- The Gold price is on the backside of the weekly trendline and bulls have been active from a 61.8% ratio of the prior bullish impulse’s range.

- However, a break out below the now counter-trendline and the resistance of the M-formation’s neckline area opens the risk of a continuation.

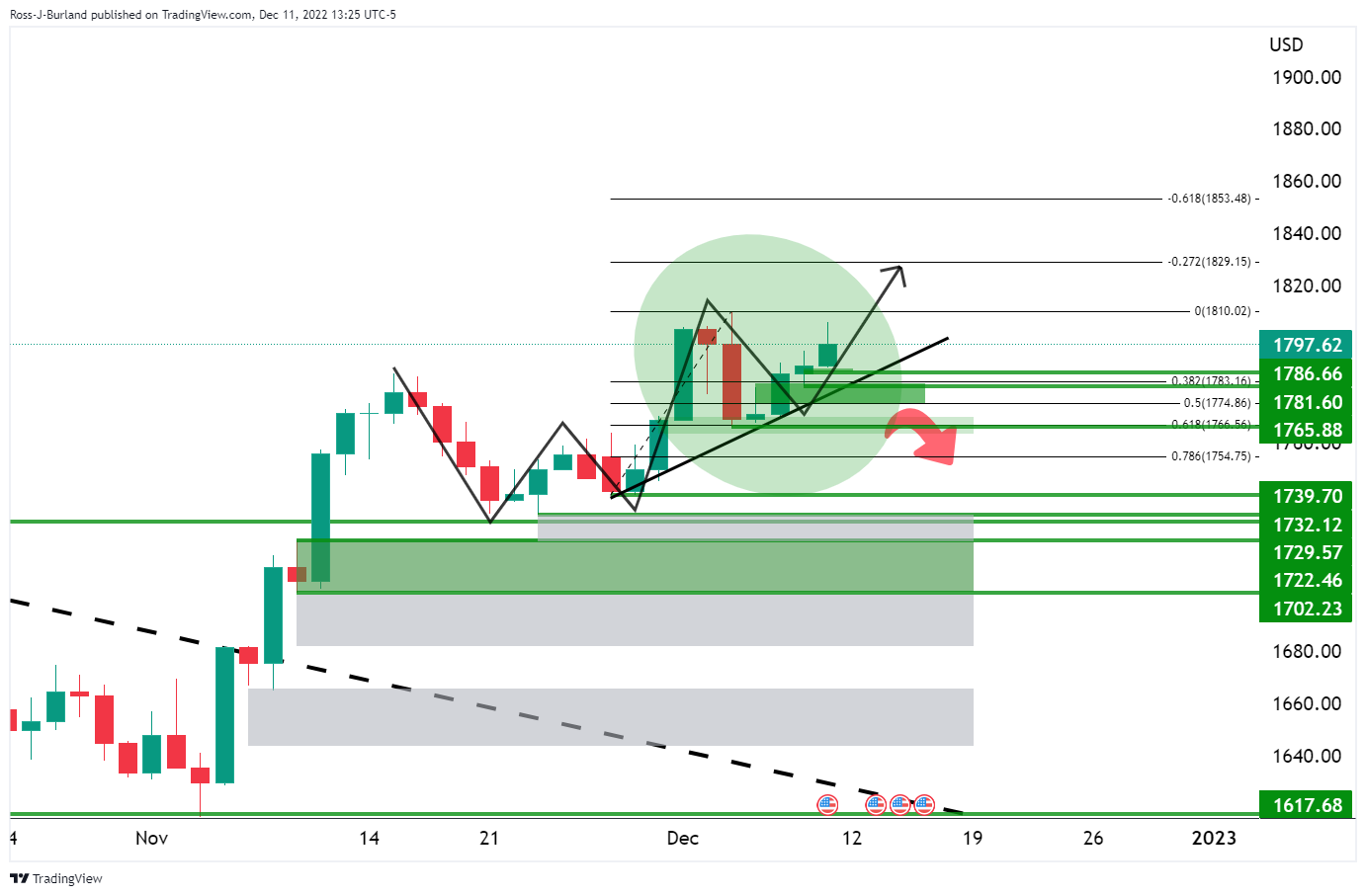

As per the prior pre-open analysis, Gold, Chart of the Week: XAU/USD bulls eye a test of $1,810, the bulls tapped into the target but now face challenges for the week ahead as the bears take on a daily trendline support structure as the following illustrates.

