Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

The UK’s unemployment rate has dropped further below its pre-pandemic levels as employers struggle to hire staff, and more people drop out of the labour force.

And Britain’s wage squeeze continued, with regular pay dropping by 1% over the last year after adjusting for inflation.

The UK jobless rate slipped to 3.8% in the three months to February, the latest labour force survey released this morning shows. That’s the lowest rate since October-December 2019, just before Covid-19 hit the economy, with the unemployment total down 86,000 to 1.296m.

Employment rose by 10,000 during the quarter, with 32,485 people now in work. That left the UK employment rate flat at 75.5%, still 1.1 percentage points lower than before the coronavirus pandemic.

Instead, the economic inactivity rate increased by 0.2 percentage points to 21.4% in December 2021 to February 2022. That’s because 76,000 more people became economically inactive in the quarter, taking the total to 8.857 million.

This increase was driven by those who are economically inactive because they are looking after family or home, retired, or long-term sick, the ONS explains.

Office for National Statistics (ONS)

(@ONS)Headline indicators for the UK labour market for December 2021 to February 2022 show that

▪️ employment was 75.5%

▪️ unemployment was 3.8%

▪️ economic inactivity was 21.4%

Companies did add more staff, with 35,000 more people in payrolled employment in March than in February.

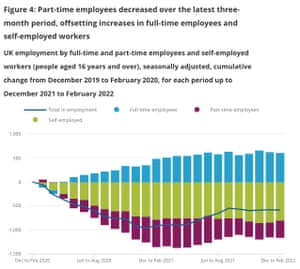

But while the number of full-time employees increased during the latest three-month period, this was offset by a decrease in part-time employees, as this chart shows:

Job vacancies hit a new record over the quarter, jumping to 1,288,000.

But the rate of growth in vacancies continued to slow down. There were 50,200 new openings added in January to March 2022 compared with the previous quarter, the slowest rise in almost a year.

The largest increase was in human health and social work, which increased by 13,100 to a new record of 215,500 vacancies.

Office for National Statistics (ONS)

(@ONS)There were an average of 1.288 million job vacancies across January to March 2022, up from 1.238 million in the previous quarter https://t.co/U8h1PEutCI pic.twitter.com/SKl4rGLKM2

More details to follow….

Also coming up today

US inflation may hit a fresh 40-year high today, with March’s consumer price index data forecast to jump to 8.4% from February’s 7.9%.

That would be the fastest pace since 1981, and probably spur the Federal Reserve to raise US interest rates aggressively over the coming months. Economists now expect half-point hikes in both May and June.

We also get the latest economic confidence index for Germany from the ZEW institute, which will show the impact of the Ukraine war on investors.

European stock markets are set to open lower, having dropped around 0.6% yesterday.

IGSquawk

(@IGSquawk)European Opening Calls:#FTSE 7561 -0.75%#DAX 13996 -1.39%#CAC 6478 -1.18%#AEX 707 -1.15%#MIB 24520 -0.93%#IBEX 8495 -1.05%#OMX 2068 -1.43%#SMI 12427 -0.81%#STOXX 3791 -1.27%#IGOpeningCall

The agenda

- 7am BST: UK labour market report

- 10am BST: ZEW survey of German economic confidence in April

- 11am BST: NFIB index of US business optimism index

- 1.30pm BST: US inflation report for March

Read More:UK jobless rate drops as more people leave labour market, and wage squeeze continues – business live | Business

2022-04-12 07:05:52