- Retail sales and housing data from the US pointed to a slowing economy.

- Canadian retail sales rebounded in December.

- There is a 70% probability of a 25bps rate hike from the BoC.

The USD/CAD weekly forecast is bearish as investors expect another rate hike from the Bank of Canada owing to the positive economic data.

–Are you interested to learn more about Forex apps? Check our detailed guide-

Ups and downs of USD/CAD

There were a lot of data releases last week from Canada and the United States that affected USD/CAD’s price movements. Retail sales and housing data from the US pointed to a slowing economy as the effects of the Fed’s aggressive policy started being felt.

There was also an indication of further easing inflation when the PPI report came in lower than expected. However, initial jobless claims fell, pointing to a still-tight labor market.

In addition to other recent data on jobs and prices that point to another interest rate next week, data released on Friday revealed that Canadian retail sales dipped 0.1% in November from the prior month before rebounding in December.

According to the most recent economic data, Canada added 104,000 new jobs in December, while core inflation measurements barely changed from the previous month over the same period. These are signs that the economy is still hot.

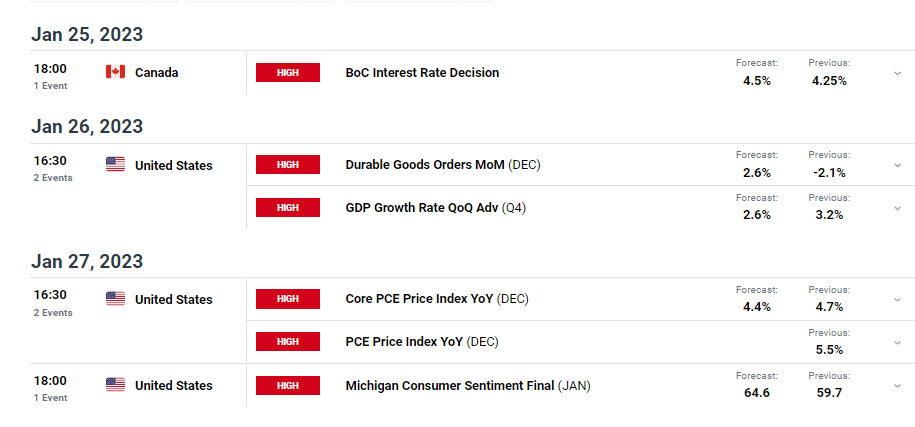

Next week’s key events for USD/CAD

The Bank of Canada increased its benchmark interest rate at a record pace of 400 basis points in just nine months, reaching 4.25%. According to Royce Mendes of Desjardins Group, ongoing economic momentum will likely drive the Bank of Canada to hike rates another 25bps next week.

The probability of a quarter-point increase by the Bank of Canada next week in the money markets is over 70%.

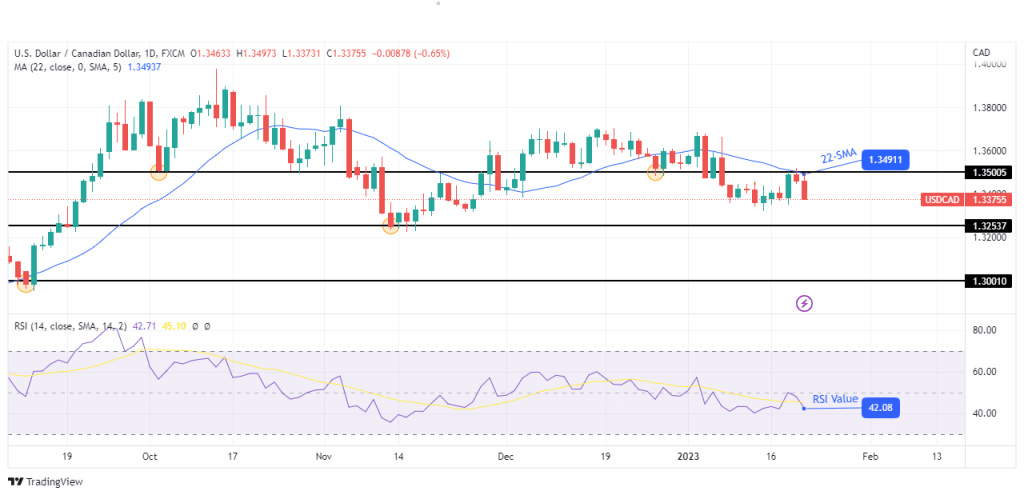

USD/CAD weekly technical forecast: Bears are eyeing the 1.3253 level.

The daily chart shows USD/CAD bouncing lower after finding resistance at the 22-SMA and the 1.3500 key psychological level. The RSI also pushes lower after touching the 50 mark, a sign that bears are still in control.

–Are you interested to learn more about STP brokers? Check our detailed guide-

With the 22-SMA acting as resistance, the price will likely decline next week to the next support level at 1.3253. If bears are still strong at this support, the price will probably break below and head for the 1.3001 support. The bearish bias is strong and could mean a bearish week if the price stays below the 22-SMA and the RSI below 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Read More:Markets Expecting 25bps BoC Hike

2023-01-21 18:23:01