budget2021 pic.twitter.com/nHikhlMD3e

The OBR calculates that an increase in interest rates of 1% would increase debt servicing costs by £20bn — wiping out all the tax revenues which hiking corporation tax to 25% will bring in.

But…. if those rising interest rates are driven by better growth, then tax revenues should rise broadly, and automatic stabilisers (lower welfare payments) should kick in too.

The agenda

- 9am GMT: UK car sales for February

- 9.30am GMT: UK construction PMI for February

- 1.30pm GMT: US weekly jobless claims

Read More:Worst UK February car sales since 1959; bond worries weigh on markets – business live | Business

2021-03-04 12:45:23