Gold, prior analysis

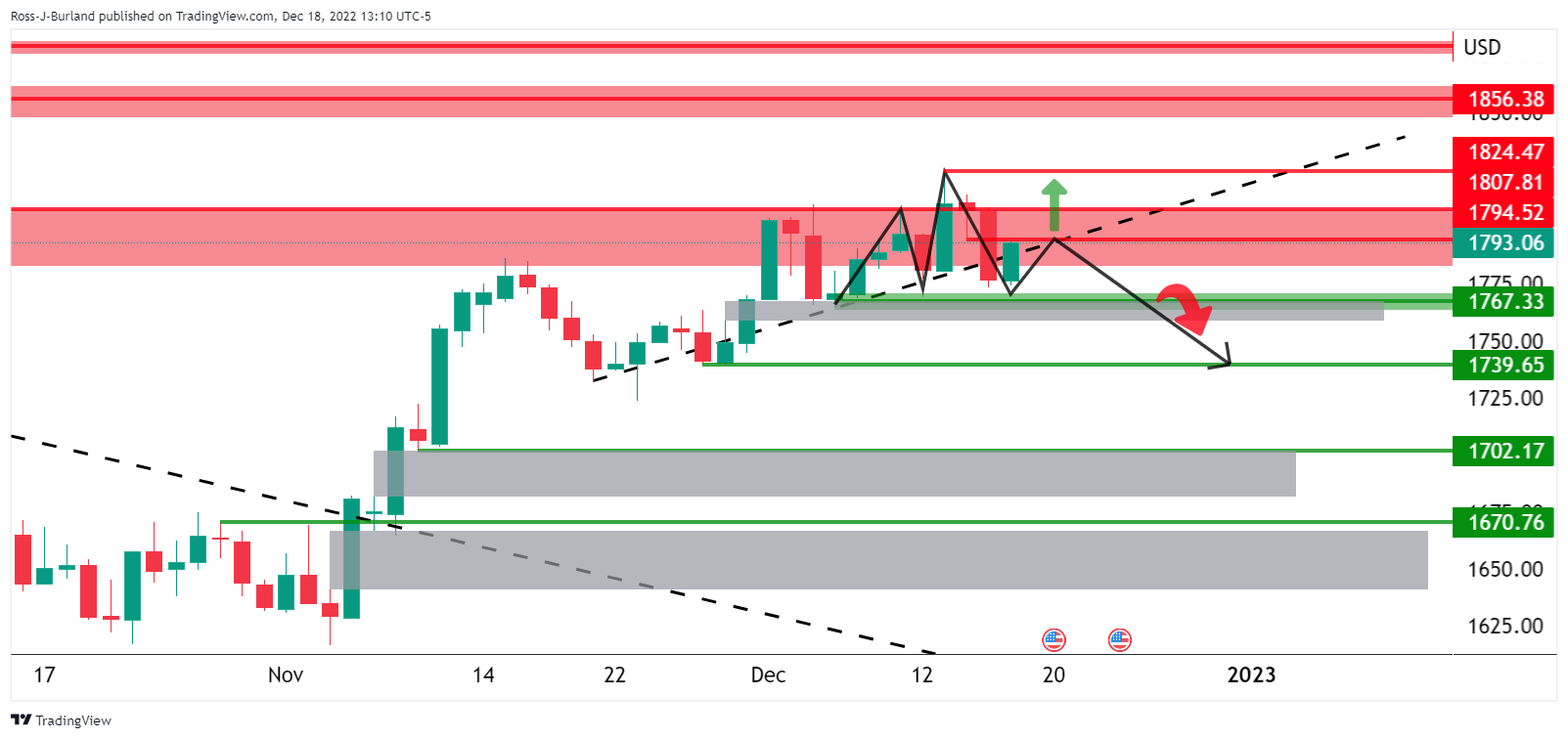

Gold, update

Gold price reached the $1,820s but has started to carve out what could be a meanwhile peak formation between $1,824.47 and $1,767.33 the low. A break out below the now counter-trendline and the resistance of the M-formation’s neckline area opens the risk of a continuation below $1,740 towards $1,702 and $1,670 after that.

On the other hand, should the price break recent highs, the counter-trendline will come back under pressure and there would be prospects of an upside continuation:

Such a move would be in line with the following weekly bullish outlook:

The price is on the backside of the weekly trendline following a bullish correction from triple bottom lows. While the correction has decelerated, the bulls have been active from a 61.8% ratio of the prior bullish impulse’s range.

However, while money managers have started to build long exposure in the gold price once again, analysts at TD Securities have the following warning to the bulls:

”While the pace of rate hikes was slowed, the FOMCs’ dot plot maintained the Fed’s hawkish messaging. In this sense, a continued drawdown in net liquidity from quantitative tightening should begin to weigh on asset prices once more, and higher rates for longer should continue to weigh on precious metals prices in the near-term.”

Read More:XAU/USD bears need to commit below $1,800

2022-12-18 18:42:04