When can we truly say goodbye to this bear market? While Bank of America’s global fund managers are no longer “apocalyptically bearish,” some on Wall Street remain wary.

Add our call of the day to that last batch. It comes from True Contrarian blog and newsletter’s chief executive, Steven Jon Kaplan, who sees investors mired in what could be the longest bear market in history, and “approaching the next and probably the biggest percentage drop of this bear market so far.”

MarketWatch last spoke to Kaplan in mid-November 2021, when he warned of a looming selloff for stocks, notably big highfliers. Just days later, the Invesco QQQ

QQQ

exchange-traded fund (ETF) that tracks the Nasdaq-100 Index, and many other tech funds topped out. The S&P 500

SPX

peak followed on Jan. 4.

Kaplan based that November caution partly on one of his favorite indicators — company insider selling and buying, which he tracks via J3 Information Services Group.

In an interview with MarketWatch on Wednesday, he rattled off a list of worrying signals, such as aggressive selling by that group again, individual investors piling into the market, declarations that the bear market is over and the Cboe Volatility Index, or VIX

VIX,

skirting under 20 in recent days.

History also plays a big part in his worries about markets right now.

True Contrarian/StockCharts.com

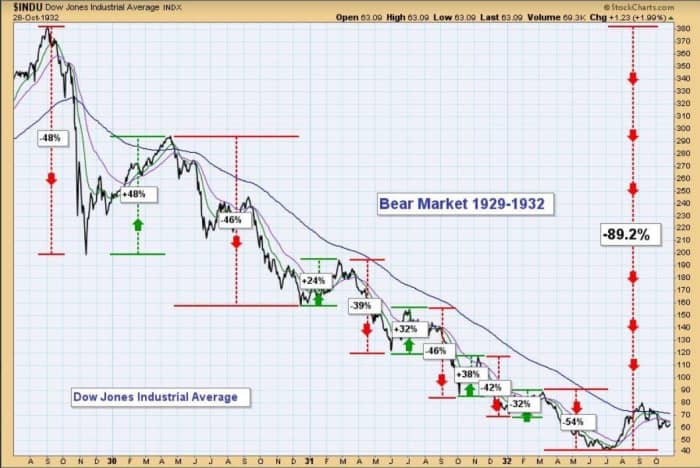

“It is fascinating to see how closely the 1929-1932 and 2000-2002 bear markets paralleled each other, with almost exactly the same kinds of pullbacks and rebounds. I expect similar behavior for 2022-2025,” he said.

QQQ pullback from 2000 through 2002

True Contrarian/Trading View

Kaplan noted that it took eight years for the 1929 bear market to arrive, nearly 10 years for March 2000s and even longer for the bear market he sees as ongoing, given the bull market began in March 2009.

“So what they all have in common is that these very long bull markets preceded the bear markets for so long, that people tended to forget how to invest in bear markets and what they’re about,” he said.

The familiar bear market pattern through history has been a small drop to start that doesn’t spread panic, then a soothing bounce, then a bigger drop and a bigger rebound, which again relaxes investors. But he said based on 1929, 1973 or 2000, the next stage of selling could bring dramatic losses, such as 40% for a fund like QQQ.

Kaplan is worried about the latest Fidelity quarterly retirement survey, which revealed investors clinging to hopes that the market will return to highs if they wait long enough. Challenging that, Kaplan pointed to another study showing that individuals who invested in the market in September 1929 were still 38% down by August 1982 in real terms, adjusted for inflation.

“It kind of explodes the myth that you have to come out ahead if you just kind of hang in there when things are tough,” he said.

Read: Most retirement savers are ‘staying the course’ — even if they’re totally stressed

So how to cope with another big drop. Repeating November advice, he recommends I-Bond or Series I savings bonds that can be bought directly from the government and are currently offering a return of just over 9%. U.S. Treasurys are also paying 3% to 3.5% right now, another way to go for the coming years, he said.

Read: This rule with a perfect record says the market hasn’t bottomed, says Bank of America’s star analyst

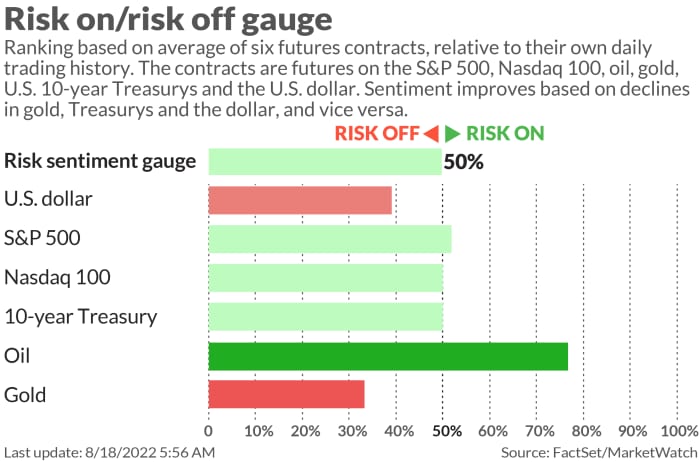

The markets

Stock futures

ES00

NQ00

are inching up, following Wednesday’s Fed-inspired losses. Bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are easing, while the dollar

DXY

is flat. Oil prices

CL

BRN00

are climbing, and bitcoin

BTCUSD

is hovering under $24,000.

The buzz

Shares of Bed Bath & Beyond

BBBY,

which has been on a crazy meme ride lately, are slumping after GameStop

GME

Chairman Ryan Cohen disclosed plans to unload his hefty stake in the retailer months after buying it. Meanwhile, this 20-year-old made a massive profit on the stock, according to Securities and Exchange Commission filings.

Cisco

CSCO

stock is climbing after the tech giant’s surprisingly upbeat earnings and revenue forecast.

Apple

AAPL

plans to unveil its latest iPhone 14 and smartwatches on Sept. 7, according to a new report.

“End of an era.” Stellantis

STLA

unit Dodge to discontinue two popular ‘muscle cars’ as it tilts toward electric vehicles.

Weekly jobless claims and the Philly Fed index are due ahead of the opening bell, followed by existing home sales and leading economic indicators. Kansas City Fed President Esther George will speak at 1:20 p.m. Eastern and Minneapolis Fed President Neel Kashkari at 1:45 p.m.

Best of the web

Big Oil is too optimistic a slow transition away from carbon will be enough to halt global warming

Two years after Covid infections, risks of psychotic disorders and dementia linger

Kremlin reportedly ousts head of its Black Sea Fleet following Crimea attacks

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

Random reads

Tourists behaving badly: Two arrested in Venice for cruising its waterways on motorized surfboards.

An extinct massive shark was faster, bigger and hungrier than scientists originally thought

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Read More:This contrarian investor gave a timely warning for the last big tech top. He now sees the biggest drop of this bear

2022-08-18 10:56:00